Bitcoin price was moving back towards the all-time high region from a low of $66,000 at the time of writing. After breaking the new all-time high record at $69,990, BTC also stirred altcoins. The current outlook for a popular altcoin points to a significant risk of decline. So what are the current predictions?

Polkadot (DOT)

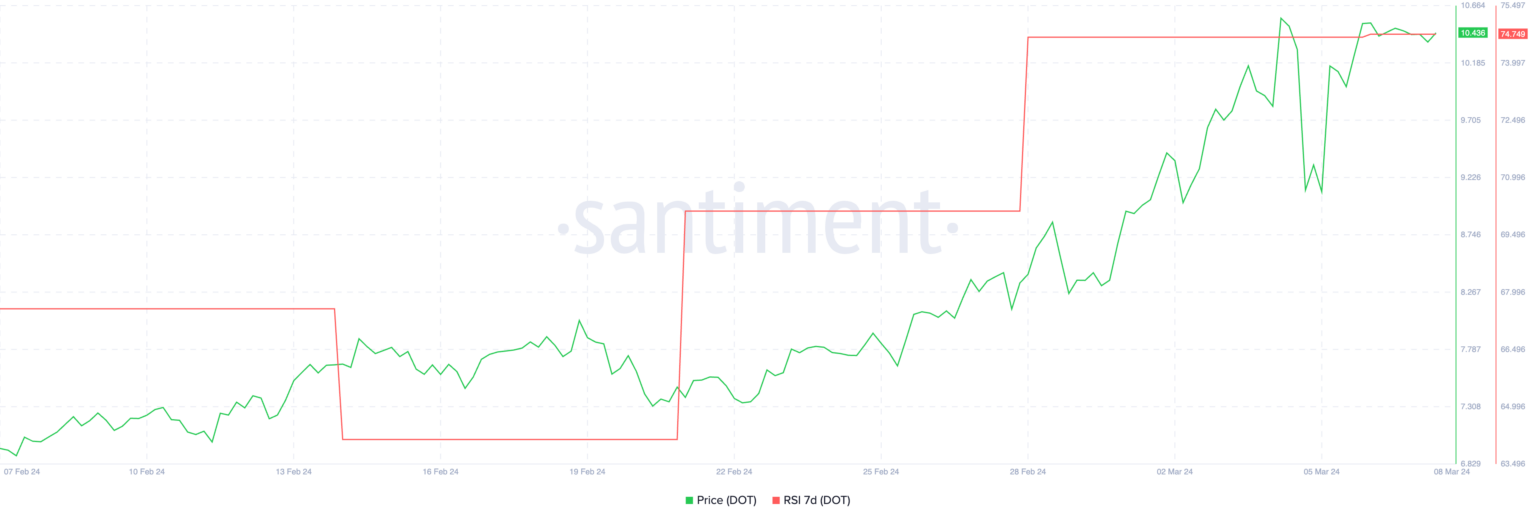

Market volatility is high, and if BTC sustains above $68,000, things could change over the weekend. However, for now, some indicators point to a potential decline in DOT Coin price. DOT development activity climbed from 13.10 on February 13 to 17.85 at the beginning of March but has since fallen back to 15.29 in the last two days.

Historical data suggests a correlation between DOT price and development activity. However, this correlation has been weaker in the past few weeks, indicating a possible decoupling. For instance, we saw this in February. Nevertheless, several exceptions confirmed in the past do not completely eliminate this correlation.

Potential Drop for DOT Coin

The RSI, recently surpassing 74, indicates overbuying and is quite high. While the DOT RSI level did not experience an immediate drop when it last surpassed 74, the current level warns investors of potential losses up to 30% as an early signal.

In a potential decline scenario, the key region for DOT Coin investors will be the $10 support. At the time of writing, the price is hovering near this level, and closing below it could lead to a journey down to $8.5 and deeper lows.

Short-term trends indicated by the EMA (such as over a 9-day period) crossing below the EMA designed to reflect medium-term trends (like over a 26-day period) also increase the risk of price decline. This is the third indicator signaling a potential drop for DOT Coin.

Additionally, Bitcoin price climbed to $68,500 at the time of writing, and if this momentum is sustained, a new peak for BTC could be imminent. If Bitcoin enters a consolidation phase in the $68,000-$69,000 range and attempts to move higher, it could lead to increased demand for altcoins.

Türkçe

Türkçe Español

Español