At the time of writing this article, the king of cryptocurrencies is finding buyers at $27,400 and volumes continue to decline. The ADP data was the best news today, but it also failed to lift the markets as expected. On the other hand, the strengthening dollar index and increasing expectations of interest rate hikes are causing concern among investors.

Bitcoin and Cryptocurrencies Commentary

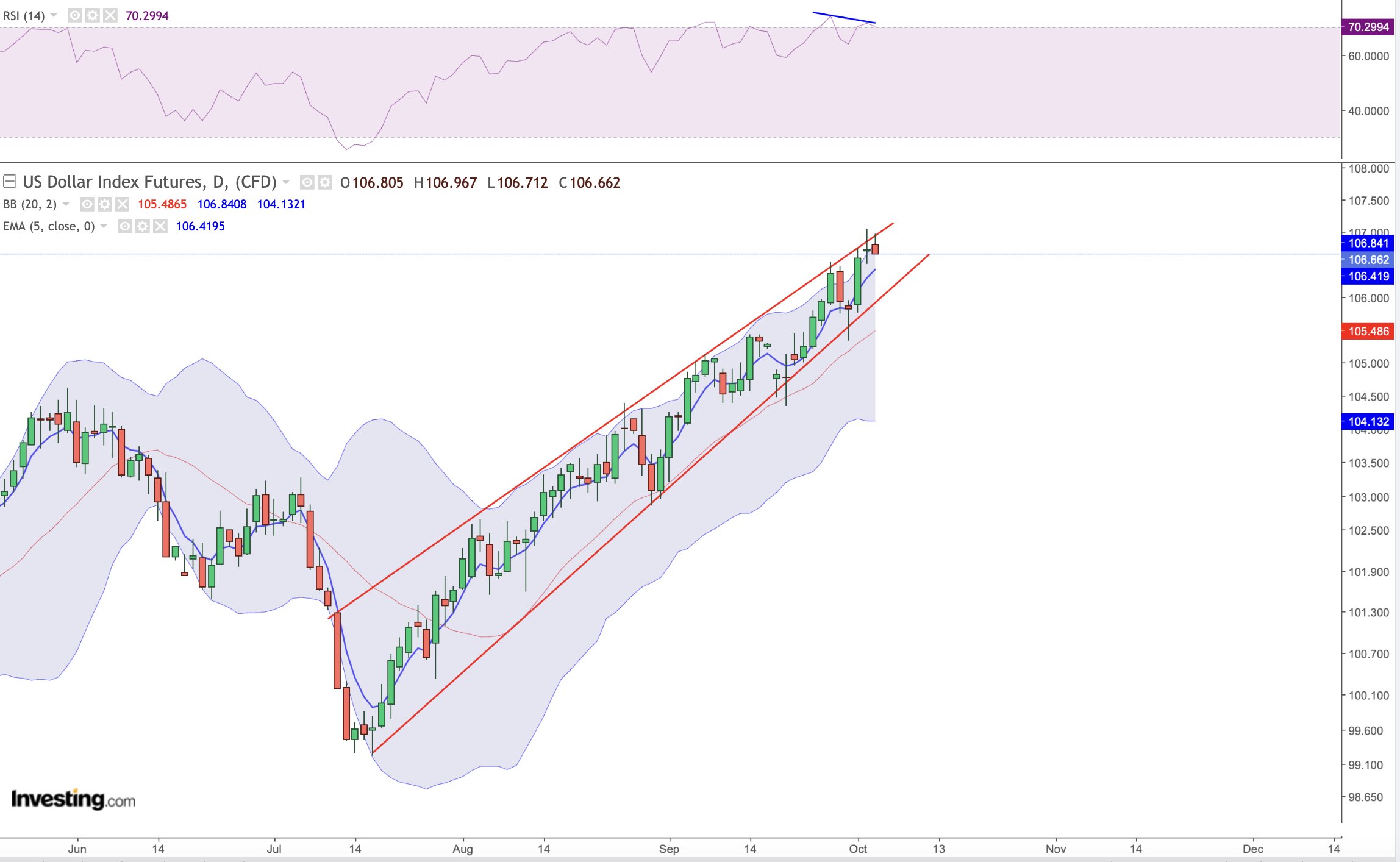

The markets started the week intensively with excitement about the ETF. However, the rise did not last long. On the other hand, although it seems that the DXY has turned back from the 107 level for now, the possibility of it resuming movement is worrying.

