Bitcoin price is lingering around $65,600 with about an hour left to the daily close, and the last two-week candle is red. We know that cryptocurrencies do not always rise and will not. Even on the toughest days of bull and bear markets, there are interim corrections. So what are the current Bitcoin predictions of cryptocurrency commentators?

Cryptocurrency Commentators

The US stock markets did not open as positively as expected. Spot Bitcoin ETFs did not see the anticipated excitement. In other words, we did not experience the events that would trigger the expected general market rally after the Fed meeting on the fourth day of the week. Powell’s statements were still positive, and following the upcoming inflation data, it is possible for the markets to become even more isolated from macro pressures.

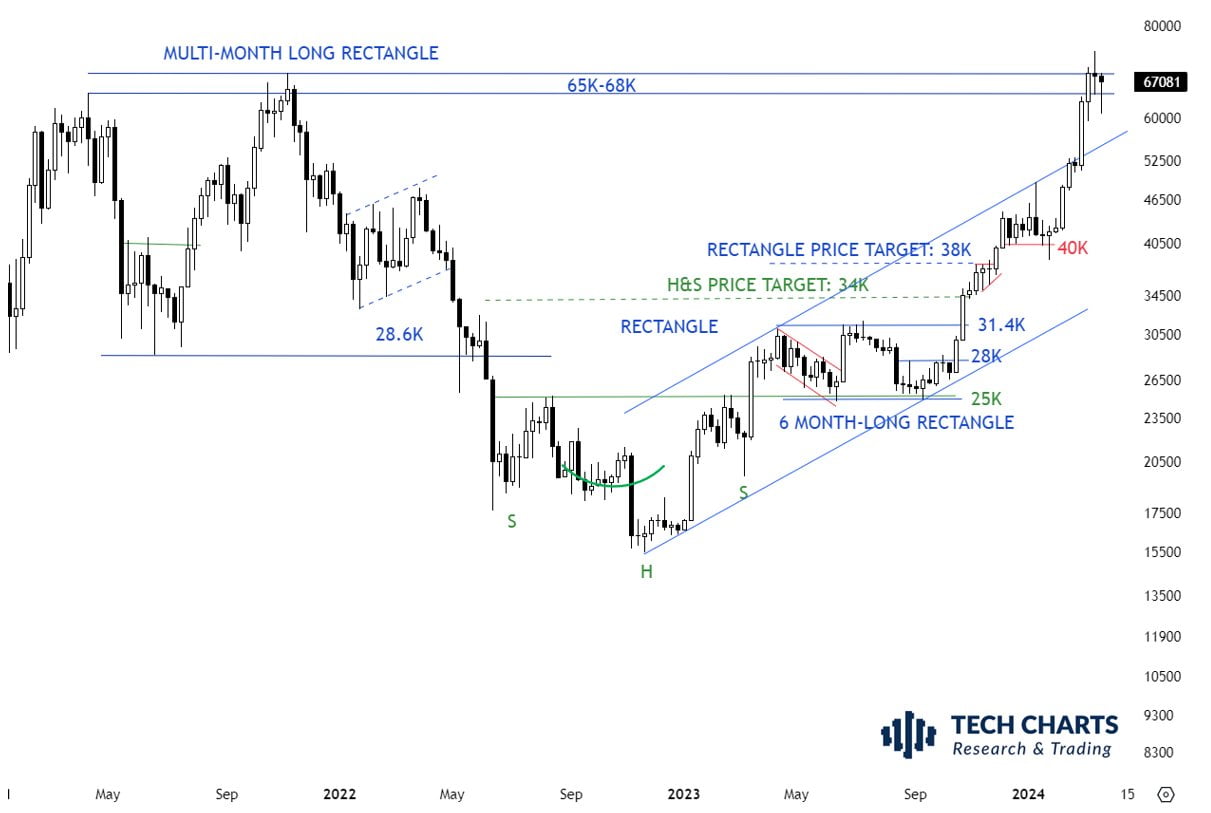

Popular cryptocurrency commentator Aksel Kibar had this to say about the current situation;

“The ideal condition might be happening for me. I like this. Parabolic movements are not healthy for the long-term trend. Pauses allow for greater participation.”

This analyst thought that the price needed to trade sideways for a while before breaking through $69,000. This process may have started, albeit delayed.

Bob Loukas’s Bitcoin Commentary

Another popular cryptocurrency commentator, Bob Loukas, also targets deeper bottoms for new highs. Bob believes that price corrections are necessary for the rise to continue strongly.

