Bitcoin (BTC) bulls have driven the price above $71,500 due to cooling inflation and bullish technical chart patterns. The current focus is on surpassing the $72,000 level, which could lead to the liquidation of $1.5 billion in short positions and reaching an all-time high of $75,000.

Bitcoin and Ethereum Investors Await Critical Data

Experts believe that the market is at a critical point, as indicated by the decreasing trading volumes ahead of the expiration of $2.2 billion in Bitcoin and Ethereum (ETH) options and the upcoming non-farm payroll and unemployment data from the US.

Despite the expiration of $2.2 billion in Bitcoin and Ethereum options, the cryptocurrency market remains calm. Specifically, 17,493 BTC options worth $1.24 billion expired with a 0.69 put-call ratio and a maximum pain point of $70,000. This situation indicated that Bitcoin investors had some room to liquidate their positions amid ongoing selling pressure. Additionally, implied volatility (IV) dropped to 50%, signaling a potential price decline.

Similarly, 260,000 ETH options worth approximately $1 billion expired with a 0.65 put-call ratio and a maximum pain point of $3,650, lower than the current price of $3,813. This meant Ethereum investors had room to liquidate and potentially lower the price. From this point, monitoring trading volumes is necessary for more guidance on ETH’s price direction.

Meanwhile, the US Bureau of Labor Statistics will release non-farm payroll and unemployment data today. The US economy is expected to add 185,000 jobs in May 2024, slightly higher than the 175,000 in April. The unemployment rate is expected to remain steady at 3.9%, with wages increasing by 0.3% monthly compared to 0.2% in April. Annual wage growth is expected to remain steady at 3.9%. An unemployment rate above 3.9% could positively impact the market.

As investors await important economic data, Bitcoin has been trading sideways around $71,000 for the past two days. Currently, Bitcoin is trading at $71,047, with a 24-hour price range of $70,119 to $71,625. Low trading volume indicates decreased interest among investors.

Prediction of $83,000

10x Research suggests that the head and shoulders pattern indicates Bitcoin could soon rise to $83,000 and break the resistance line in the coming days. 10x Research pointed to today or the upcoming week as the ideal time for breaking this resistance.

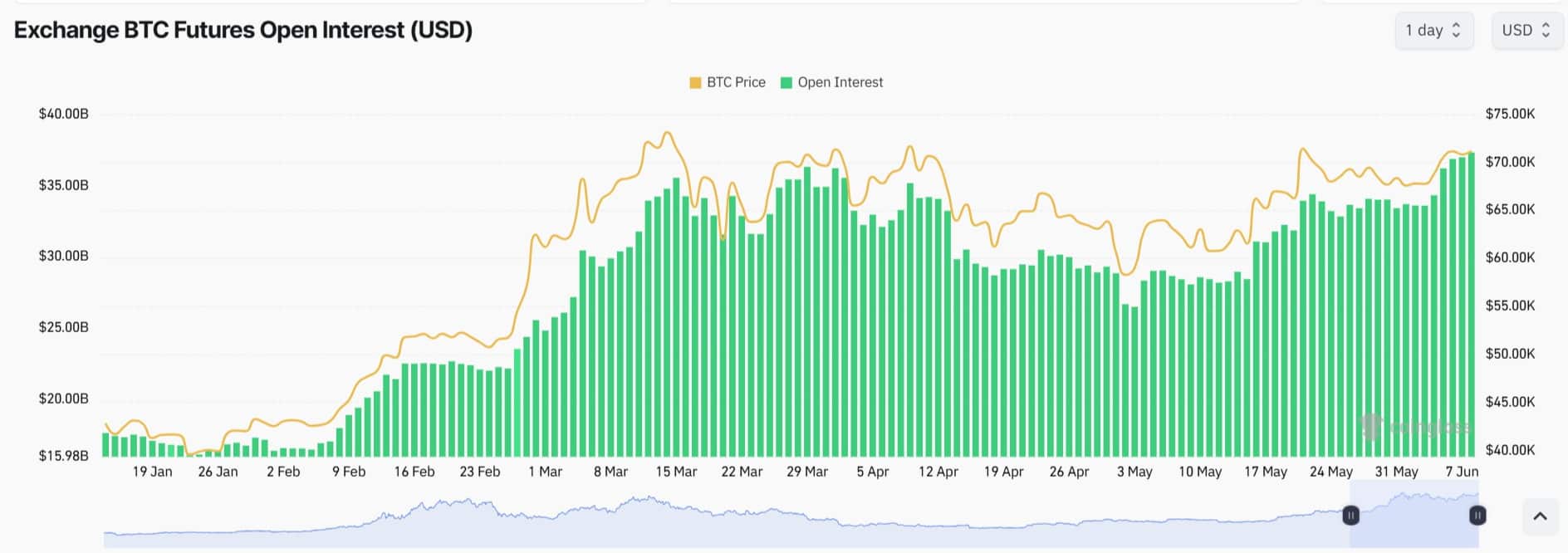

Moreover, open interest in Bitcoin futures began to decline today before the CME Bitcoin futures market closed, with total BTC futures open interest rising to $38.04 billion.

Türkçe

Türkçe Español

Español