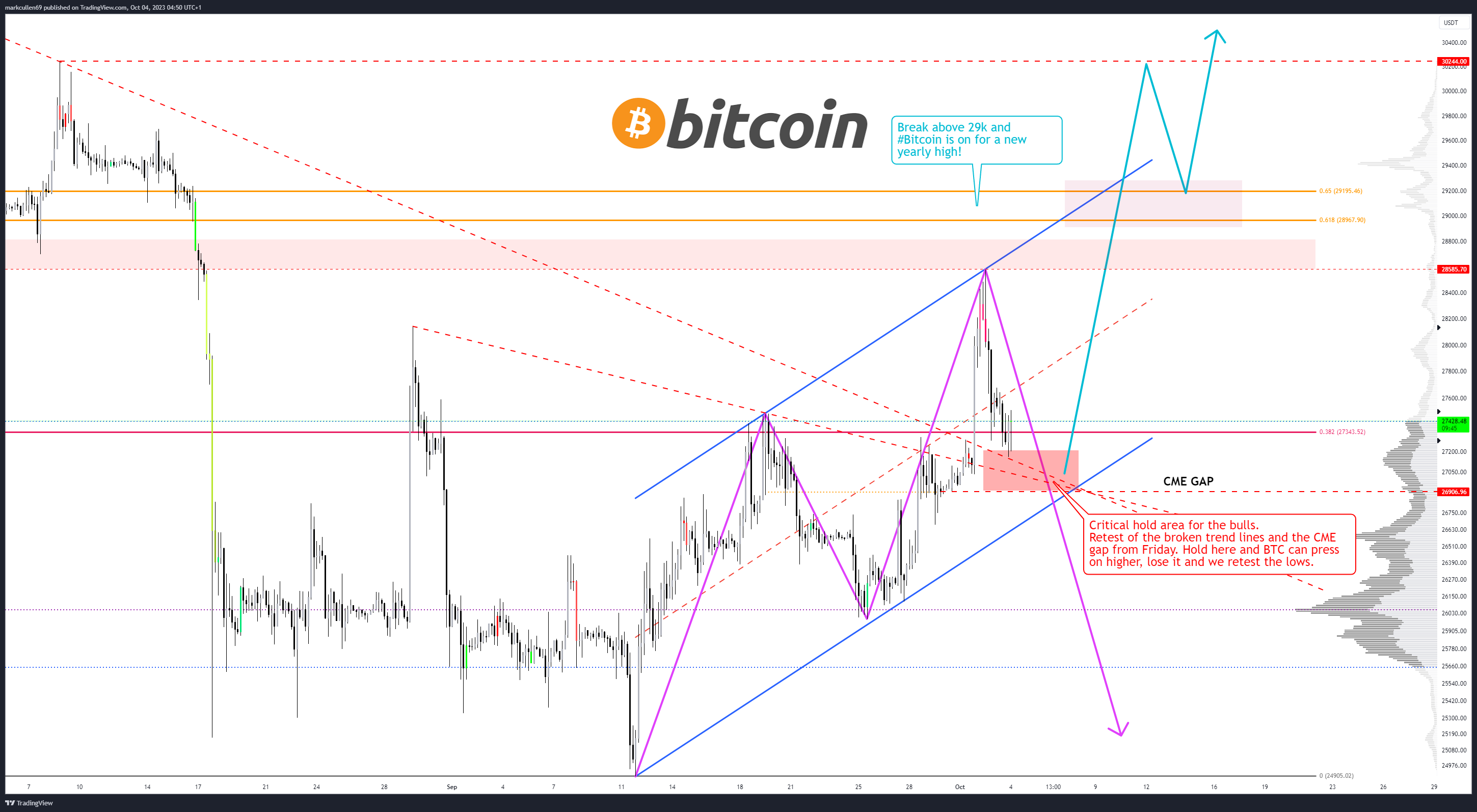

Popular cryptocurrency commentator known as Skew drew attention to the importance of $27,600 for BTC. If the bulls can reclaim this zone, we may witness the start of an uptrend in this scenario. However, the critical price level has become the center of profit-taking.

Crypto Tony emphasizes the need to maintain the $27,000 region for the future of the price. Mark Cullen agrees with him and says the following:

“Bitcoin is receiving a reaction from my area on its first attempt and breaking its trend line. The market conditions in Tradfi are not great, so the pressure has eased. Let’s see if BTC can hold on in this area until other markets stabilize. Holding $27,000 is very important for BTC!”

Will Cryptocurrencies Rise?

The rise of US 30-year Treasury bond yields to the highest levels in the past 16 years negatively affected the risk markets. Skew considers the weakness in trading volumes to be normal in the midst of macro uncertainty. Investors prefer to stay on the sidelines because they cannot predict what will happen.

“The market is probably trying to digest everything that is happening in terms of risk parameters and exposure.”

The US dollar index (DXY) experienced significant fluctuations during the opening of Wall Street today. The US dollar index (DXY) rapidly dropped from levels not seen since the fourth quarter of last year. Sven Henrich, the founder of NorthmanTrader, defended that this was the expected scenario when commenting on the situation.

“In the midst of all the chaos and volatility, there is an incredibly consistent and clean chart: the US dollar is respecting the channel trendlines. Negative divergence at the recent high levels of the channel. In this case, what will happen will likely be one of the most important factors guiding the market for the rest of the year.”

If the DXY starts a rapid turnaround, this could initiate a move to 115 or even higher levels. The critical threshold is 108, and the DXY is not far from it.