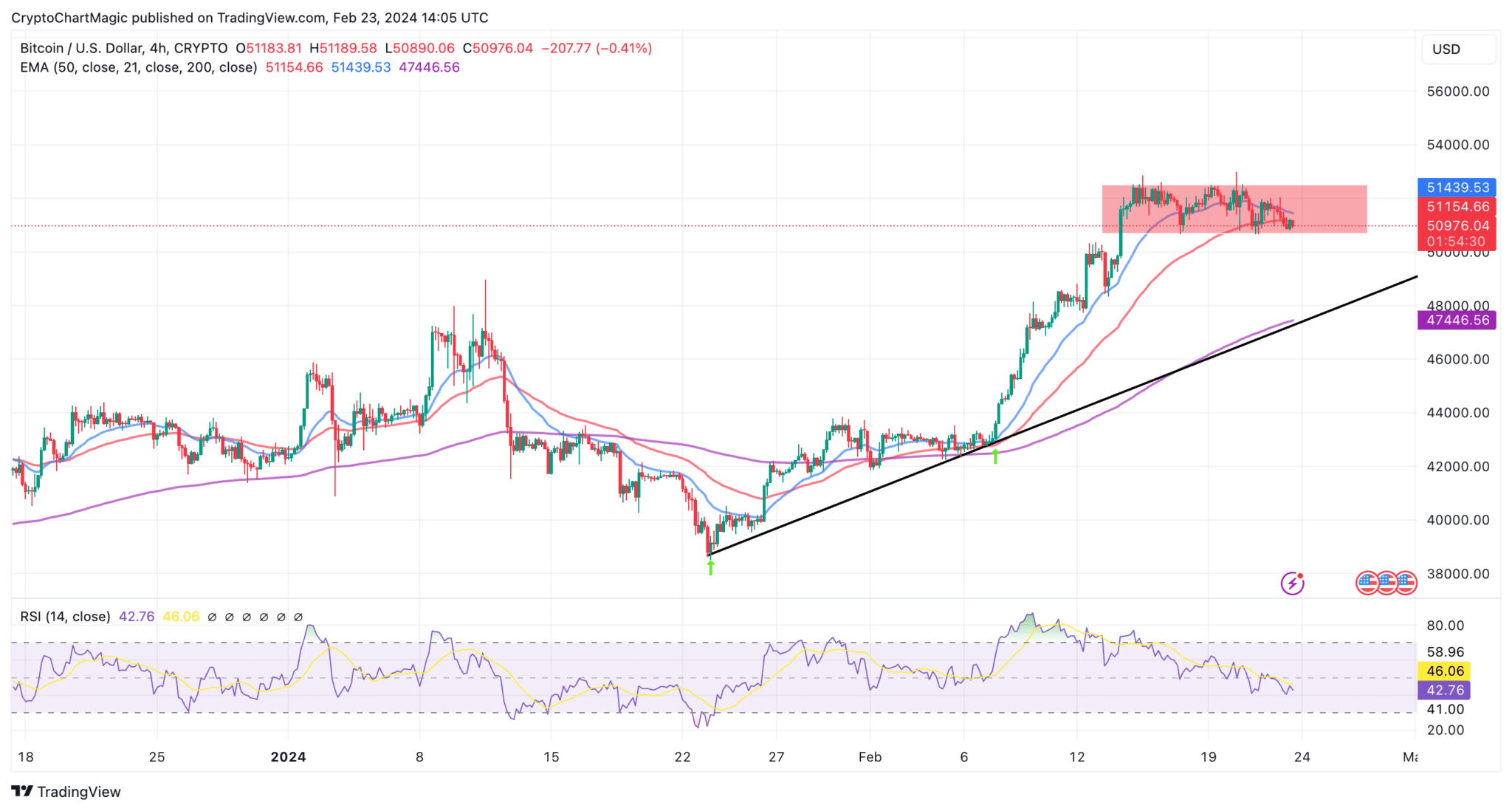

With a market value exceeding 1 trillion dollars, Bitcoin (BTC), the most prominent cryptocurrency, is currently bouncing back from an important support level at $50,800. Weakening demand has kept Bitcoin below the liquidity-rich level of $53,000, leading to price declines.

Bitcoin’s Retest Zone

However, with this key support holding, bulls may have another chance to attempt a breakout towards $58,000, known as the pre-halving rally. Bitcoin gained some strength from the support at $50,800 following Trump’s comments, but the upward trend seems to be weakening above $51,000.

Positioned below the 20-day Exponential Moving Average (EMA) and the 50-day EMA, the leading cryptocurrency BTC could cause volatility with more downward movement expected towards the weekend. If the decline continues, the Bitcoin price could drop to retest the $50,800 support. Breaking this area could be detrimental not only for BTC but also for altcoins that may face further retracements.

ETF Data on BTC

The impressive performance of Bitcoin ETFs over the past few weeks is a factor that must be considered before calling Bitcoin’s next major pullback. SoSoValue’s ETF data could indicate a massive inflow of $5.39 billion in cumulative total net entries, with a daily total net entry of $251 million coming in on Thursday.

Nevertheless, the better performance of ETFs could mean that sentiment is positive among both institutional and individual investors. Those with a long-term view on Bitcoin, considering the upcoming halving, may not prefer to sell due to downturns. Therefore, as both short-term and long-term positions are taken by crypto analysts and investors, pullbacks could increasingly become more profitable.

Türkçe

Türkçe Español

Español