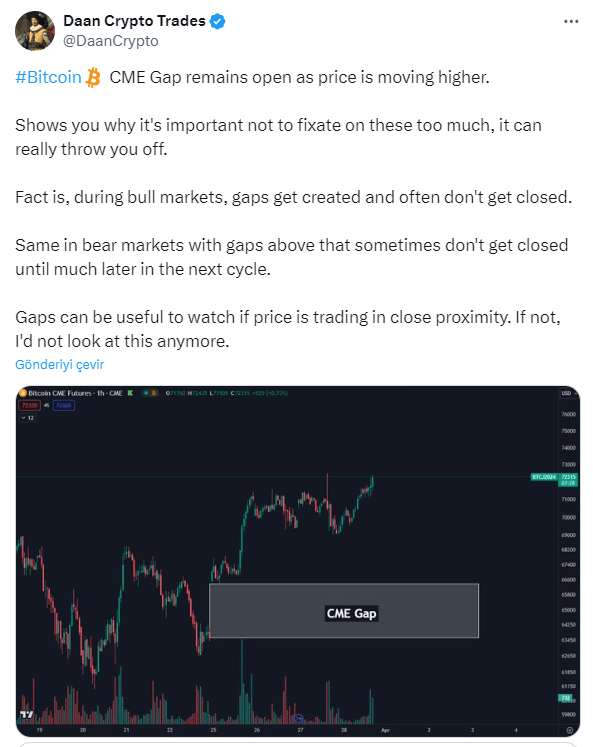

As the Easter holiday approaches, Bitcoin (BTC) price continues to gain strength. In parallel with this rise, altcoins such as Ethereum (ETH) and Ripple (XRP) are also achieving similar gains. On the other hand, CME Gaps continue to maintain liquidity above and below the BTC price. Analysts point out that Bitcoin‘s price being squeezed between $70,700 and $68,240 is causing the market to remain quite stagnant. In this case, it indicates that instead of expecting a trend in one direction in the market, inertia will continue. Therefore, individual investors continue to wait with a short-term bias.

While BTC bulls are back on stage, the Bitcoin price is significantly above $70,000. However, without a clear catalyst to affect the BTC market, investors seem inclined to take short positions, expecting a correction before the next move.

This may be a logical approach, but technical data indicates an uptrend. The Relative Strength Index (RSI) is showing higher peaks well above its midline of 50, indicating rising momentum. Additionally, both the Awesome Oscillator and the Moving Average Convergence Divergence (MACD) are signaling a strengthening uptrend with green histograms.

If bulls increase buying pressure, BTC could overcome this barrier and reclaim the $73,777 peak, moving to a higher level. On the other hand, traders starting to take profits could halt the rally in Bitcoin’s price, leading to a pullback. If they break the average threshold of the supply zone at $61,509 and close below it, a long downtrend could begin.

