Bitcoin (BTC)  $103,035 has increased by 5% over the past week, continuing its upward trend. Although investors remain cautious, social media data reveal a growing optimism in the market. The largest cryptocurrency reached up to $88,500, recovering to this level after 17 days. Additionally, the biggest altcoin, Ethereum (ETH)

$103,035 has increased by 5% over the past week, continuing its upward trend. Although investors remain cautious, social media data reveal a growing optimism in the market. The largest cryptocurrency reached up to $88,500, recovering to this level after 17 days. Additionally, the biggest altcoin, Ethereum (ETH)  $2,346, briefly surpassed $2,100 after 14 days, joining in the rally.

$2,346, briefly surpassed $2,100 after 14 days, joining in the rally.

Excitement for Cryptocurrency on Social Media

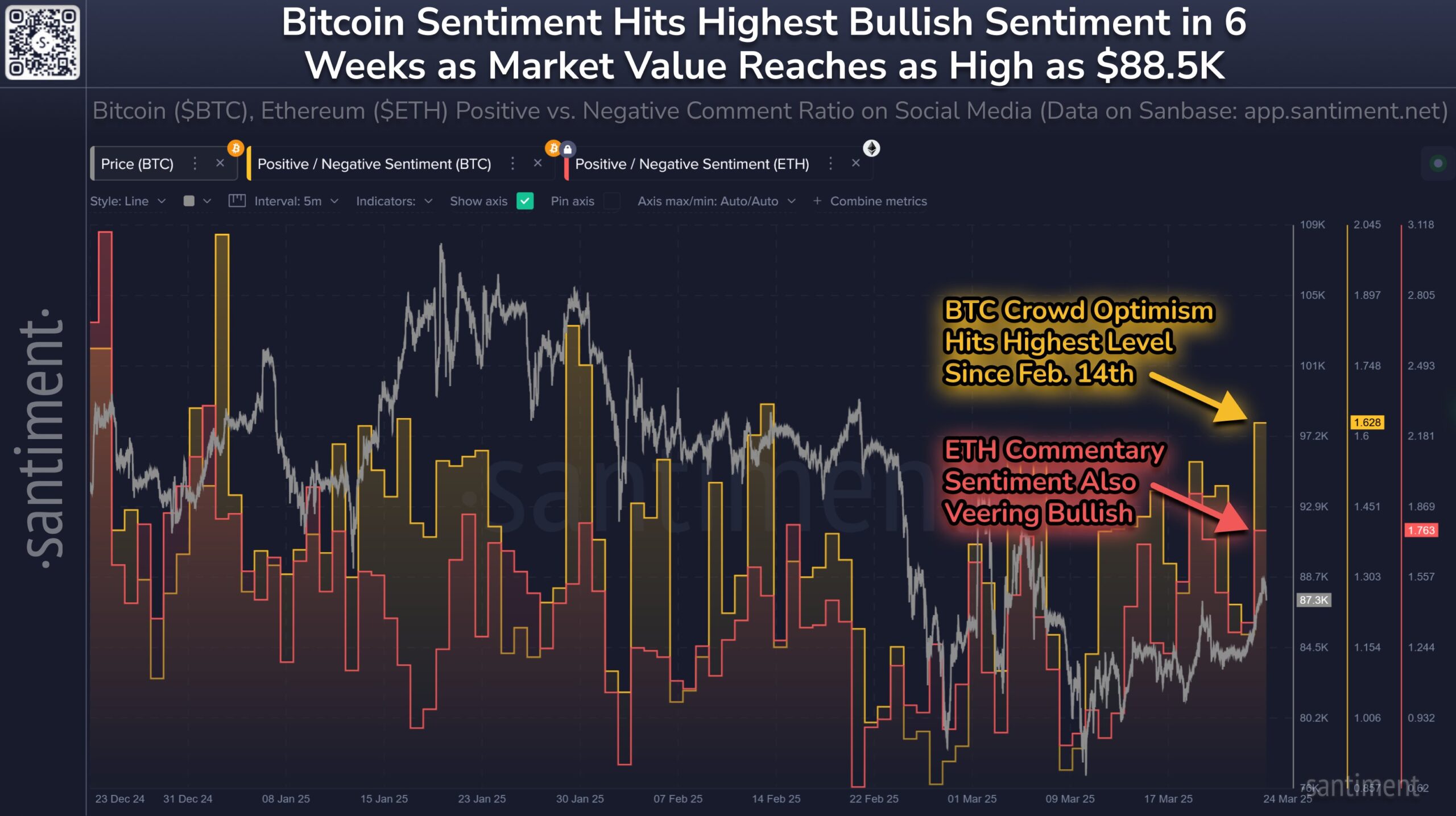

According to on-chain analysis platform Santiment, positive comments in social media posts by investors have hit a six-week high. For Bitcoin, social sentiment is notably positive for the first time since February 14. A similar trend is present for Ethereum, indicating a resurgence of confidence in the cryptocurrency market.

Investor sentiment often plays a crucial role in price movements. Historically, increased positive social sentiment has resulted in upward market reactions. The current outlook strengthens the possibility of continued upward momentum.

Ethereum’s momentary rise above $2,100 highlights investor interest not only in Bitcoin but also in major altcoins. The upward trend seen in both cryptocurrencies has contributed to building investor confidence.

Mixed Signals from On-Chain Indicators

Despite the rise, Bitcoin’s Inflow-Flow Position (IFP) metric shows weak signals. The IFP stands at 696,000, below the 90-day simple moving average of 794,000, indicating that a strong upward trend has not yet been validated. Moreover, the CQ Bull & Bear Market Cycle indicator continues to produce bearish signals, similar to previous downturns.

Bitcoin’s Market Value to Realized Value (MVRV) ratio is trading below the 365-day average. A similar scenario occurred during the carry trade crisis in August 2024, leading to selling pressure. Current risks remain consistent with this pattern.

The Net Unrealized Profit/Loss (NUPL) metric is also below the 365-day average. This suggests that the momentum for a market rise may be weakening. For Bitcoin to regain strength, NUPL must rise above average levels.

Türkçe

Türkçe Español

Español