Struggling with regulatory issues and increasing competition, the world’s largest crypto exchange, Binance, had a challenging 2023. Since the halting of its free trade program on March 22, the crypto exchange lost a significant portion of its market share.

However, according to digital asset data provider Kaiko, May brought some relief with Binance’s bounce-back reclaiming part of the lost market share. Nevertheless, despite this surge, Binance‘s share in monthly volume stayed notably lower than the highest levels seen in February.

The Trouble for Binance?

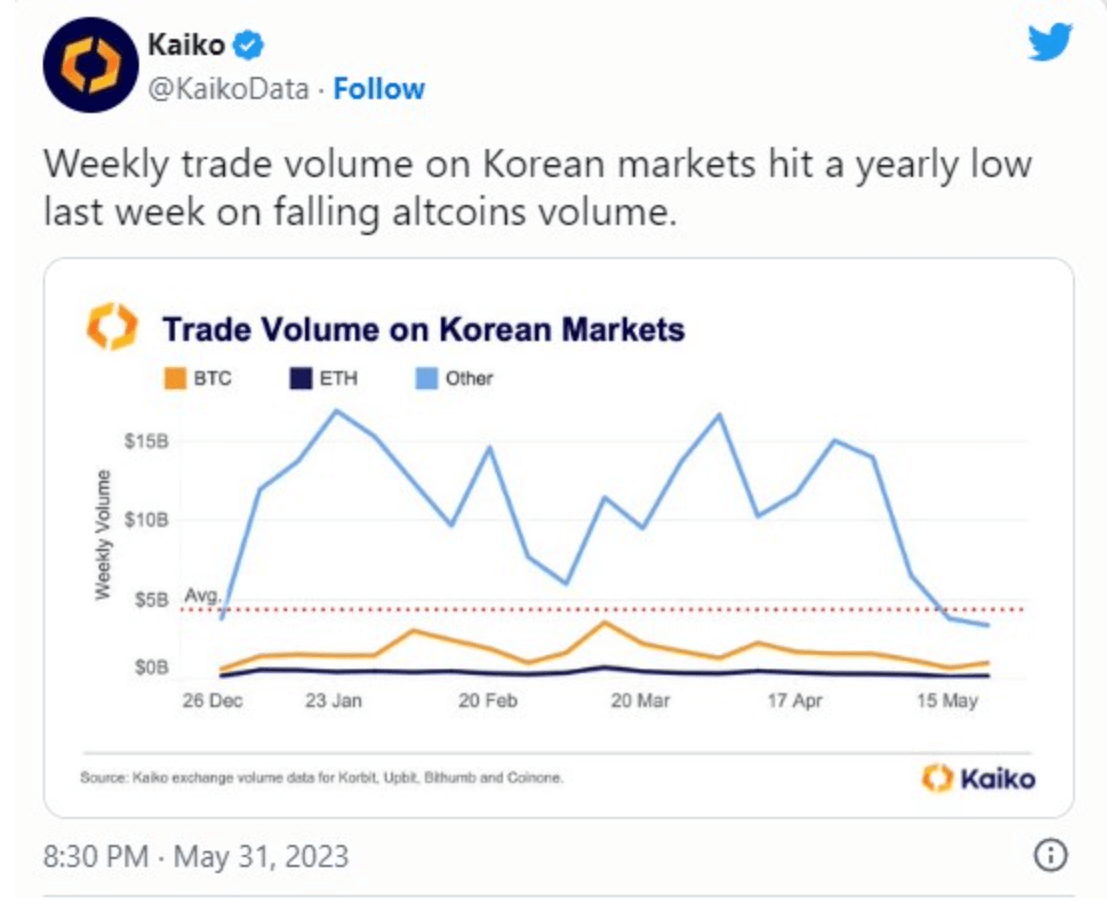

A closer examination of the data reveals that most of the gains made by Binance resulted from the decline in trading volumes in Korean exchanges. It is worth noting that Korean exchanges witnessed a dramatic surge in transaction volumes in March and April, and these platforms were preferred for altcoin trading.

