Bitcoin, despite its incredible rise in February, has yet to reach its all-time high, but bulls have already set a new record. Glassnode analyst Checkmate shared in a post on March 1st that a notable event occurred in Bitcoin prices. The monthly close on February 29 indicated a clear victory for Bitcoin bulls.

Bitcoin’s Insatiable Appetite for Records

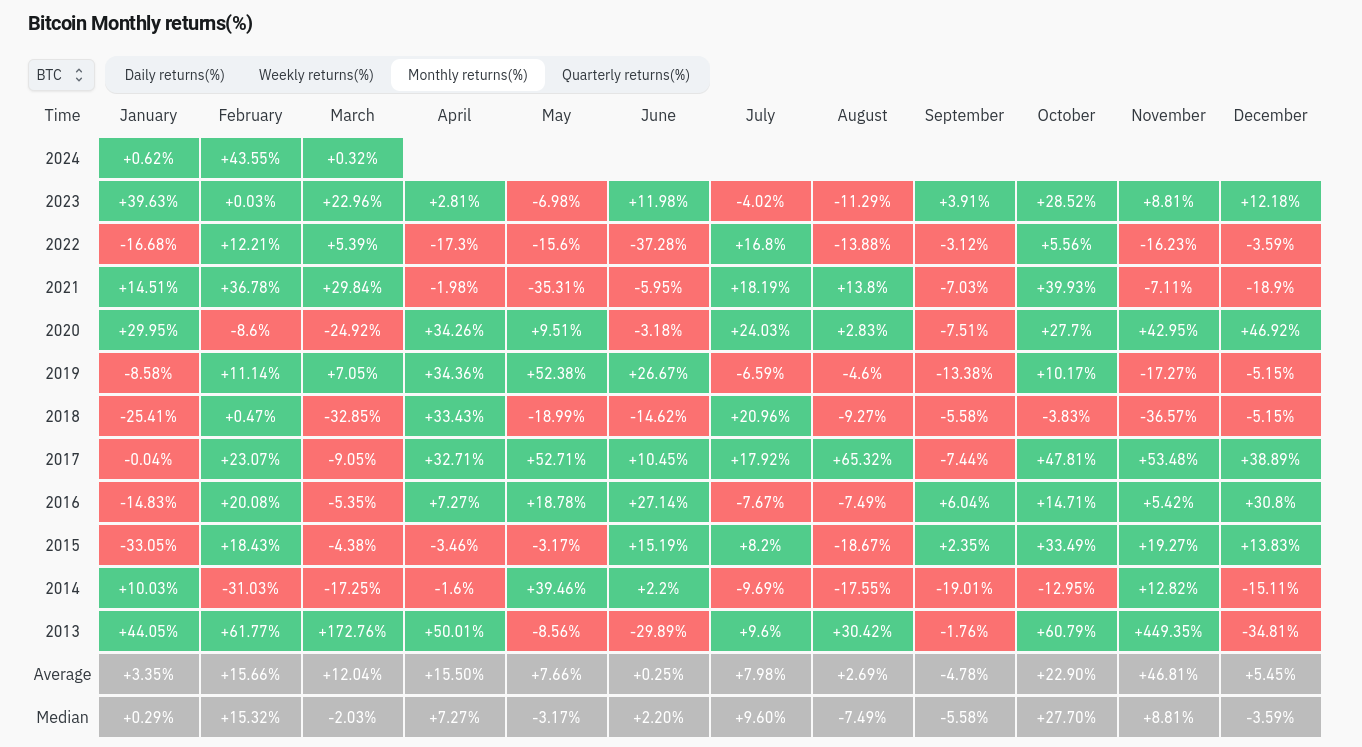

According to data from blockchain data analysis platform CoinGlass, February marked the largest gain for the BTC/USD pair since December 2020, with a 43.55% increase.

