The BTC price closed above $34,000, but it has since dropped to the $33,600 region. The recent surge in altcoins has raised concerns among investors that the BTC rally may reverse. However, the fact that the king cryptocurrency is holding the $33,000 level indicates that a new rally may be on the horizon.

Bitcoin (BTC)

The cumulative market cap of cryptocurrencies has fallen below $50 billion after the recent uptrend. If BTC closes the month at these levels, it will be a strong signal for the start of a bull season. The $32,400 region is being defended, and the price is targeting the $40,000 region. The support-turned-resistance at $32,000, which was tested but not overcome in April and July 2023, is an important sign.

In the daily chart, it is crucial for BTC to hold above the $32,800 region. If there is a correction, the focus will shift to the $32,800 region as the price quickly rose but failed to surpass the $35,000 resistance. In the weekly chart, a close above $34,000 will make the $40,000 target more apparent.

Ethereum (ETH)

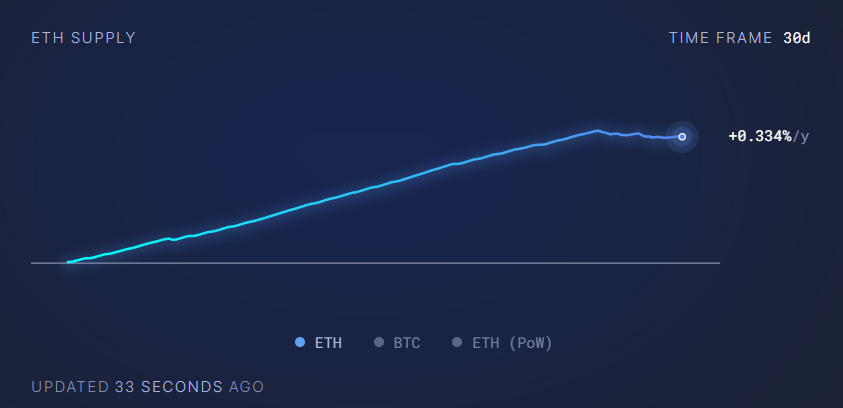

The calmness in bear markets due to the transition to PoS has significantly reduced network activity. Decreased transaction fee revenues have also reduced burnings, leading to ETH inflation reaching 0.334% over a 30-day period. The decrease in volumes on centralized exchanges is considered normal due to the decline in user activity.

In terms of price, ETH is unfortunately not keeping up with the performance of the king cryptocurrency, BTC, despite reaching its 17-month high. If we are to see a delayed rally, the targets will be the $2,950 and $3,584 levels with closes above $2,155. While some altcoins have experienced increases above the performance of BTC, stronger demand is needed for ETH to move in terms of market value. The lack of ETF volumes also supports the weak performance in the recent uptrend.

Ripple XRP Coin Analysis

They tried but failed. The ball is now in the SEC‘s court, and although the score is 3-0, if the regulatory agency wins the appeals, they can score goals from their own goal. The dropping of charges against executives was aimed at expediting the end of the lawsuit. So, is the SEC aiming for something? Yes, since the interim appeal was not accepted, it will open the door to mass appeals when the lawsuit concludes. This could erase the July victory that relieved altcoins (the decision that altcoin sales on exchanges are not securities). The parties will determine a negotiation schedule for a settlement by November 9.

For XRP Coin price, everything is so clear that closes above $0.59 target $0.63, $0.74, and $0.94. Closes below support levels at $0.53, $0.49 will bring up the $0.44 support levels. The chart is quite clear and straightforward, but time seems to be working in favor of the SEC.

Türkçe

Türkçe Español

Español