“There is a quite clear path for Bitcoin. The strengthening of the FOMC could mean lower levels in a 60-day timeframe. If there is still a lower move to come, the 10dma is where this move will revert to lower levels. Structurally better for the sustainability of the bull market. Otherwise, a close > $70,000 is likely rally time.”

Decentrader

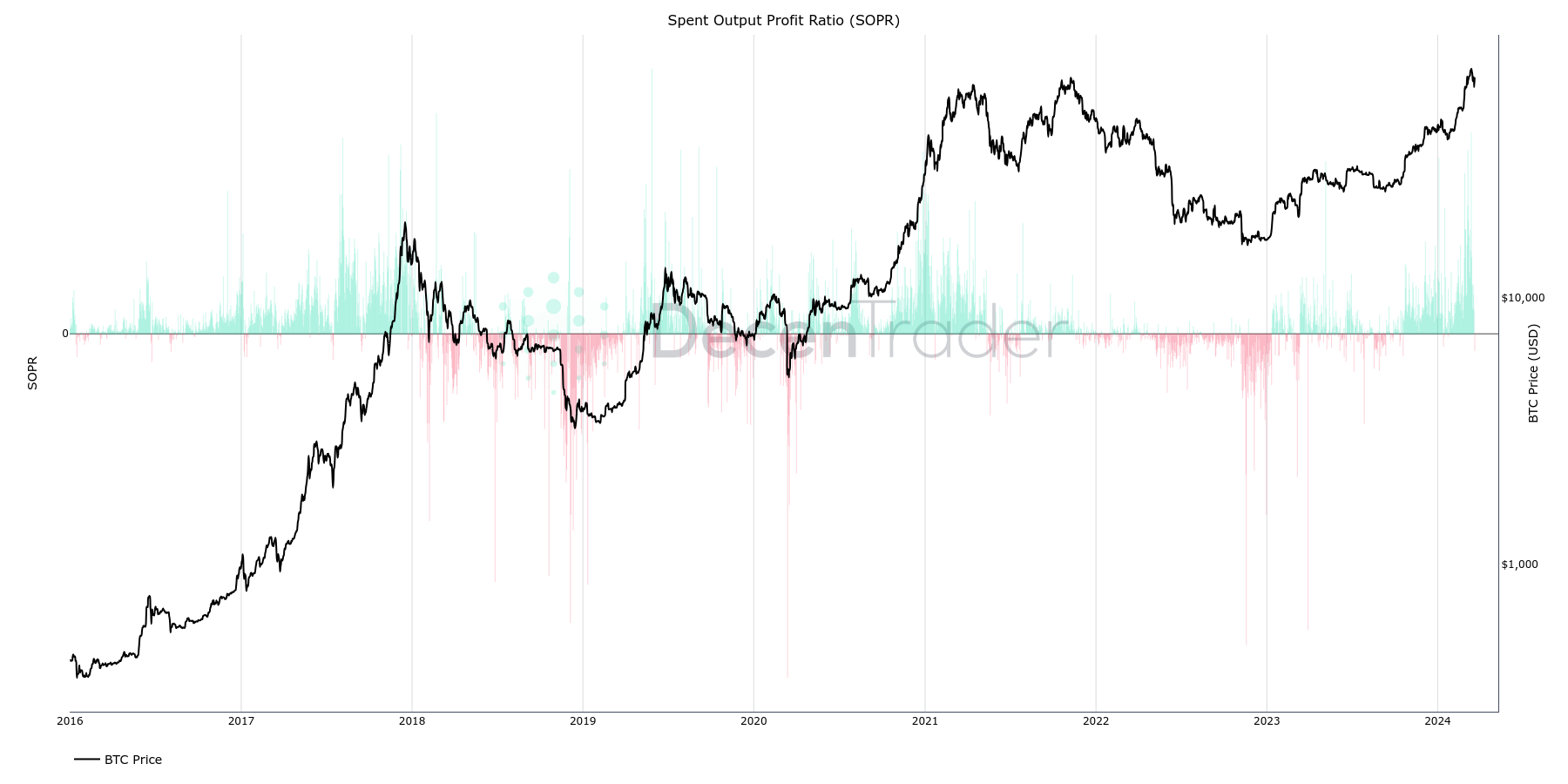

As reported by Decentrader, on March 20th, Bitcoin’s Spent Output Profit Ratio (SOPR) turned negative for the fifth time this year. This metric tracks the extent to which assets moved on the network are carried at a loss. It is measured according to whether the buying price is below or above the current price when the BTC is moved.

Negative values indicate more loss-making transactions and reflect the selling pressure on investors.