Binance, the world’s largest cryptocurrency exchange by volume, has published an important report highlighting essential data relevant to cryptocurrency investors. The report provides insights into average fund sizes and the total number of investors on the platform, which is favored by many in the crypto investment community.

Binance Cryptocurrency Report

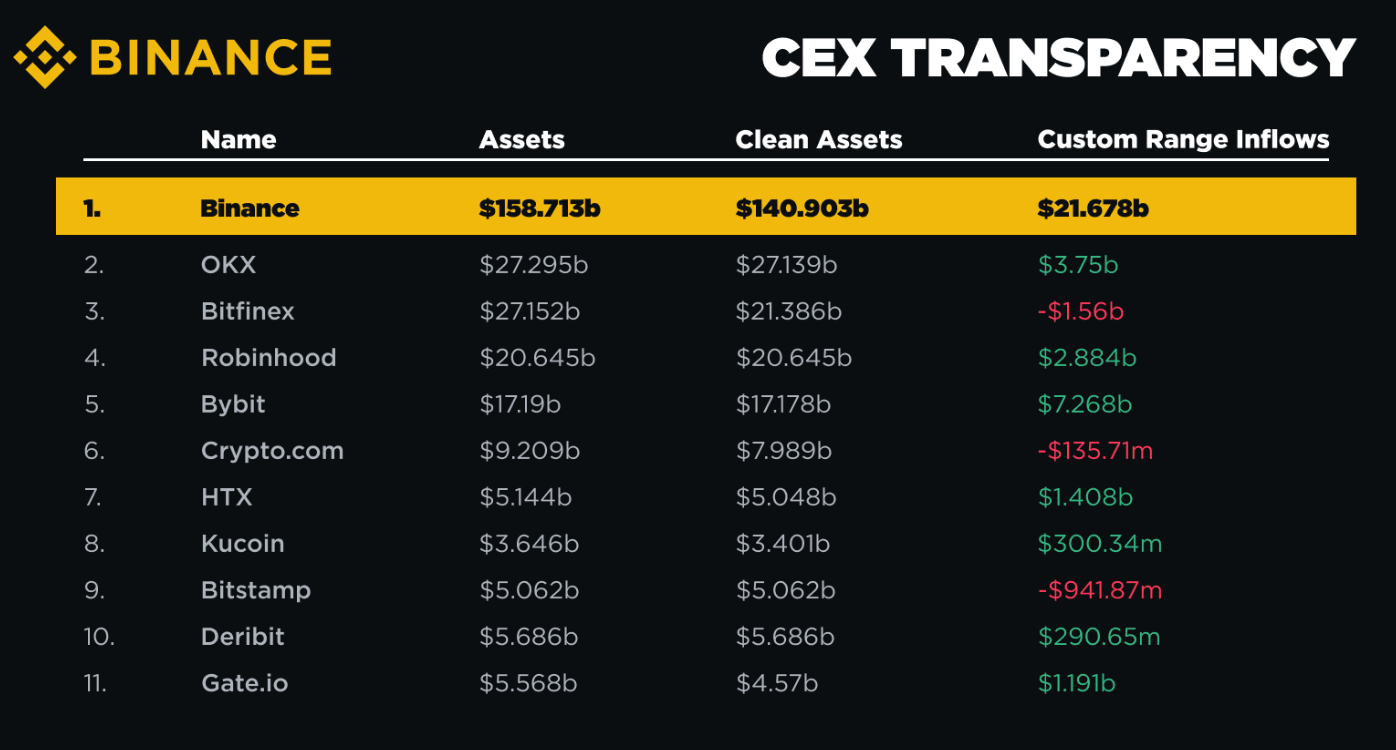

According to the Binance report shared at the time of writing, fund inflows in 2024 account for 40% of the total from the ten largest exchanges. The total customer deposit inflow of $21.6 billion in 2024 significantly exceeds the $15.9 billion total inflow of the other ten cryptocurrency exchanges by approximately 40%.

Comparing total deposit inflow figures in exchanges with ETFs and MicroStrategy’s purchases provides a clearer understanding of the intriguing levels of institutional demand.

Future of Cryptocurrencies

The approval of Bitcoin  $91,967 ETFs in markets like the United States, Brazil, Hong Kong, and Australia has bolstered trust among institutional and individual investors in these regions. Notably, the approval of BTC and ETH ETFs in the U.S. has significantly strengthened the legitimacy of cryptocurrencies.

$91,967 ETFs in markets like the United States, Brazil, Hong Kong, and Australia has bolstered trust among institutional and individual investors in these regions. Notably, the approval of BTC and ETH ETFs in the U.S. has significantly strengthened the legitimacy of cryptocurrencies.

Richard Teng, the CEO of Binance, expressed gratitude towards the approximately 250 million users who continue to trust the platform for trading. His remarks underscore 2024 as a pivotal year for the crypto industry.

According to CryptoQuant, the average Bitcoin deposit in exchanges has significantly increased from 0.36 BTC in 2023 to 1.65 BTC in 2024. Similarly, USDT assets have surged from an average of $19,600 to $230,000. Binance has also become the first cryptocurrency exchange to surpass a trading volume of $100 trillion.

Market evaluations indicate unprecedented liquidity inflows, with nearly half of the BTC cash inflows occurring in the last 15 years this year. This detail signifies that as cryptocurrency ETFs gain more demand in 2025, the growth in cryptocurrencies is poised to accelerate.

Furthermore, with Trump taking office on January 20, 2025, and Gary Gensler no longer serving as SEC Chair, a shift in the SEC’s stance towards cryptocurrencies is anticipated. This change, evidenced by the approvals of ETH ETF inflows, suggests further increases in cryptocurrencies alongside other altcoin ETF approvals.