Famous cryptocurrency analyst Benjamin Cowen noted that Bitcoin’s (BTC) current correction resembles the price movements in 2019. Cowen explains this similarity based on social risk metrics and viewership rates of cryptocurrency-focused YouTube channels.

Viewership of Cryptocurrency-Focused YouTube Channels and Similarity in Social Risk

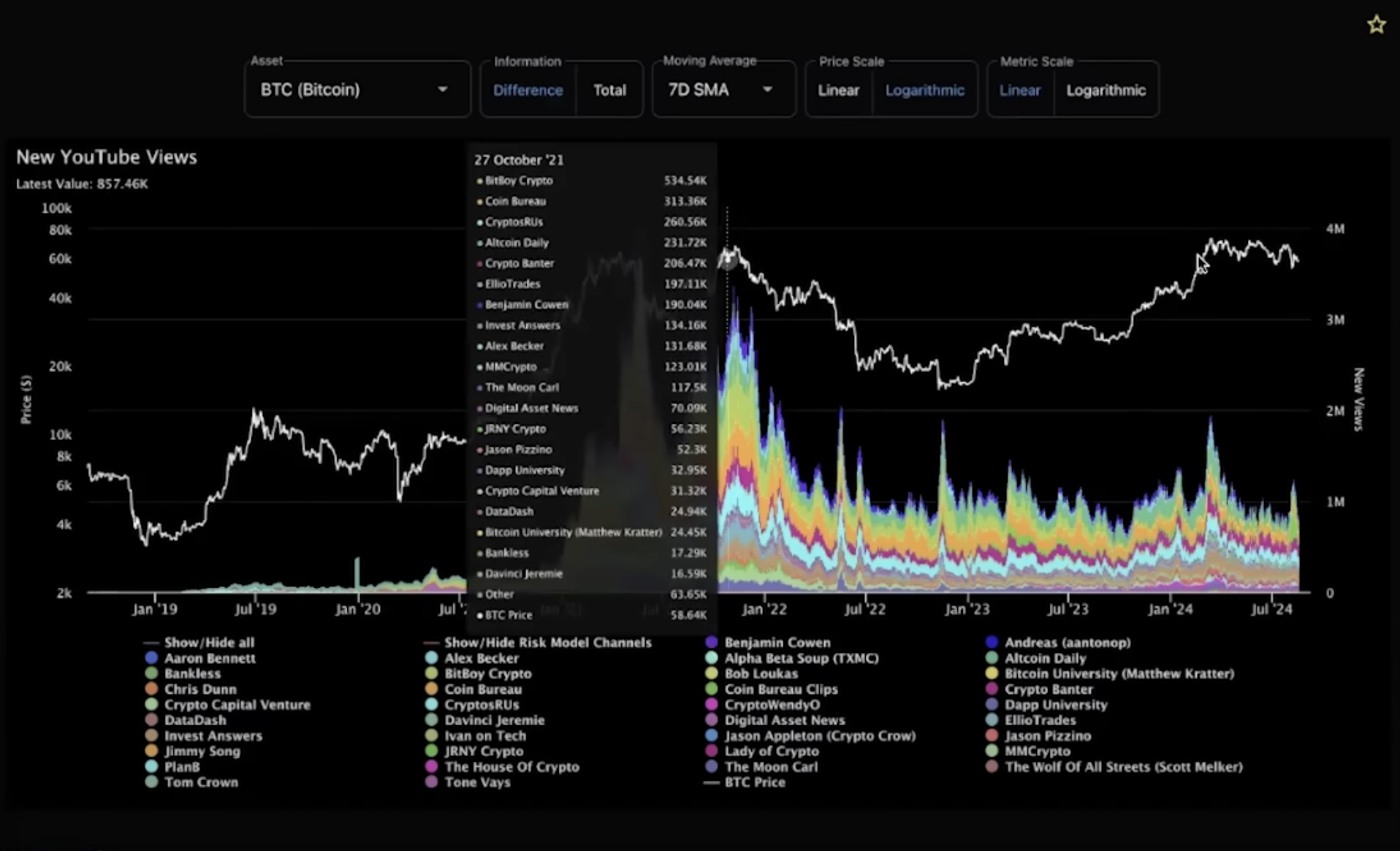

Cowen stated that during the major rise in 2021, the daily average viewership of cryptocurrency-focused YouTube channels was around 4 million, but now this number is approximately 850,000. He emphasized that this significant drop in viewership parallels the decline in social risk indicators. He added that this situation resembles the trends in 2019.

The analyst highlighted that the intense interest seen in 2021 is not present now and individual investors have not returned to the market. According to him, this lack of return has not brought individual investors back to the market despite Bitcoin reaching its all-time high.

A Recovery Similar to the Past May Be on the Table

Cowen pointed out that the price movement from the lows of 2018 to the highs of 2019 corresponded to an increase of approximately 350%, and the rise seen from 2022 to 2024 offered a similar percentage increase. The analyst considers this as another piece of evidence supporting that the current correction is in a similar trend to the price movements in 2019.

Bitcoin, the largest cryptocurrency by market cap, is currently trading at $58,400 and has decreased by 1.84% in the last 24 hours. According to Cowen’s analysis, the correction in the cryptocurrency market overlapping with similar movements in 2019 could signal a possible recovery in the future.

This means that for the cryptocurrency market, where negativities have piled up and selling pressure exceeds buying pressure, things could turn around in the near future and prices could start to rise.

Türkçe

Türkçe Español

Español