BTC is trading close to its daily low, and losses in altcoins have exceeded 5%. But why is it falling? In the last 24 hours, Bitcoin has retreated to as low as $40,350, and SOL Coin is anchoring below $100, increasing their losses. This indicates that the negative scenario we warned about last week is beginning to materialize.

Why Is Bitcoin Falling?

Last week, we wrote that the king cryptocurrency broke down from the rising parallel channel on January 12th. We also mentioned that this could lead to a deeper correction, with the targeted region being below $40,000. As hours pass, BTC continues to race towards this scenario.

For experts, the first target is $38,500. The fundamental reason for BTC’s decline could be that the GBTC redemptions, following the ETF approval, have exceeded the new demand from other ETF issuers. Most experts, including Eric from Bloomberg, suggest that as GBTC’s BTC reserves decrease, some of them might go directly to sales rather than to other issuers over the OTC market.

Of course, this situation, following the ETF approval, led to an additional $5 billion in sales, which further spooked the already shaken bulls.

What Will Be the Price of Solana?

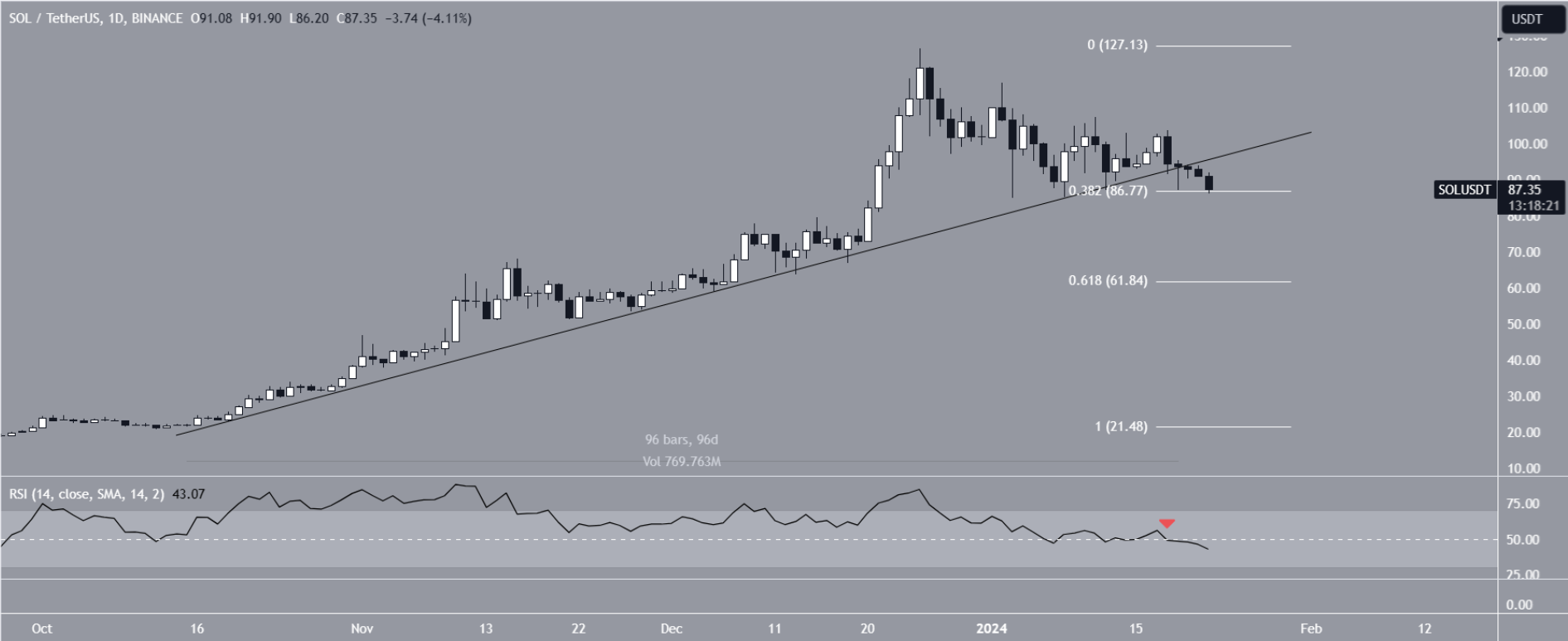

The price of Solana (SOL) has lost the rising support trend line that had been in place for about 100 days. It has retreated to the levels we highlighted in the past days and is now finding buyers at $86. On December 25th, following the rising support line, the price reached $126, marking its annual peak.

The daily RSI supports the downward trend, and BTC is making new daily lows. So, what do analysts say? A quick look reveals that an expert known as Lmn12121 expects a new low at $70. The Lord of Entry, pointing out the break in the rising support trend line, wrote;

“SOLUSDT shows a bit of a downward trend with the loss of the trend in October, the candle is closing below this current support, and the 77 region is dangerous.”

Lastly, BluntzCapital also wrote that he expects a drop to $70. According to the Elliot wave count, we see that SOL is in the C wave of the A-B-C corrective structure. This suggests that the price could retract to the support range of $70-$72.

Despite this drop in Solana’s price prediction, surpassing the triangle’s support trend line could bring a $115 target into play.