However, the contraction in the weekly trading volume in the Korean markets to its lowest levels since 2023 led to a shrinkage of market shares.

Is Binance in Financial Trouble?

Even though Binance managed to increase its dominance among competitors, it couldn’t protect itself from the ongoing downward trend. Data from CoinGecko showed a significant drop of approximately 30% in spot transaction volume last month.

The tendency of investors to accumulate coins instead of trading them on exchanges emerged as a circulating rumor in crypto circles as the cause behind this downturn.

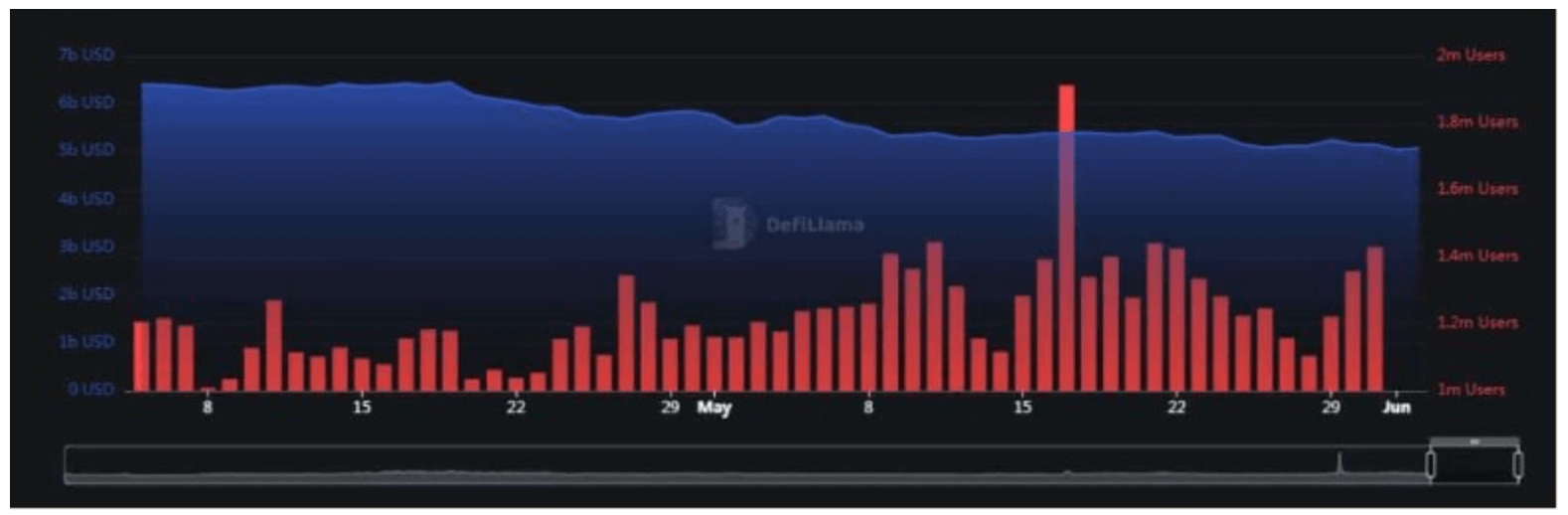

According to DeFiLlama’s data, over 63 billion dollars’ worth of assets were locked in the exchange at the time of writing this article. Last month, a net inflow of 1.431 billion dollars was recorded, which means more assets are exiting the exchange than being invested. This confirms the previous observation.

Renowned crypto journalist Colin Wu suggests that Binance was feeling the pressure of low demand and planned to downsize its workforce by 20% in June. Binance CEO Changpeng Zhao (CZ) denied allegations that the practice was a cost-cutting measure, stating instead that it was part of the organization’s routine talent density audit.

In terms of developments on the BNB chain, an increase in active user numbers was observed in the last few days, ending the declining trend witnessed since May 20. However, as the total locked value (TVL) continued to drop, user activity couldn’t boost liquidity on the layer-1 blockchain.