Bitcoin price continues to find buyers above $60,000, though spot Bitcoin ETF volumes have weakened somewhat. On the last day of February, volumes were below the record set on February 28. As we approach the weekend, if BTC remains strong, we could see significant price increases in altcoins. So, what are the predictions for BTC and ETH?

Bitcoin (BTC)

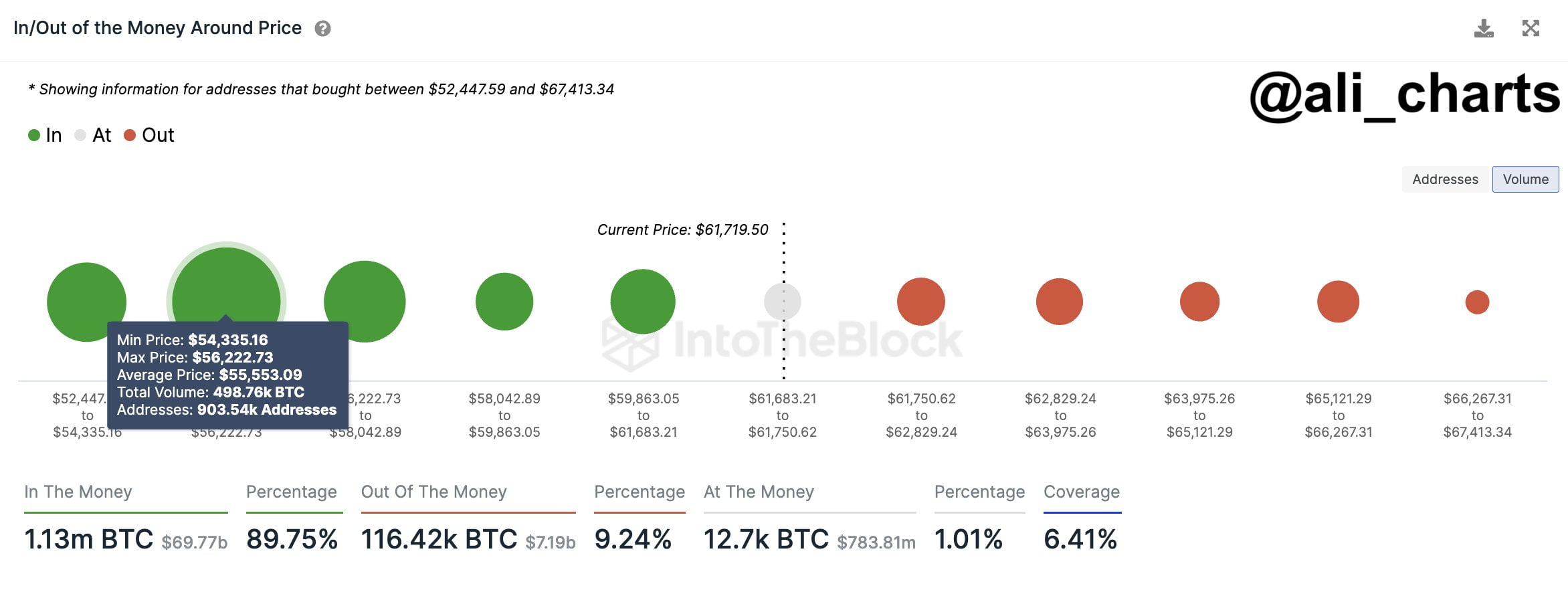

According to Ali Chart, BTC is not facing significant resistance. The IOMAP chart provided by IntoTheBlock indicates that there is no massive resistance for the king cryptocurrency. Considering profitability has risen back above 99%, this picture becomes clearer.

The chart suggests that approximately 903,540 addresses have previously bought around 500,000 BTC, creating a significant support zone between $54,300 and $56,200. This is exactly what is needed. If investors in the key region can avoid selling for a long time, it would take a very bad headline to shake BTC into rapid losses and turn it away from the ATH path.

The following weekly chart shows that the support level described above has previously provided a good bounce level for BTC. A similar process had occurred before the big move to $69,000 in 2021.

The RSI is in the overbought zone and a strong stance above 85 is supported by upward moving averages. On the other hand, Ali warns short-term investors about a sell signal given by the TD Sequential indicator on the four-hour chart, which could lead to a price correction of nearly 5%. Under normal conditions, the BTC price could test $69,000 in March.

