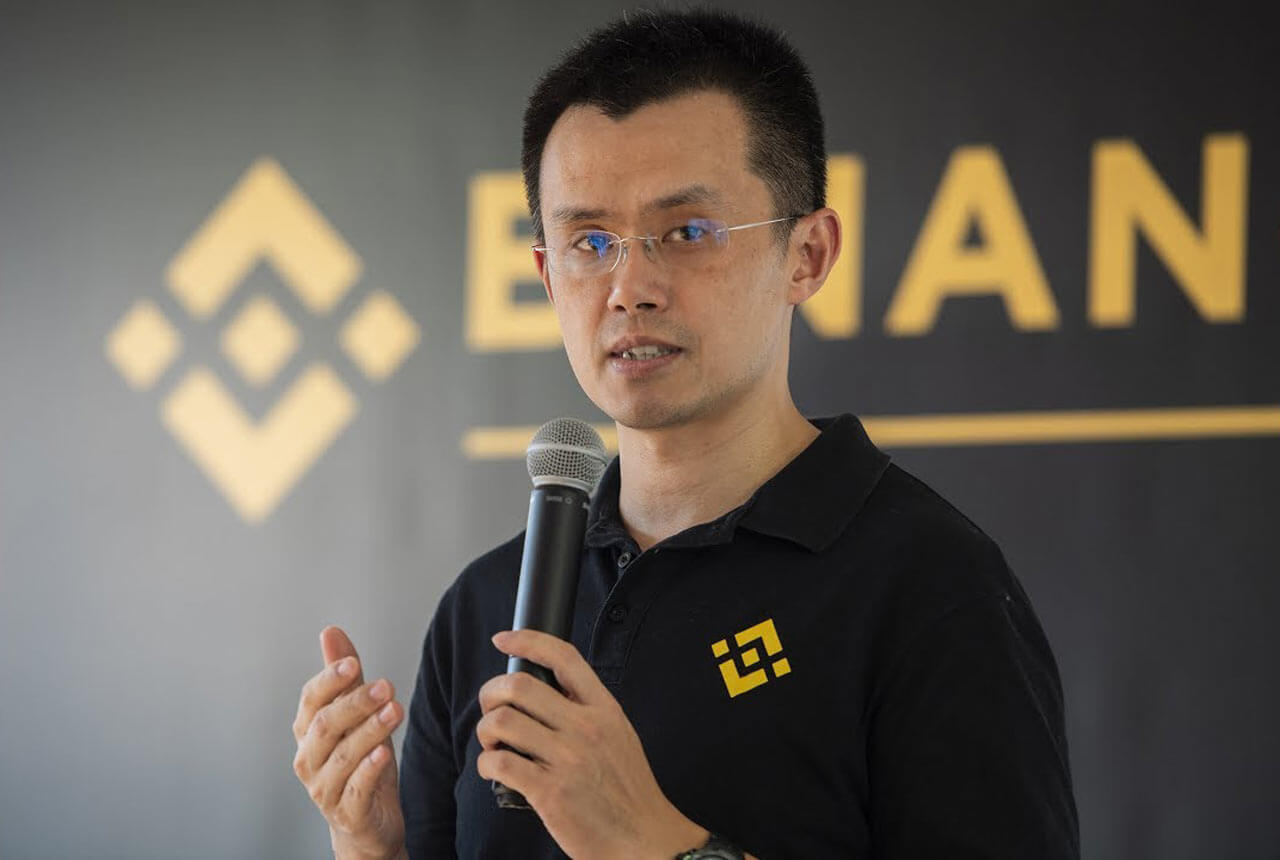

In a recent Twitter Spaces conference, Binance CEO Changpeng Zhao candidly admitted his perplexity regarding meme coins, further disclosing that an independent team handles listing decisions. As the founder of Binance, the world’s preeminent exchange by trading volume, Zhao elucidated his conscious detachment from the listing process, emphasizing Binance’s intentional noninvolvement.

Zhao Distances Himself from Listing Determinations

Changpeng Zhao expounded on his reluctance to partake in the listing process, citing his disinclination and time constraints as primary reasons.

Nonetheless, he professed no animosity towards meme coins, adding,

I personally have never truly comprehended meme coins. Numerous prosperous individuals, including Elon Musk, seemingly grasp their nuances; hence, we abide by our users’ preferences.

CZ disclosed that Binance relies on the fascination and trading volume surrounding meme coins to inform its listing decisions, albeit with the caveat of eschewing listings based solely on hype.

