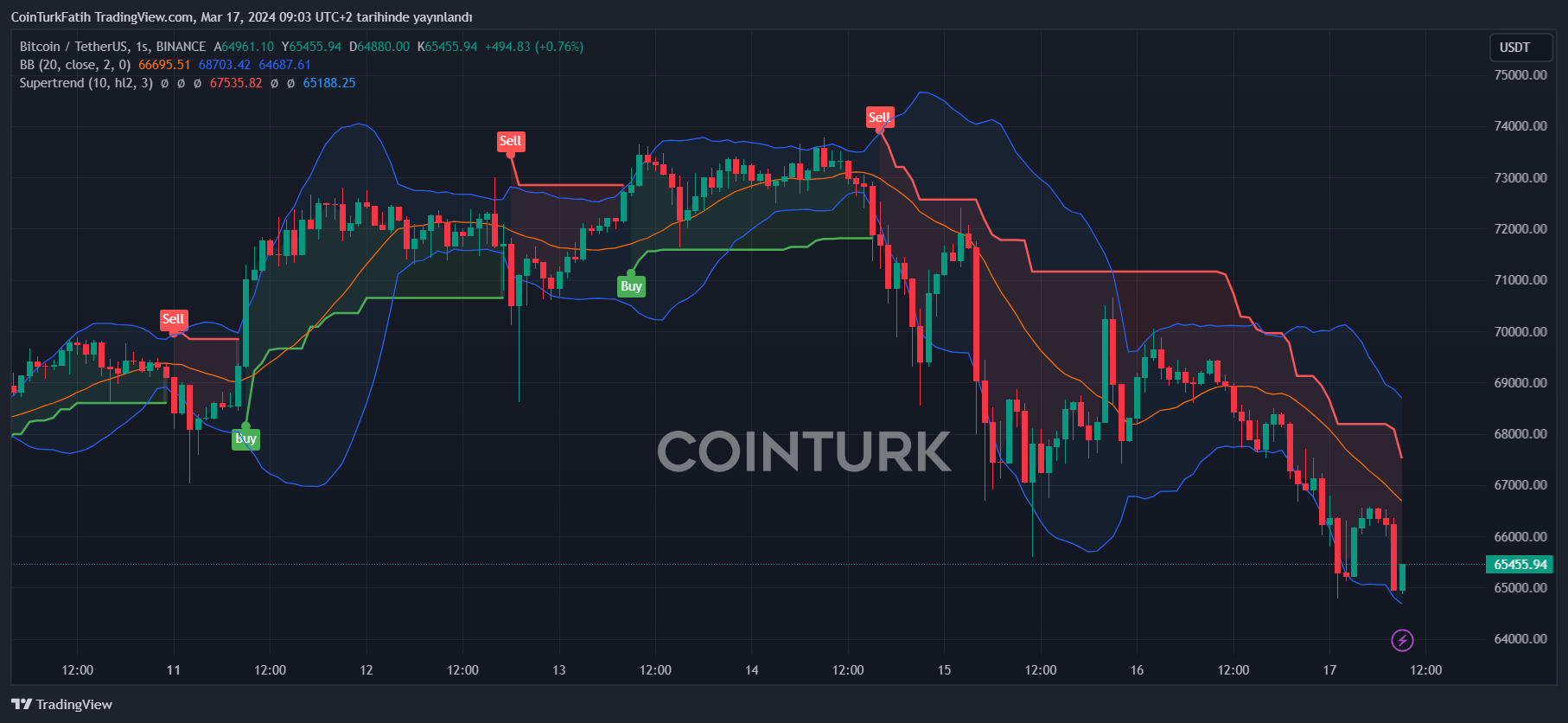

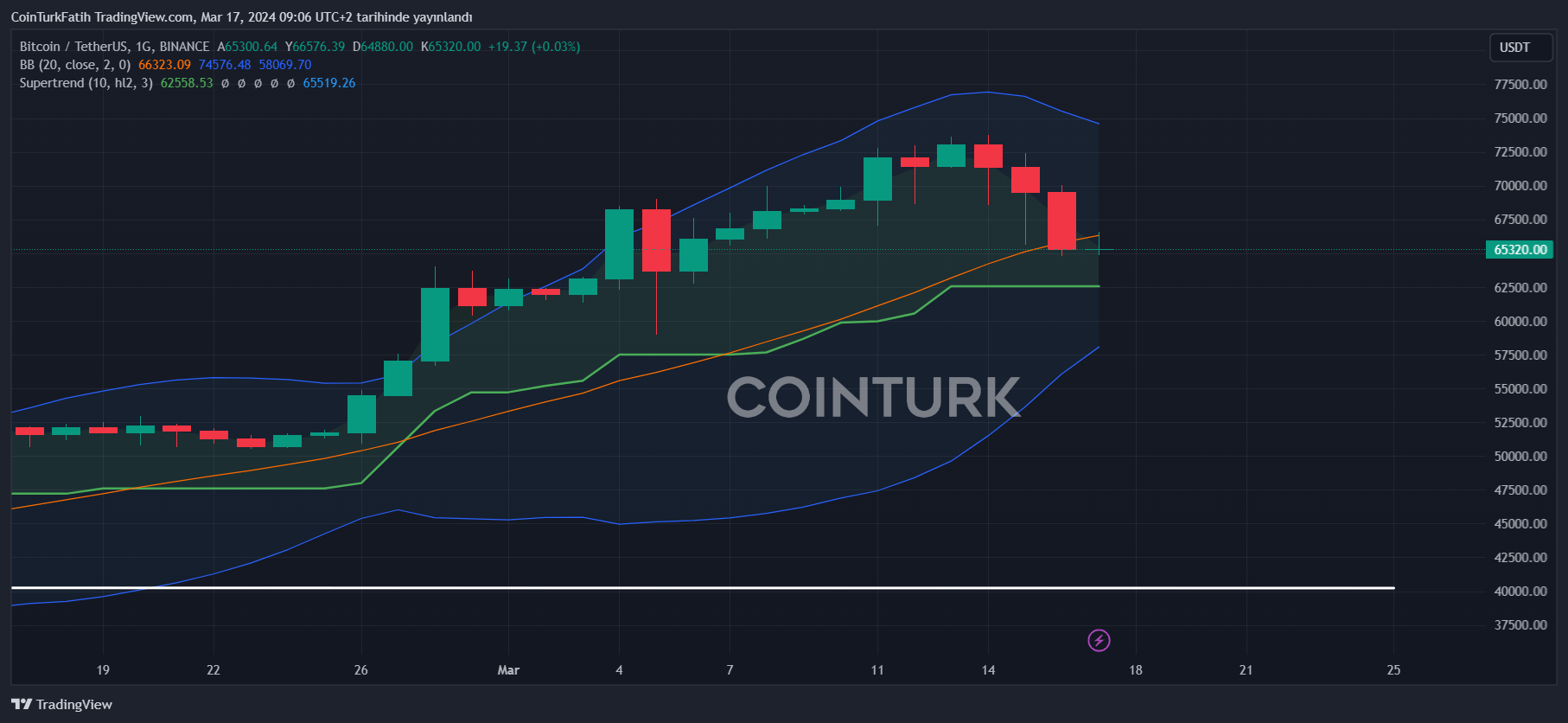

For investors, Friday was particularly disheartening as BTC sellers were in action. Following the weakening of ETF inflows and negative macroeconomic factors, BTC was finding buyers below $65,000 as this article was being prepared. So, how much longer will this decline continue?

Why Are Bitcoin and Crypto Falling?

The Fed’s interest rate decision will be announced on Wednesday, and the current outlook supports expectations of a hawkish stance. The market’s anticipation of an interest rate cut has weakened, and the Fed’s scenario of a 75 basis point cut is becoming more plausible. Just a few minutes ago, the price, which was above $66,000, has now lost the $65,000 mark, and the bulls are making a new attempt for a comeback.

Currently, the loss of the $68,000-$69,000 range has put the short-term $80,000 target in jeopardy. Investors are accustomed to 30 or even 40 percent losses during halving periods. Things are not going well on the macro front, inflation is persistent, and ETF inflows have weakened. If, in addition to all this, ETFs start a net outflow series on Monday, it could turn the week into a complete nightmare.

Cryptocurrencies are full of surprises, and investors are left flipping a coin between the possibility of prices quickly returning to an $80,000-targeting trajectory or increasing their losses. And of course, no one can see the future.