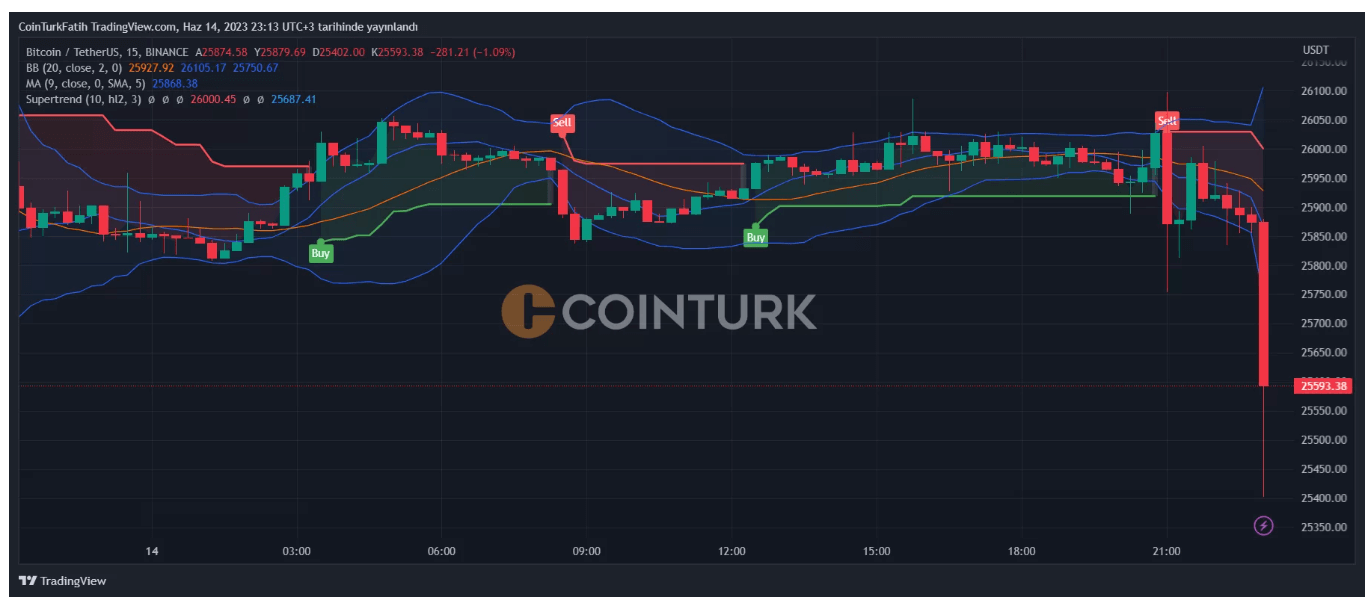

Bitcoin (BTC) and altcoins have seen simultaneous sell-offs, with Bitcoin dropping as low as $25,402. This decline post-Fed decision indicates that investors are not attracted by the pause on interest rate hikes.

Why is Bitcoin Falling?

The Fed’s pause on interest rate increases wasn’t sufficient for investors. Fed Chair Jerome Powell hinted clearly at a potential increase in July, depending on upcoming data. While investors were expecting rate cuts in March, they now price in two additional increases. Significant investor appetite has waned due to SEC pressure. Closures below $25,500 for Bitcoin could trigger more considerable losses. Moreover, altcoins had not sufficiently recovered from their recent fall.

Why are Cryptocurrencies Falling?

Losses in Bitcoin inevitably lead to rapid sell-offs in altcoins. Several altcoins have dwindled rapidly within the 15-minute candle of Bitcoin sell-offs. Sellers are on edge due to the potential loss of BTC’s $25,000 support. There are numerous reasons for the recent decline.

A list of causes includes an open war by the SEC against almost all altcoins, investor uncertainty due to lawsuits against major players like Binance and Coinbase, anticipated rate hikes by the Fed, slow core inflation rate decline, ineffective credit tightening motivation, repeated violation of the $25,500 support level by Bitcoin, withdrawal of market makers like Jump Crypto leading to liquidity dry-up, billions of dollars worth of BTC dumped in the market, and potential intervention by the US Justice Department due to allegations in the Binance case.

Regulatory interest in the sector increased after the LUNA crash. Instead of regulating it, they began disciplining the sector. This primarily affects altcoin investors. Whether the daily closure will be above $25,500 will determine the next direction.