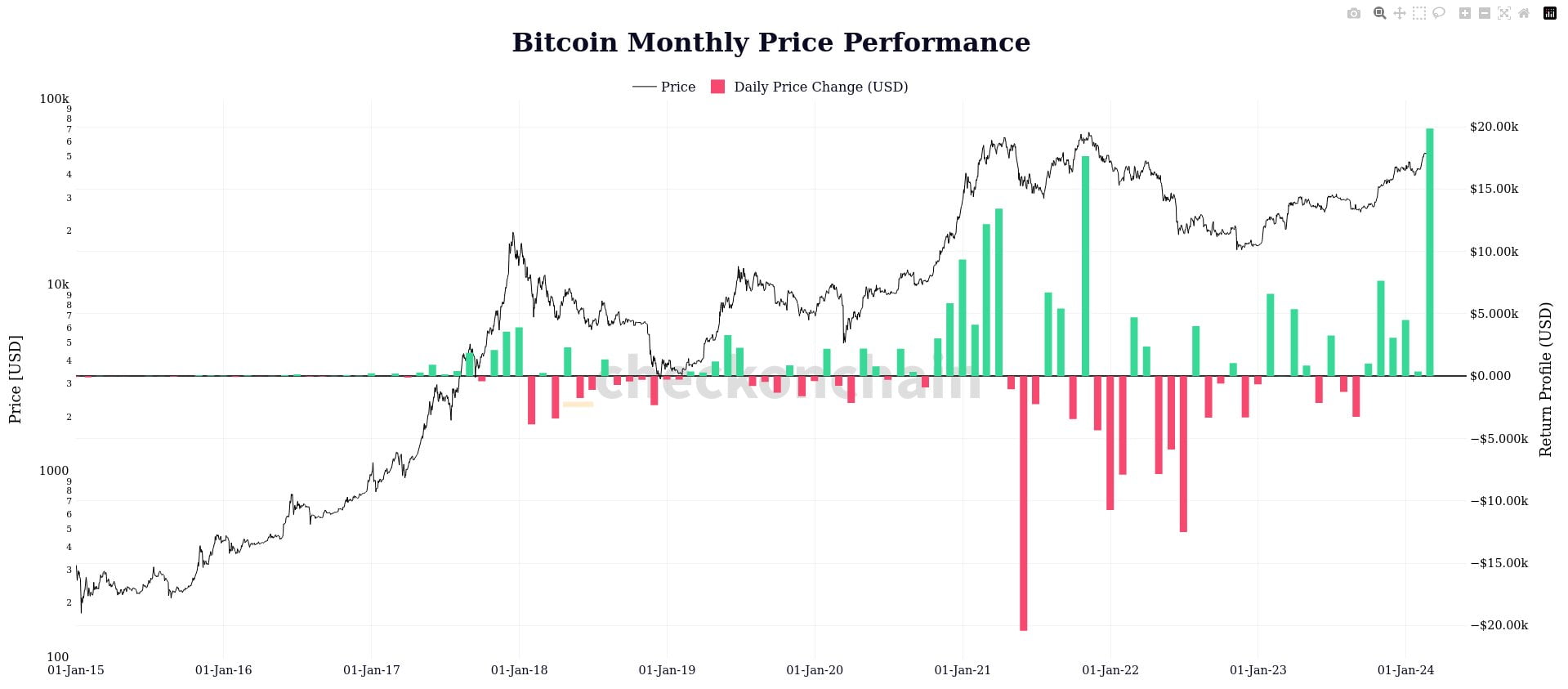

Checkmate, stated that the overall picture is even more encouraging. Referring to Glassnode data and monthly performance, Checkmate pointed out that February ended with nearly a $20,000 monthly candle and added the following:

“February 2024 means a Bitcoin candle with the largest monthly USD increase in history, amounting to $19,840. This added $390 billion to Bitcoin’s market value and represented an extraordinary 47% increase.”

In this context, $20,000 alone constitutes the all-time highest Bitcoin price level, which remained unbeaten for three years after emerging in December 2017. It took Bitcoin ten years to reach that point.

