Bitcoin starts a new week with a challenging fight to regain the ground it lost following a 15% price drop. After a weekend that wiped out a significant portion of the cryptocurrency, investors are licking their wounds, but Bitcoin has already begun to recover. Commentators comparing recent events in the Middle East to the March 2020 COVID-19 crash makes geopolitical sensitivity the main focus for the coming week.

Bitcoin Licks Its Wounds

So far, the altcoin market has borne the brunt of the sudden market reaction to tensions between Israel and Iran, and the BTC/USD pair managed to maintain the $60,000 support. The futures market, however, witnessed a comprehensive rally, and even in Bitcoin, 30% of open positions vanished instantly.

Looking forward, there is much to contend with; volatility is already quite visible, but there are only a few days left until Bitcoin’s next halving event. Thus, the environment is set for continued variable conditions as Bitcoin price movements are far from boring.

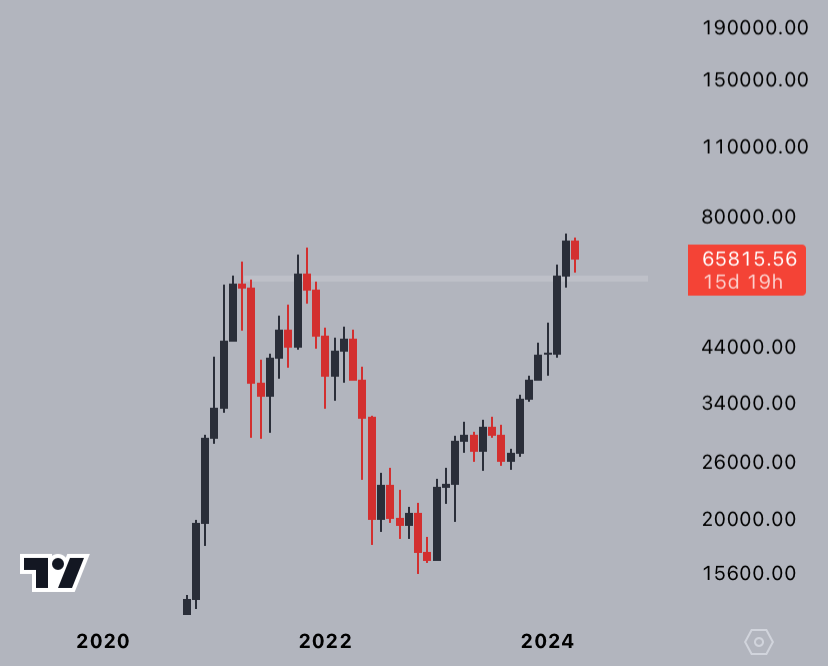

We can comfortably say that this weekend created a nightmare for crypto market investors unlike any seen before. As news of new geopolitical instability in the Middle East emerged, crypto, the only 24/7 open free trade markets, experienced sudden losses. Similar to events in Ukraine in early 2022, Bitcoin and altcoins were quickly sold off. The BTC/USD pair saw lows just above $61,000.

What Happened in the Crypto Market?

Altcoins performed much worse compared to Bitcoin; some lost up to 50% of their value before slowly joining the BTC/USD recovery process. Bitcoin’s dominance over the total value of the crypto market reached its highest level in three years last week.

While the magnitude of the movements surprised some, popular analyst Matthew Hyland later pointed out that signs of a sudden correction were already present, sharing the following via X:

“Overall, Bitcoin is still consolidating at fundamentally ATH levels. Altcoin projects were punished, but I think this was to rid the market of over-leveraged and weak hands.”

Popular trader and analyst Credible Crypto, analyzing current order book data, highlighted ongoing changes in liquidity placed and withdrawn at the largest crypto exchange Binance, summarizing the issue with these words:

“Spot is still trading at high prices; everything else still looks very healthy.”

Data tracking source CoinGlass provides a combined liquidity picture across exchanges, showing that as of April 15, the largest demand block was at $68,500. Meanwhile, investor and analyst Jelle, referring to monthly closing levels, shared these statements:

“Bitcoin is still standing above the previous cycle’s highest levels. Everything will work out.”

Türkçe

Türkçe Español

Español