Binance Coin (BNB) has seen an incredible rise over the past few weeks, and its continuation is eagerly anticipated by investors. When examined through technical analysis, BNB remains attractive to buyers due to its risk-reward ratio. However, a price drop below $301 could alter these expectations. The latest indicators and price movements suggest that an upward trend is becoming more likely.

BNB Price Analysis

An examination of BNB’s 4-hour price chart reveals a consolidation period following a strong surge. If the market structure is viewed pessimistically, a potential drop below $307 could trigger the start of a downward movement. Following this price drop, the coin could reach the $273-$260 support zone, which was the price range before the recent rise.

Additionally, the price range between $301.4 and $315.4 could be considered a support zone on the weekly chart. This area acted as resistance in May 2022, during the previous year’s declines. A fall below $301.4 could lead BNB’s price to a support level of $273.5 or even lower to $261 if it fails to hold strong in that region.

As of the time of writing, the Relative Strength Index (RSI) stood at 50.21, reflecting neutral investor sentiment despite the sharp rise. Moreover, there was no significant drop in the On-Balance Volume (OBV) with the rise. This suggests that during the price drop to $307, the selling volume remained low, which could indicate potential for prices to rise in the coming days.

The Future of BNB

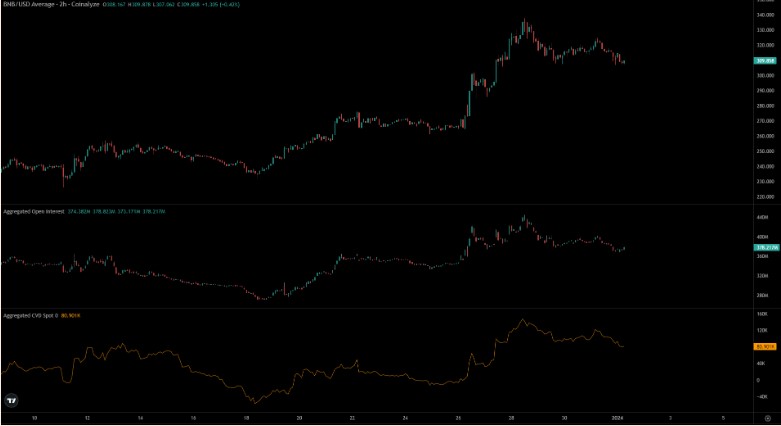

According to analysis based on Coinalyze data, sentiment appeared to be slightly in favor of sellers. Both prices and Open Interest (OI) rates have seen a decline over the last three days. Spot Cumulative Volume Delta (CVD) was also affected by this trend.

An increase in OI and spot CVD could lead to BNB’s price exceeding $315, potentially initiating a move towards $335 and $350 in the next one or two weeks. The next resistance level for BNB is seen at the $350 mark.