Prominent Analyst Shares Noteworthy Comments

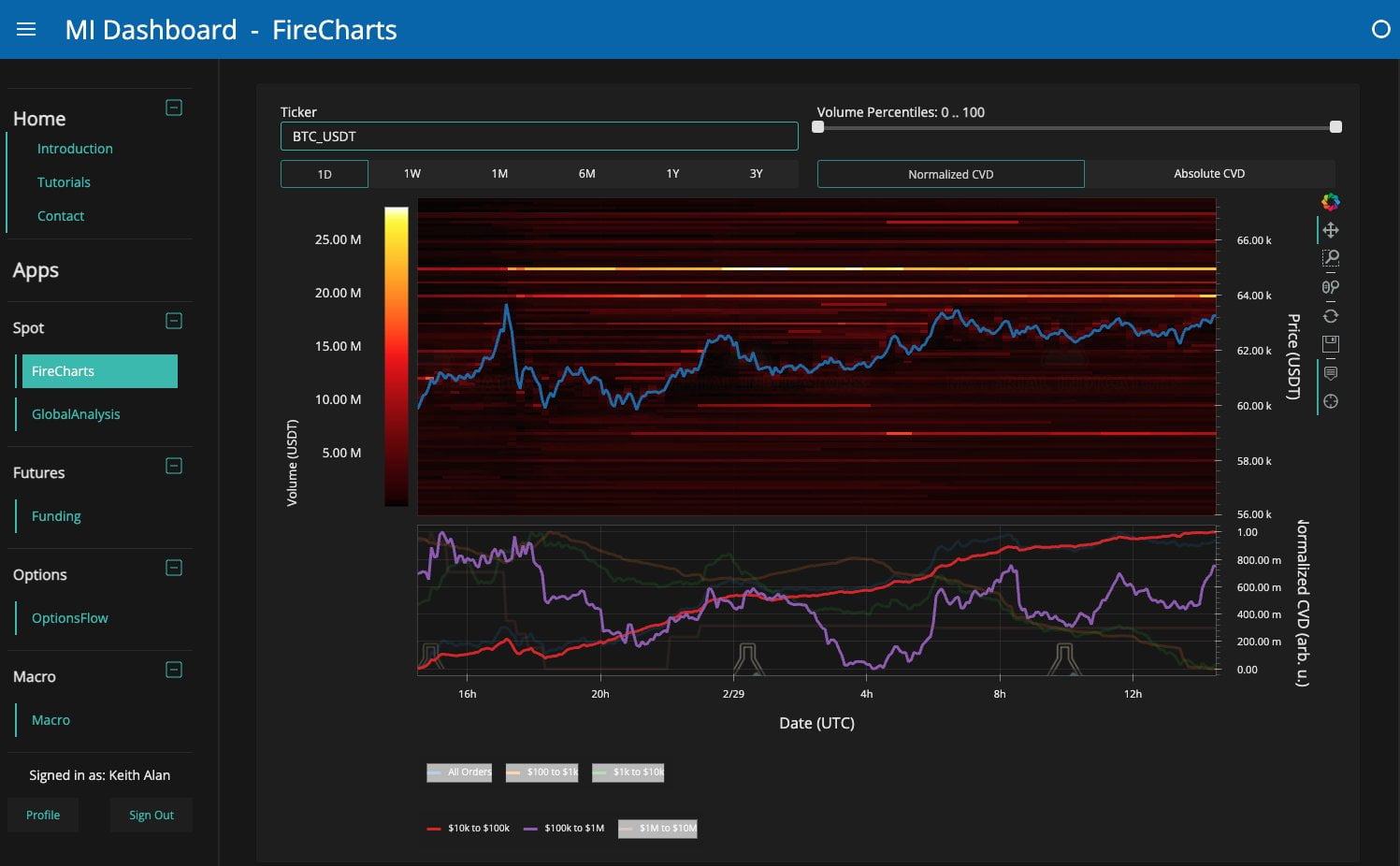

As monthly candles close, they can cause volatility in Bitcoin prices. The current situation poses a potential problem for Bitcoin as order books lack significant bid liquidity that would act as support. An instant snapshot of the order book liquidity for the BTC/USDT pair on the world’s largest exchange Binance, uploaded by trade source Material Indicators on February 29, shows $59,000 as the nearest potential safety net.

Continuing his analysis, Keith Alan, co-founder of Material Indicators, also revealed significant changes in order book data at lower levels and stated:

“In the last 24 hours, we’ve seen the most significant change in the order book since January. A rise up to $64,000 and a 49% monthly candle was beyond anyone’s imagination, and there was no sign of approximately $8 billion in BTCETF entries that pushed the price much higher than most of us expected, beyond $60,000.”

Alan referred to a significant event in the second half of last month: record levels of net inflows into spot Bitcoin exchange-traded funds or ETFs. According to data from TradingView, Bitcoin was trading at $62,030 at the time of writing this article, and volatility remained manageable after the monthly close.