Bitcoin reached new intra-week lows on March 19. What could be the next move for Bitcoin‘s price? As the downward momentum continues in the crypto markets, the real question for investors and analysts is this. After reaching all-time highs consecutively, Bitcoin is now testing the resilience of levels recently regained as support.

What to Expect on the Bitcoin Front?

Bitcoin has not yet found reliable support during this period, and market observers are setting various baseline scenarios while also planning for a potential relief rally.

Some analysts argue that the interest rate decision to be announced by the US Federal Reserve on March 20 could be a defining event that eases the pressure on oversold crypto assets. It has often been observed that risk assets were pressured ahead of the Federal Open Market Committee’s (FOMC) previous meetings. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Noteworthy Analyst Comments on Bitcoin

Following the movement after reaching an all-time high earlier this month, Bitcoin is rapidly advancing towards the $60,000 region. This is a critical point on investors’ radars, and a convincing retest has not been seen. Popular investor George X commented on the issue:

“I think we could at least see last week’s lowest level. If that doesn’t hold, I think we could see below $60,000 again.”

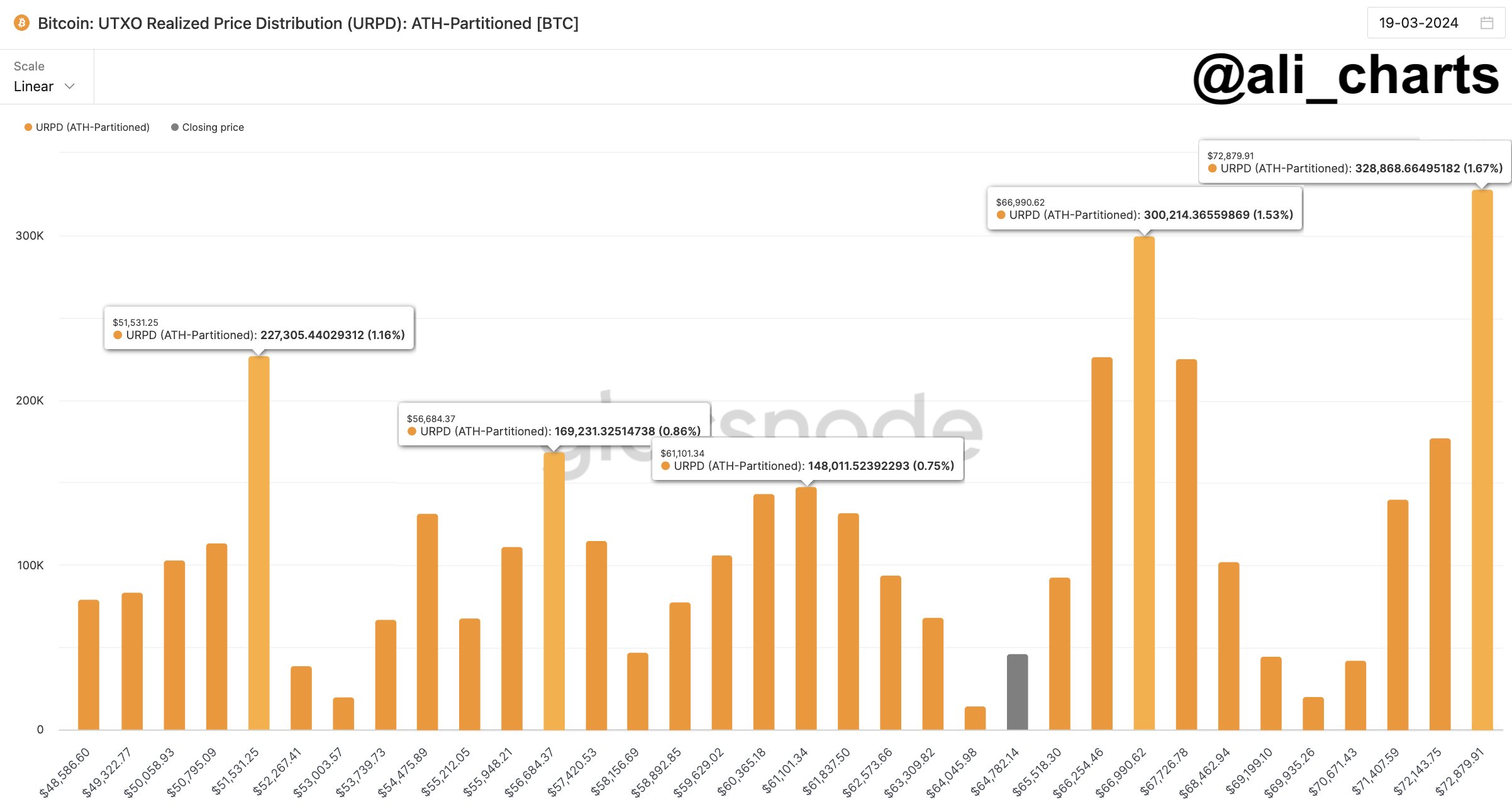

Popular investor Ali used the Unspent Transaction Outputs (UTXO) Realized Price Distribution (URPD) to indicate where price distributions occurred, providing insight into cost basis and areas of interest for support and resistance. While examining the ground below $60,000, Ali stated:

“Some important Bitcoin support levels to watch are $61,100, $56,685, and $51,530. On the other hand, critical resistance points for Bitcoin are at $66,990 and $72,880 levels.”

Meanwhile, analyst Mark Cullen, who uses Fibonacci retracement levels, highlighted a series of support levels that could come into play. In a chart uploaded by X, a bullish order block at the current spot price below $64,000 was also marked. Cullen commented on the issue:

“Looking at high volume nodes and fib levels, I think I can see where the correction might end. This will also depend on how the FOMC meeting turns out tomorrow.”

Türkçe

Türkçe Español

Español