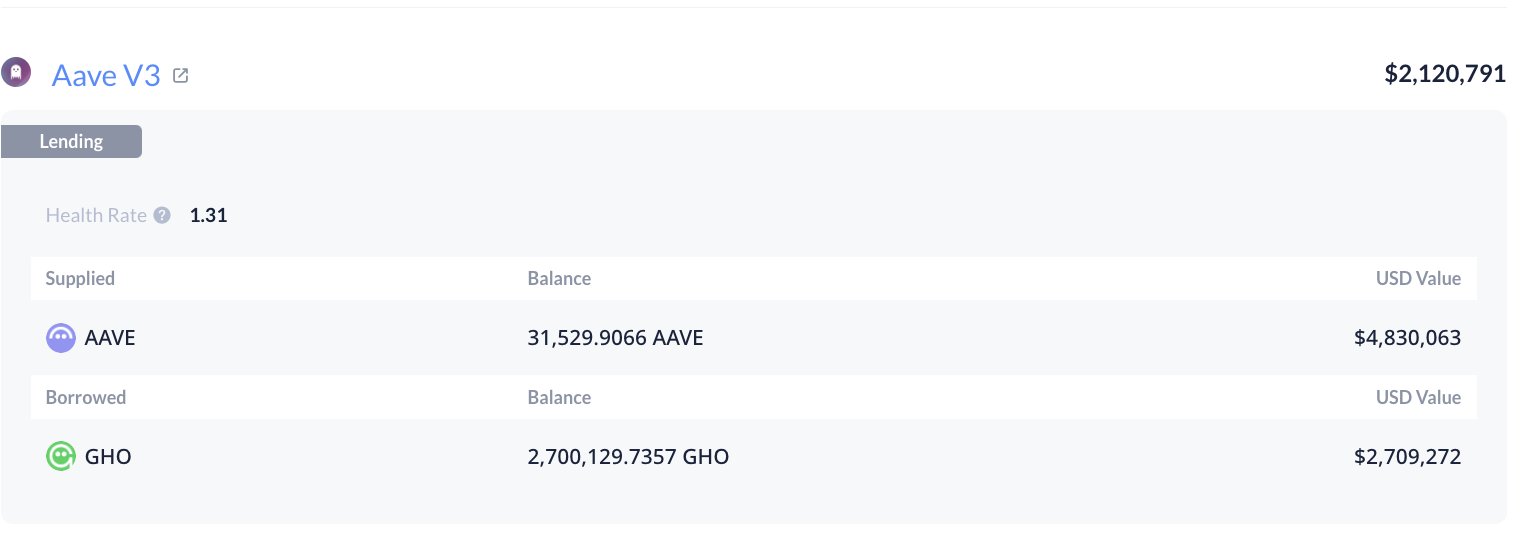

Data provided by the blockchain monitoring platform Lookonchain reveals that on October 13, a prominent crypto whale made a substantial investment in AAVE. The whale acquired a total of 31,173 AAVE coins, spending approximately 4.8 million dollars. By staking these assets within the Aave protocol, the investor strategically aimed to benefit from the decentralized finance ecosystem, reinforcing expectations that AAVE’s price will rise.

Dual Profit Strategy with Investment

The whale’s goal extended beyond merely accumulating AAVE; it also sought to leverage the opportunities presented by decentralized protocols. Using the acquired AAVE coins as collateral, the investor borrowed 2.7 million GHO stablecoins. Subsequently, these GHO coins were converted to USDC and transferred to the Coinbase exchange, indicating the investor’s plan to utilize this liquidity for further acquisitions and to expand their position.

These types of transactions reflect an experienced strategy in both asset management and decentralized usage. The fund created through borrowing signifies an intention to achieve a stronger position in AAVE.

Potential Market Impact of the Whale’s Acquisition

Such large-scale transactions can lead to fluctuations in the market. High-volume trades often trigger short-term price volatility in the cryptocurrency world. This activity may attract the attention of other investors, prompting them to adopt similar positions.

These moves not only enhance investor confidence in AAVE but can also stimulate interest in the decentralized finance ecosystem. The strategic actions of large investors underscore the opportunities presented by decentralized finance. Potential price changes in AAVE will ultimately determine this movement’s impact on the market.

According to current data, AAVE is trading at $152.40 after a 5.03% increase in the last 24 hours. The data also shows that the trading volume for the altcoin rose by 48%, reaching $244.86 million in the same time frame.