Bitcoin price is trying to gather strength for a new two-year high as we mentioned earlier. The January peak might be surpassed. At the time of writing, BTC is holding strong above $48,300 despite decreasing volumes as hours pass. We had mentioned that this would happen when GBTC sales weaken and other ETFs come to the forefront. Meanwhile, the competition between SOL and BNB is also heating up.

Solana and BNB Coin

The rivalry between the two has been ongoing for a long time. Recently, Solana (SOL) briefly surpassed BNB in market value, climbing to the fourth position. Now, with approximately $160 million more in growth, the same event is likely to occur again.

According to Coinmarketcap data, SOL Coin‘s market value has increased by about 12 percent over a 7-day period. At the time of writing, it’s around $48.1 billion, and BNB is at $48.26 billion. Both the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) indicate that SOL Coin’s price growth may continue, potentially surpassing BNB soon.

Santiment data reflects a dominant bullish sentiment in SOL’s Binance Funding Rate. The size of increasing long positions along with open interest suggests that the derivatives market is in buying mode.

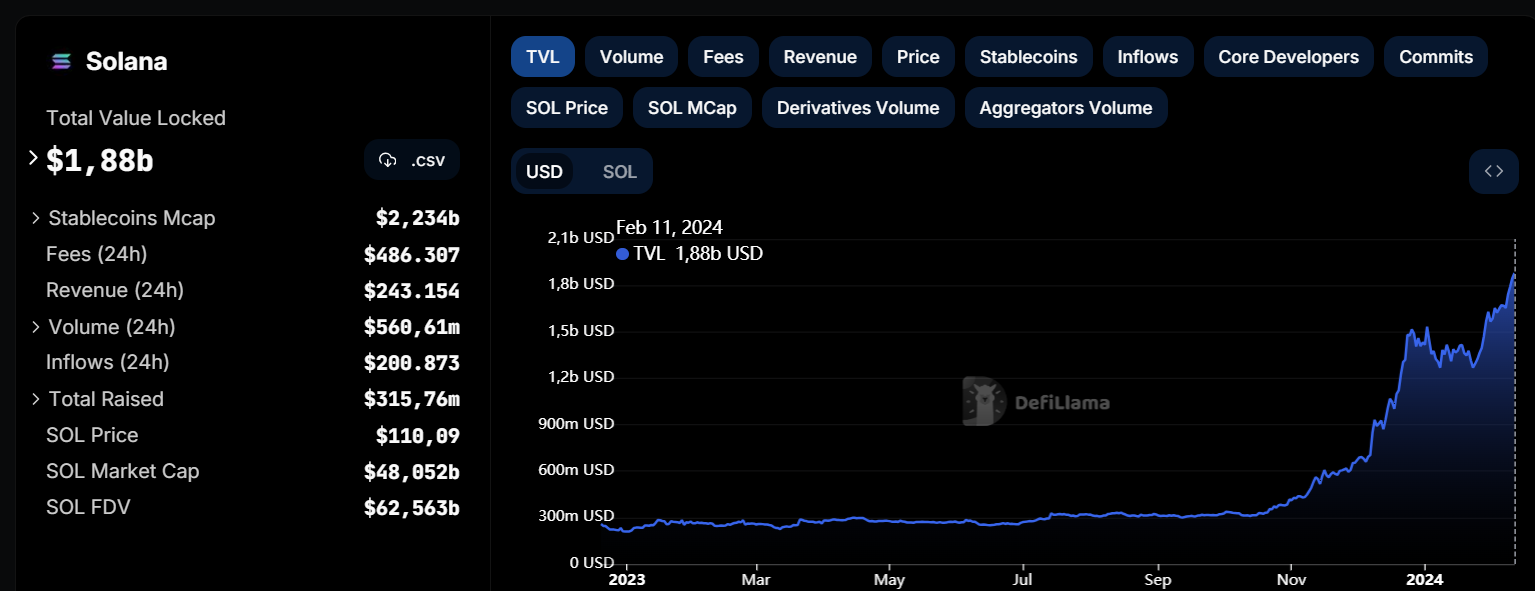

It would not be surprising to see Solana winning this competition for a while in the coming week. However, when considering the total value locked in the network, we must say that SOL Coin’s price seems overvalued. Both the speculative rally supported by GSOL and the hype brought by airdrops on the Solana network have triggered this excessive pricing.

Solana (SOL)

SOL Coin investors have good news: the total value locked on the network reclaimed the $1 billion threshold and soon approached the $2 billion mark. It seems that the significant TVL drop from 2022 will soon be compensated. If Solana’s TVL continues to rise, it could permanently or temporarily surpass BNB Coin in the rankings.

Although it may not attract much attention, network transaction revenues have been hitting all-time highs since the end of last year. This indicates that the activity on the network is much better compared to the bull season, highlighting the community’s vitality.