Bitcoin’s Price Stability

Bitcoin and Ethereum have experienced a significant decrease in volatility in the past 90 days. Both digital assets are currently at their lowest volatility levels in two years, raising questions about the impact of stability on the wider cryptocurrency market.

Recent data from analytics site Kaiko highlights the shift in dynamics, indicating that while Bitcoin’s price has been on an upward trajectory, volatility has remained subdued. The primary observation from the data is the stability of Bitcoin, even as the price fluctuates around the $30,000 mark.

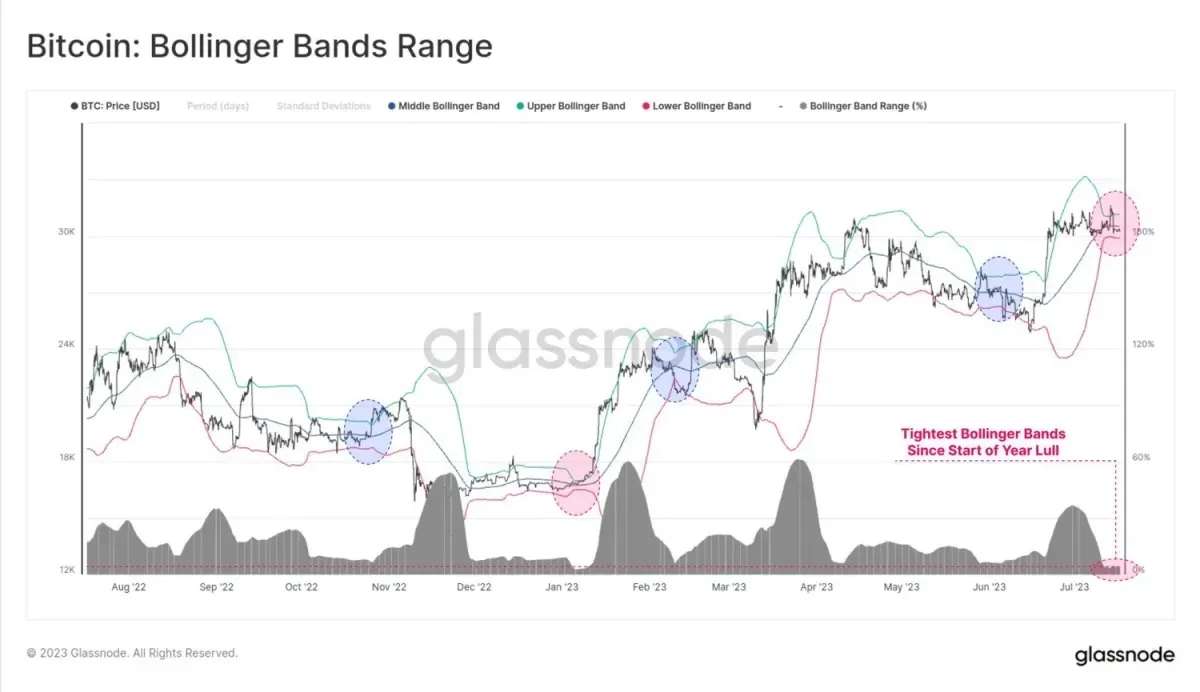

Bollinger Bands, a popular technical analysis tool, map the price movements of an asset by plotting upper and lower bands based on recent price action. The analysis revealed that Bitcoin is currently experiencing an extremely tight range, with only a 4.2% difference between the upper and lower bands. Such low volatility levels have sparked debates about their potential impact on Bitcoin, Ethereum, stablecoins, and the broader cryptocurrency market.

The observed stability of Bitcoin’s price may attract traditional investors seeking a reliable store of value. Additionally, Bitcoin’s price often sets the tone for the overall cryptocurrency market. Price stability can encourage institutional investors and individual users to explore the digital asset as a potential hedge against inflation and economic uncertainty.

Ethereum Following in Bitcoin’s Footsteps

Ethereum, the second-largest cryptocurrency by market capitalization, has also experienced a decrease in volatility, to some extent mirroring Bitcoin’s movements. However, Ethereum’s unique features, such as smart contract capabilities and its involvement in the evolving decentralized finance (DeFi) ecosystem, may provide some level of insulation during periods of low volatility.

While this stability may appeal to traditional investors, it can also impact speculative trading activities. Ethereum’s unique ecosystem and its effects on stablecoins add further complexity to the developing cryptocurrency market. As the market continues to mature, the role of stability and its impact on investor behavior will be critical factors shaping the future of the crypto space.