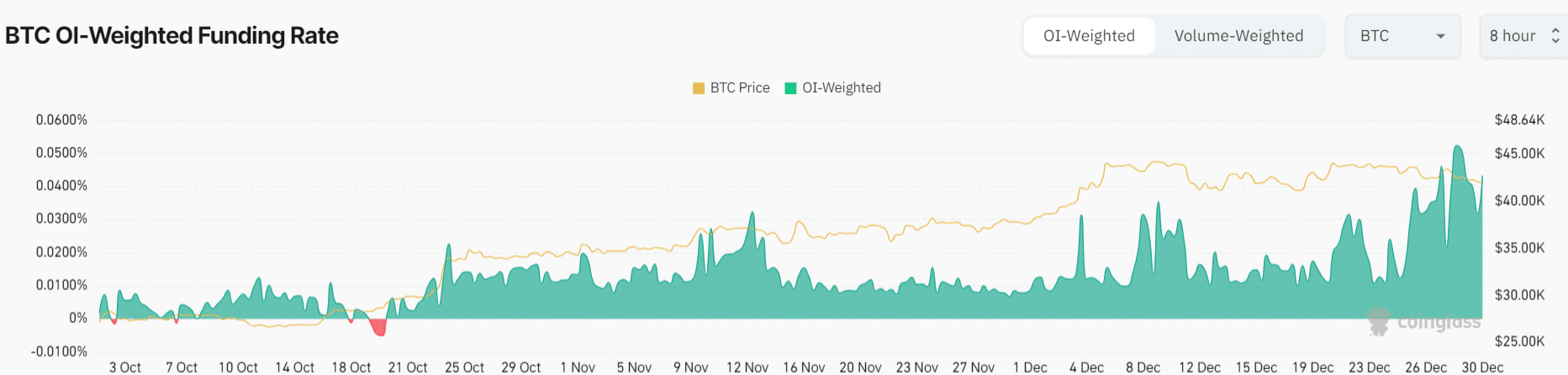

After the expiration of the year’s last options worth 11 billion dollars on December 29, there was a relaxation in the prices of Bitcoin (BTC) and Ethereum (ETH). The largest cryptocurrency, BTC, is expected to close the year below 44 thousand dollars, and the largest altcoin, ETH, below 2 thousand 400 dollars. BTC and ETH continued to rise throughout 2023 with the support of increasing open interest (OI), while record increases in funding rates caused the rally to stop at the end of the year. Experts expect the rise to continue despite high OI and funding rates.

Latest on Bitcoin and Ethereum’s OI and Funding Rates

The open interest (OI) of Bitcoin and Ethereum in the futures market decreased after the options expired on December 29 and the recent pullback in the cryptocurrency market. Despite this decrease, traders and investors continue to stay on the positive side, expecting more increases.

Current data shows that the total OI of all Bitcoin futures across cryptocurrency exchanges is over 18 billion dollars. The OI of Bitcoin futures on CME and Binance are at 4.81 billion dollars and 4.31 billion dollars, respectively, and have started to rise again after the recent drop. Similar figures are also found on other cryptocurrency exchanges such as Deribit, Coinbase, Bybit, OKX.

The total OI of Ethereum futures is at 3.36 million dollars. Moreover, the total OI of Ethereum futures on the three largest cryptocurrency exchanges (Binance, Bybit, and OKX) has also started to rise again after the price drop.

Experts Analyze OI and Funding Rates

Crypto influencer Kamikaz stated that the OI of BTC and ETH was completely wiped out after the expiration of the options, but investors began to rise due to the expectation caused by the potential approval of a spot Bitcoin ETF, making them hesitant to short sell.

Experienced cryptocurrency analyst Credible Crypto agrees with Kamikaz on the market being in an uptrend. The analyst clarified that people confuse high funding rates with an excess of over-leveraged participants, emphasizing that in reality, OI has been completely reset to levels not seen in the last few years. Credible Crypto mentioned, “The funding rate is only relatively high because traders using leverage are predominantly in long positions.”

Data currently shows that the funding rate has dropped from record levels. The OI-weighted funding rate chart for Bitcoin suggests that a price increase is possible in the coming days.

Türkçe

Türkçe Español

Español