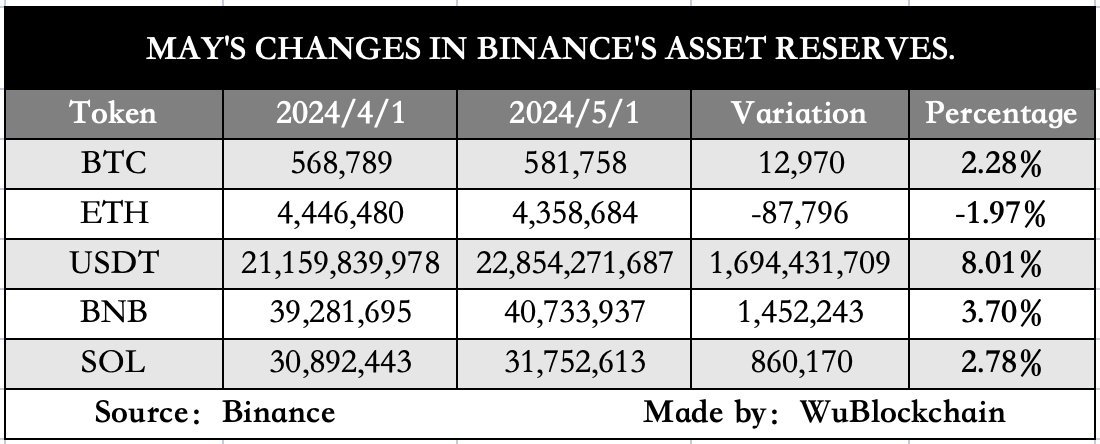

Binance, still the world’s largest cryptocurrency exchange by trading volume, has published its latest reserve report. Reserves are calculated and published from the first to the first of each month and are verified with zero-knowledge proof. Following the collapse of FTX, exchanges had to take such steps to regain customer trust.

Binance Reserves

As a trading volume generating exchange, all investors closely monitor the health of Binance’s reserves. It is mandatory to hold assets on a 1:1 basis for every altcoin, and if this is not met, a collapse like that of FTX could happen in other exchanges too. WuBlockchain recently touched on some details about the latest reserve report, which can be summarized as follows;

- User BTC assets have increased by 2.28%, or 12,970 BTC, to 581,758 since the last report.

- ETH assets decreased by 1.97% or 87,796 ETH, reaching 4.358 million.

- Users’ USDT assets reached 22.85 billion, an increase of 8.01%. This roughly equates to 1.69 billion dollars.

- BNB assets increased by 3.70%; User SOL assets increased by 2.78%.

- DeFiLlama reports that the total reserve size of the Binance exchange reached 118.5 billion dollars, a net inflow of 6.49 billion dollars compared to the previous month.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.

Türkçe

Türkçe Español

Español