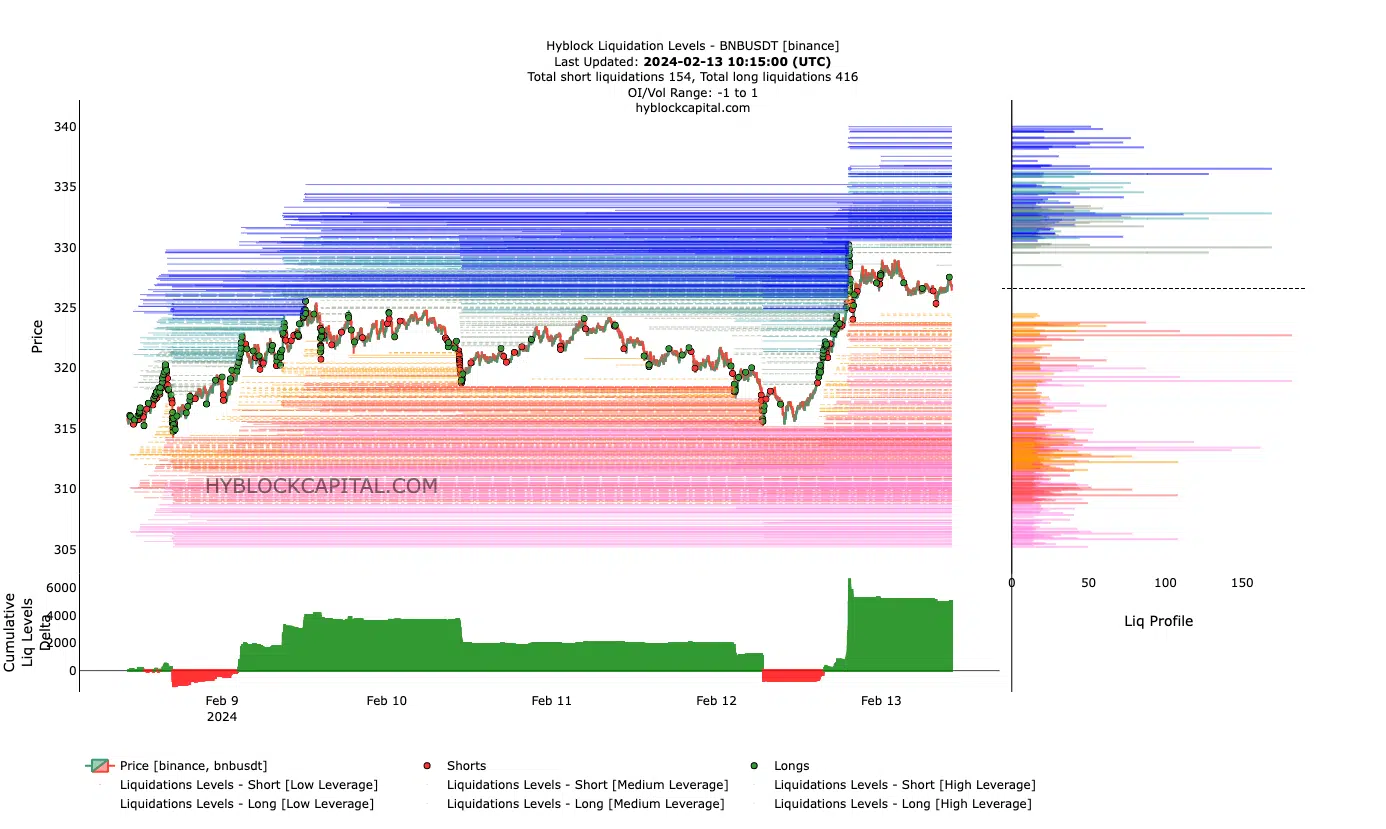

Binance Coin’s (BNB) price has joined the rise of other cryptocurrencies in the broader market. However, investors with long positions could face the risk of liquidation. Liquidation in cryptocurrencies occurs when a leveraged position is automatically closed, which can be due to insufficient margin balance. At the time of writing, the analysis of BNB’s liquidation levels indicated the presence of a liquidity cluster ranging from approximately $329 to $340.

Leveraged Trades in BNB

Liquidation levels are estimated price points where significant liquidations could occur. However, this does not mean that BNB cannot reach these prices in the short term. Data from HyblockCapital also showed signals from the Cumulative Liquidation Level Delta (CLLD). CLLD is the sum of the difference between all long liquidation levels and short liquidation levels. Additionally, it was suggested that BNB’s CLLD is positive.

In most cases, this data could indicate a downtrend in the token and could mean a full retracement is possible. In such a scenario, BNB’s price could drop to $315. On-chain volume data has risen to $1 billion in terms of volume. The increase in volume could be linked to growing interest in the cryptocurrency. If the price of the cryptocurrency continues to rise along with the volume, BNB could surpass $327 in the short term. However, if the volume increases while the price moves downward, BNB could lose its upward momentum. Therefore, its value could correct by up to 10% in the coming weeks.

Report from Santiment

According to cryptocurrency analytics firm Santiment, the funding rate for Binance Coin is at -0.008%. The funding rate is the cost of holding an open position in the derivatives market. If the metric is positive, it could mean that its price is trading at a higher price compared to the spot price. However, since BNB’s funding rate was negative at the time of writing, this could indicate that its price was trading at a high level.

Despite negative data, the inference here could be that short positions are not aggressive. Therefore, experts believe a significant bounce is likely in the current position. However, if the measure rises excessively and potentially reaches -0.01%, BNB’s price could recover. In this case, a move towards $400 could be reasonable.