Ethereum (ETH)

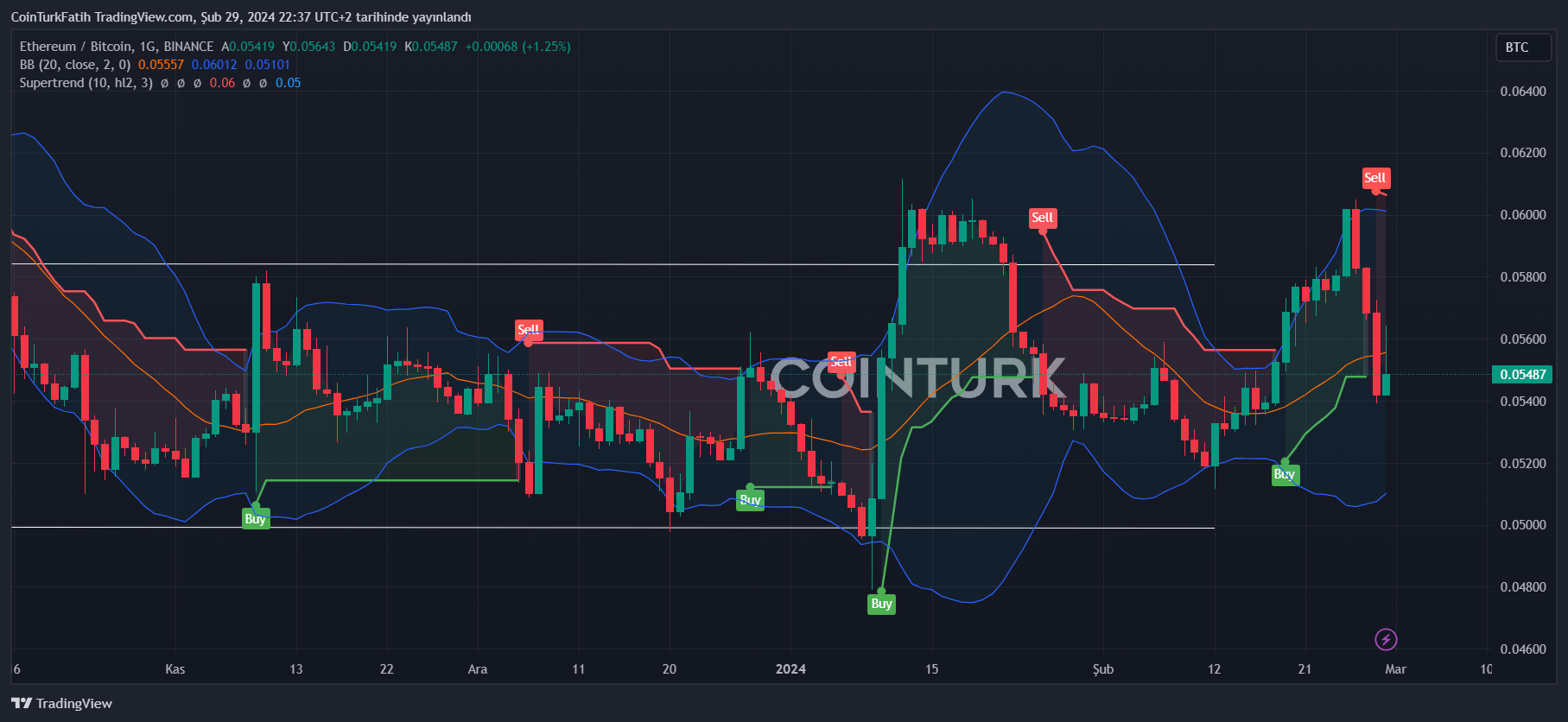

Altcoin king saw a breakout at full BTC parity and could move towards the 0.08BTC region, starting the rally. With the increase in BTC price, it rebounded from the 0.06051BTC level and found support at 0.0539BTC. Although its dollar-based price has increased, its weaker performance compared to BTC is concerning. However, the good news is that there are Dencun and Spot Ethereum ETF decisions on March 13 and at the end of May.

If the expected demand revival is triggered with Dencun and accelerated with ETF expectations, the price climbing to the 0.06-0.07 BTC region could rise to $4,300 in March.