Binance, the largest cryptocurrency exchange by trading volume, has been highly visible, and the settlement in November was a significant event. Investors are pleased as one of the biggest fears ended with the resolution of issues between the US and Binance (excluding the SEC). The latest proof of reserves also shows that the settlement has had positive outcomes for investors.

What is Binance Proof of Reserves?

As this article is being prepared, the king cryptocurrency has once again risen above $45,000. The ongoing surge is as much due to the excitement over a potential spot Bitcoin ETF as it is to the end of the Binance FUD. One of the biggest risks was the possibility of Binance exchange being subjected to crippling penalties by the US. However, now we see that the strongest exchange by trading volume is moving forward with a new clean slate.

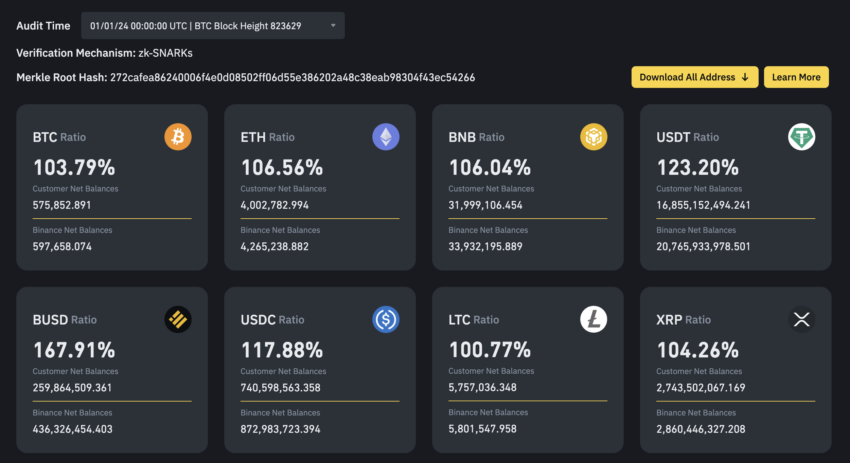

Binance has published its fourteenth Proof of Reserves. After the collapse of FTX, investors’ trust in centralized exchanges was justifiably shattered. Following the exposure of FTX’s fraudulent activities involving the sale of fake cryptocurrencies, centralized exchanges began publishing reserve proof reports. Binance was one of these exchanges.

This report shows, in a verifiable way through on-chain means, that investors’ cryptocurrencies are where they should be.

Binance 2024 Proof of Reserves

Data following the settlement shows growth in Binance’s reserves. This confirms that there is no negative sentiment regarding investor confidence in the exchange. Users’ Bitcoin (BTC) holdings climbed by 2.65% to 575,000, and Ethereum (ETH) holdings also increased by 2.9%. According to the latest report, users hold 16.8 billion USDT on the exchange, which also shows a 4.45% increase in USDT assets.

These figures do not include Binance exchange’s corporate assets. Although it was long alleged that Binance mixed customer assets with its own cryptocurrencies, no such finding was made in the latest Binance investigation. This eliminated one of the major allegations about Binance with the US settlement.

2024 has started well for the cryptocurrency markets. Binance’s reserves look solid, DCG recently paid off its debts to Genesis, and we seem to be just hours away from the approval of a spot Bitcoin ETF. Investors, unaccustomed to everything being so perfect, should be prepared for surprise negative developments, especially as the ETF excitement wanes and risk markets are pressured by rumors that the Fed will make fewer cuts in 2024.

Türkçe

Türkçe Español

Español