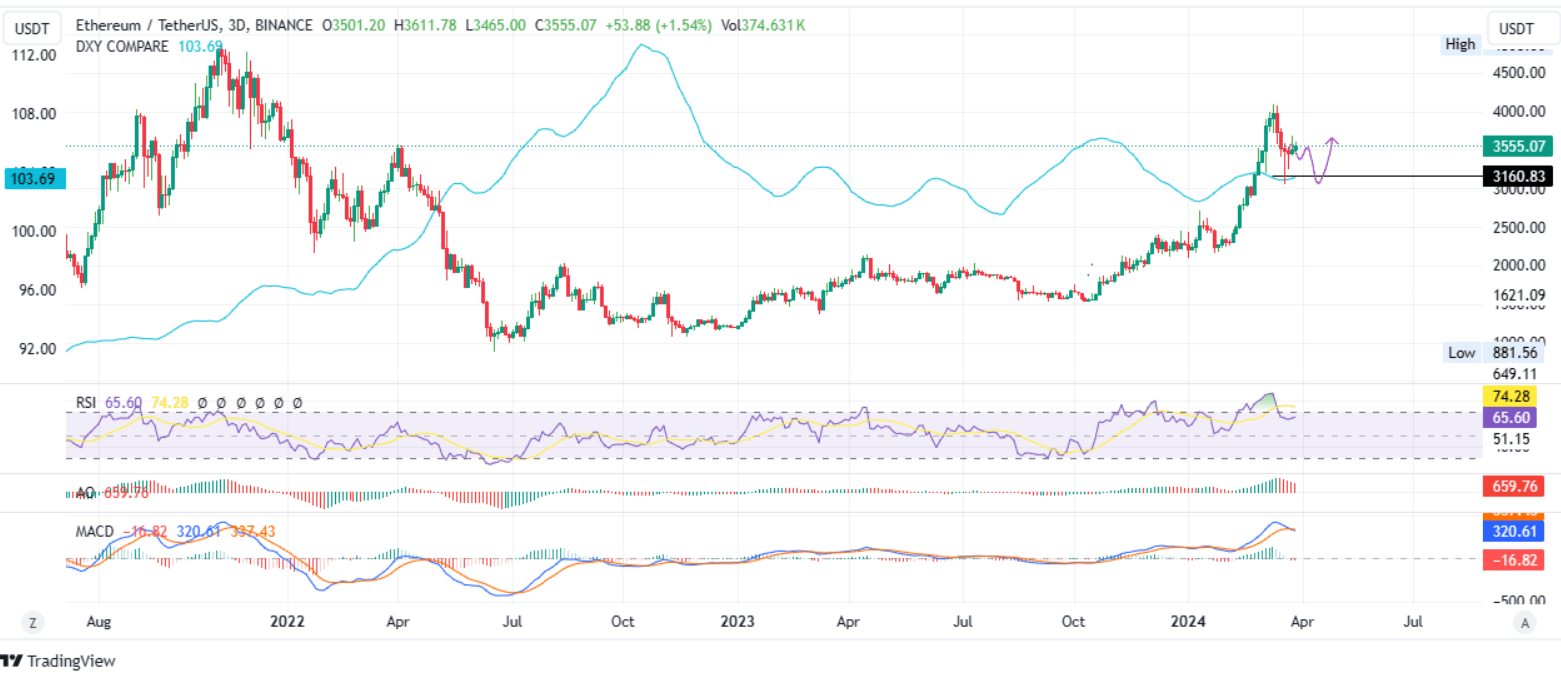

Ethereum Price Likely to Correct by 10% Before Rising

While the Bitcoin price remains steady, the Ethereum price could fall by about 10% to $3,160 before a possible recovery. Initially, the MACD could dip below the signal line while AO histograms turn red, indicating a weakening uptrend.

On the other hand, considering that the RSI is rejecting further declines, bulls might still have the potential to push the Ethereum price higher. Increased buying power could move the ETH price to reclaim the psychological level of $4,000.

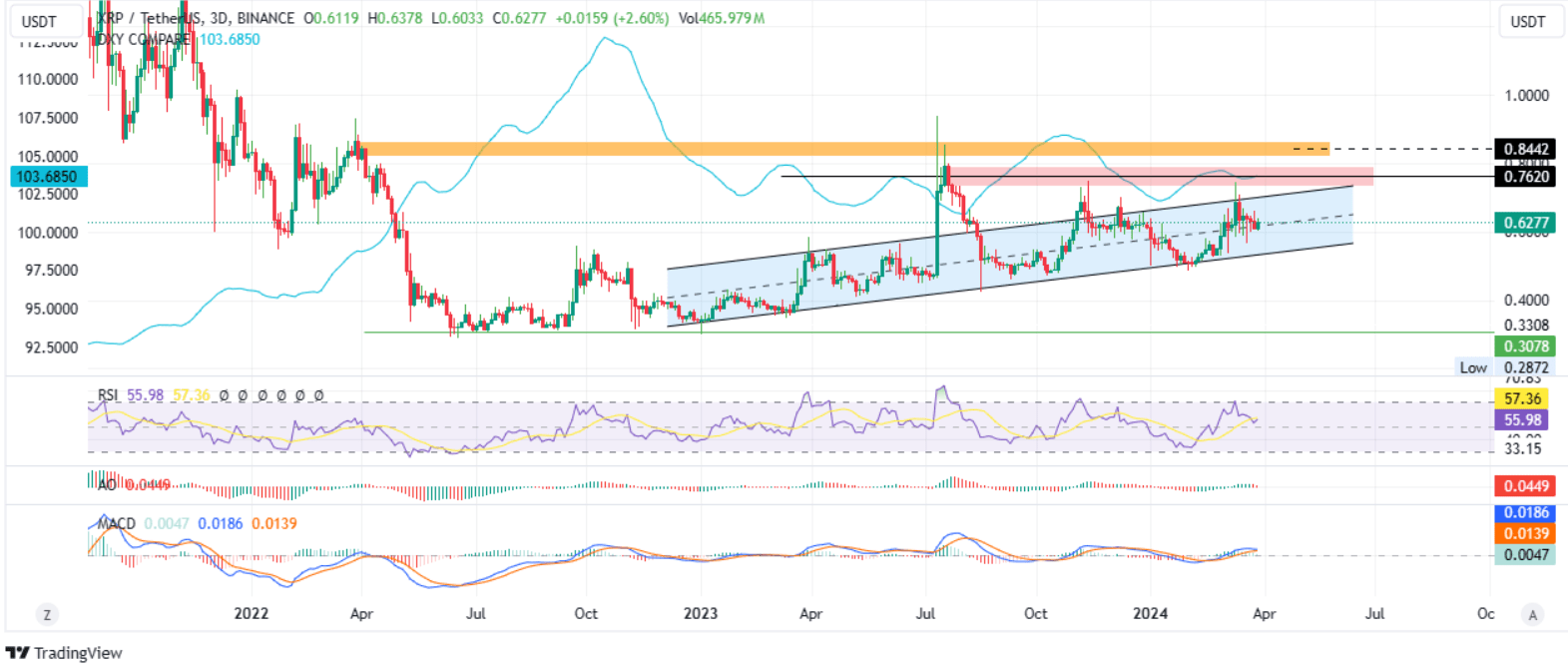

Ripple Price Could Drop Below $0.6

Depending on the show of strength in the BTC market, weakness in the Bitcoin price could affect the XRP price, pulling the cryptocurrency’s market value below the psychological level of $0.60 and potentially towards the bottom of the rising parallel channel.

However, increased buying power could put Ripple (XRP) price into exploration mode, pushing it above the $0.70 level. A move above $0.7620 would be a positive sign, but the most desirable turnaround would involve a move that includes support at $0.8442.