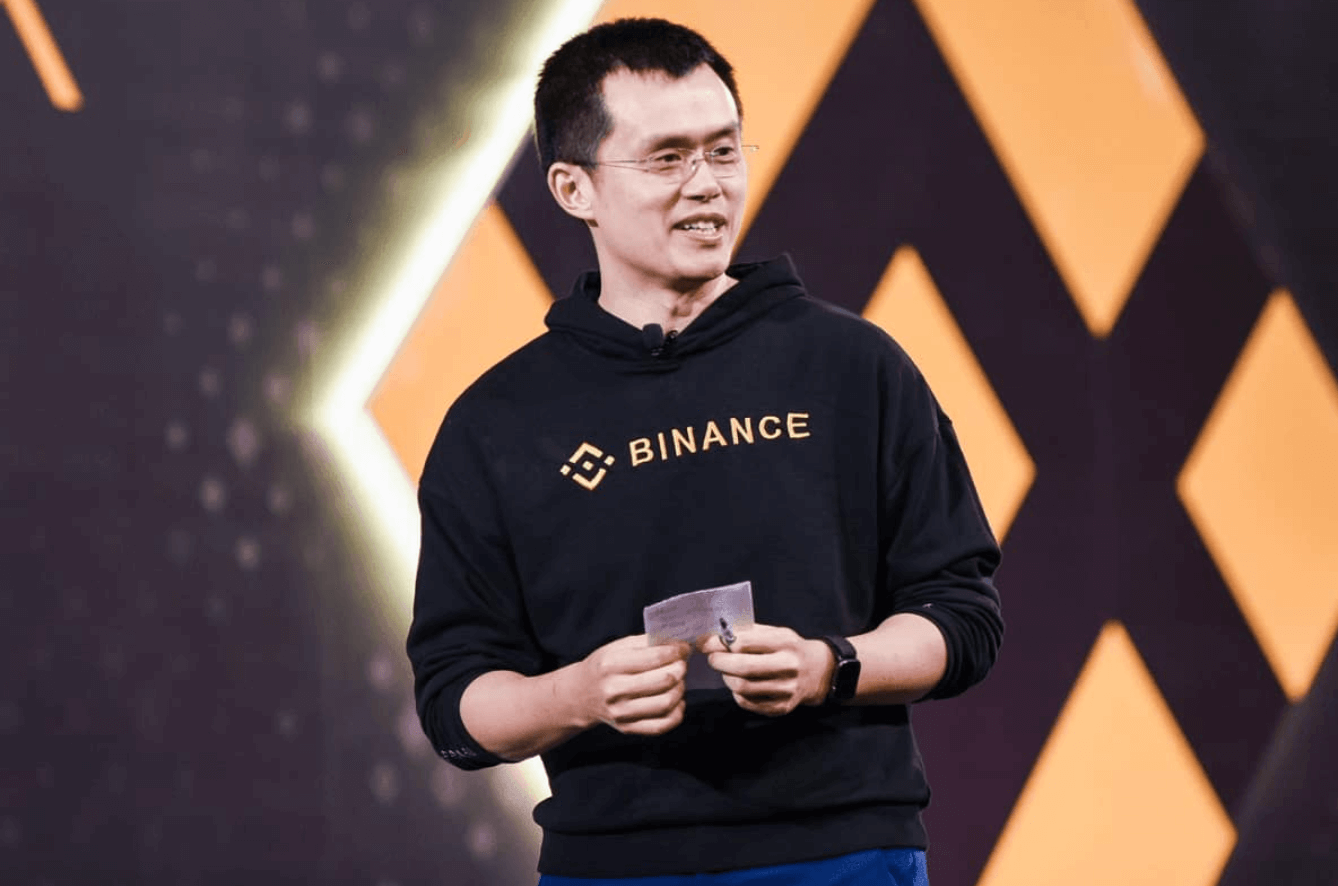

The Binance Effect Holds Sway

Historically, Binance’s listings have bolstered the value of meme coins. For instance, Floki Inu’s incorporation into Binance previously incited a price increase of up to 50%. In the case of SHIB, the exchange’s high-ranking executive revealed that a discrete team evaluates potential listings.

He subsequently remarked:

We listed SHIB, and it now boasts one of the highest trading volumes on Binance. We harbor no animosity towards meme coins or any coin, for that matter.

Last week, memecoins like PEPE ignited speculative interest in cryptocurrencies before the fervor gradually dissipated. Since its April 14 debut, Pepe’s price has skyrocketed by approximately 38,900%, propelled by social media zeal.

Simultaneously, DOGE and SHIB experienced stagnant movement. Following the commencement of the dump, meme coins have remained relatively subdued in the past 24 hours.