Bitcoin analyst Jelle predicts a significant increase for the cryptocurrency BTC, reaching $180,000. According to Jelle, a breakout in Bitcoin could lead to higher prices due to fear of missing out (FOMO). However, he suggests that market liquidity will be weak at these high levels. Therefore, as Bitcoin approaches this peak, he advises aggressively taking profits to avoid losses when the market eventually corrects.

Jelle’s Retrospective and Technical Analysis

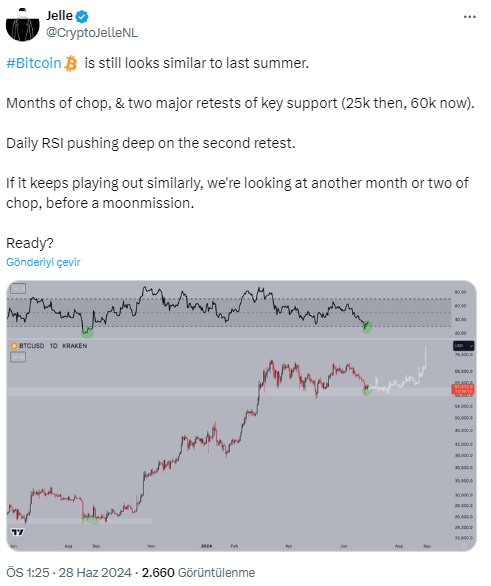

Comparing Bitcoin’s current state with the pattern observed last summer, Jelle notes that the cryptocurrency saw months of sideways trading, retesting two significant support levels: $25,000 last summer and now $60,000.

According to the analyst, the daily Relative Strength Index (RSI) is oversold during this second retest, indicating a potential recovery. If Bitcoin continues to mirror its behavior from last summer, Jelle foresees one or two more months of consolidation before a significant upward movement, often referred to as a journey to the moon.

Jelle’s analysis also emphasizes the importance of strategic profit-taking. He highlights the need to “scale up” by gradually selling portions of assets to secure profits and reduce risks. Jelle warns against holding the cryptocurrency BTC for too long, as the rapid price increase caused by FOMO could lead to a sharp decline once the buying frenzy subsides.

Increasing Interest in Cryptocurrency ETFs

Beyond Bitcoin, Jelle notes the growing interest in Bitcoin ETFs. While Bitcoin maximalists believe there will only be one Bitcoin ETF, he emphasized the rapid evolution of the market.

Ethereum is preparing to launch its ETF next week, and VanEck has applied for a Solana ETF. This expansion indicates increased mainstream acceptance and investment in various cryptocurrencies.

Jelle humorously suggests that even the older generation, which has been skeptical of cryptocurrencies, will join the market in a few years. The increasing adoption of cryptocurrency ETFs by traditional financial institutions could provide more growth and legitimacy in the crypto space.

Türkçe

Türkçe Español

Español