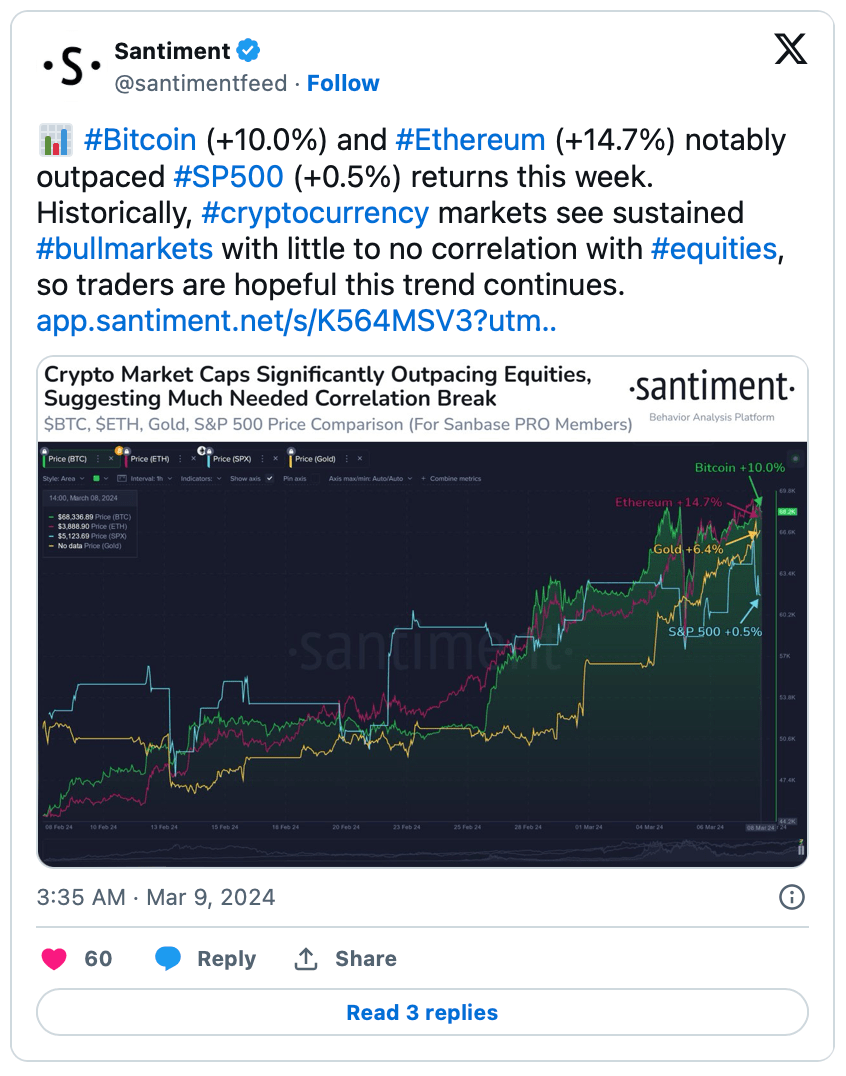

According to crypto data provider Santiment, amidst recent market activity, Bitcoin (BTC) and Ethereum (ETH) significantly outperformed the S&P 500 index in weekly returns. This notable success was marked by Bitcoin reaching an all-time high of $70,199 on the Coinbase exchange and Ethereum also recording a significant rise, approaching $4,000.

They Beat the S&P 500 Index

Santiment reported that this week, Bitcoin and Ethereum brought in notable gains compared to the S&P 500 index. Bitcoin saw an increase of over 10%, while Ethereum recorded an impressive rise of over 14%. In contrast, the S&P 500 index only managed a rise of 0.5%. The data provider mentioned that Bitcoin and Ethereum currently have little to no correlation with stock indices, including the S&P 500 index, which instills hope in investors for the continuation of the upward trend.

Despite Bitcoin refreshing its record, Santiment added that the percentage of social media discussions about BTC remained relatively high at 27.5%, but below the levels observed during previous exuberant periods when the price exceeded $60,000. The data provider interpreted this as a positive sign, noting that the fear of missing out (FOMO) and greed, typically indicators of market peaks, had not yet emerged.

In addition to all this, Santiment highlighted another positive indicator for Bitcoin, pointing out an increase in activity among previously inactive Bitcoin wallet addresses. This indicates that these old BTCs are re-entering circulation. This situation, which is normal during bull markets, suggests that Bitcoin’s upward price trend and investor sentiment may continue to shift towards excitement until stagnation sets in again.

Peak Date Determined

On the other hand, cryptocurrency analyst and trader Ali Martinez shared his views on the historical timing of Bitcoin market peaks. Martinez noted that historically, it has taken about a year or slightly less for Bitcoin to reach a new market peak after hitting its all-time high. Based on this analysis, Martinez expects the next Bitcoin market peak to occur between November 2024 and February 2025.

According to the latest data, BTC has pulled back to $66,000 after reaching its historic peak of $70,200. Following this decline, the largest cryptocurrency showed resilience with a 2.58% rebound and is currently trading around $68,000.