Bitcoin Cash (BCH) has experienced a significant increase in demand following the launch of EDX Markets, surpassing $300 for the first time in a long while. However, the popular Bitcoin fork also faced sell-offs during the recent market turmoil. So, what does the current outlook indicate for BCH?

Bitcoin Cash (BCH) Review

Bitcoin Cash (BCH) started August with a decline, but the price is finally fueling investors’ hopes with on-chain bullish signals. BCH short positions experienced their highest liquidations since July 13, signaling a potential resumption of the price rally.

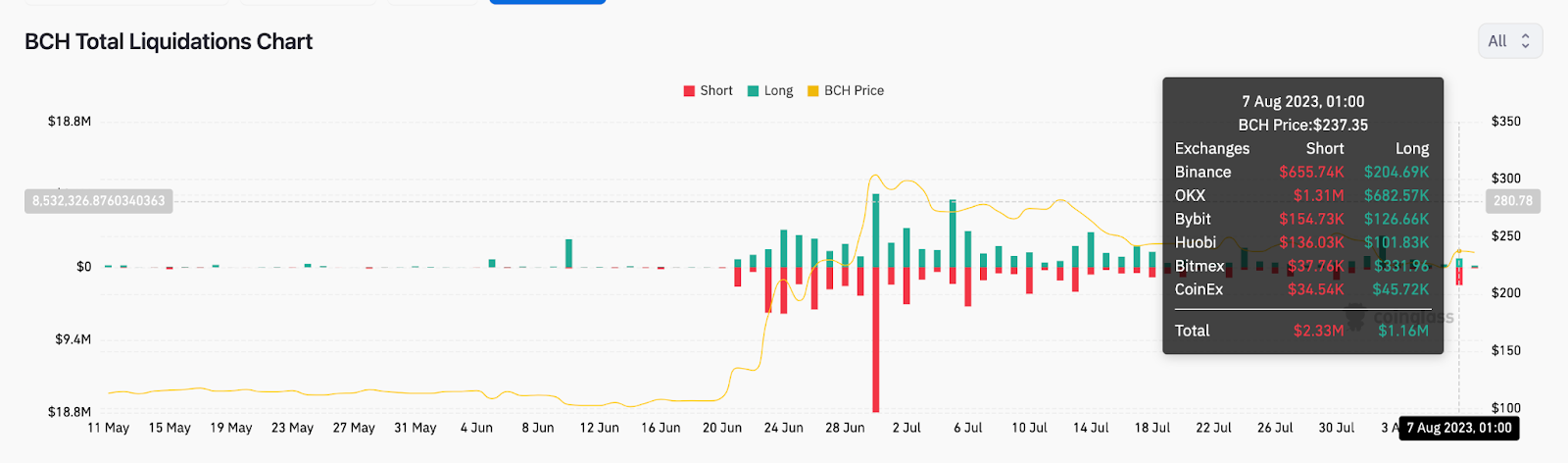

The price of Bitcoin Cash (BCH) increased by 8% from its Monday’s lowest level of $216, reaching over $235. For now, concerns about dropping below $200 seem to have diminished. According to data analysis portal Coinglass, $2.33 million worth of short positions were liquidated on August 7.

As seen in the graph below, this figure stands out as the highest liquidation volume short sellers have faced since July 13.

Significant increases in short liquidations, especially when multiple short positions are liquidated simultaneously, could indicate a price increase for BCH due to various reasons.

Bitcoin Cash (BCH) Future

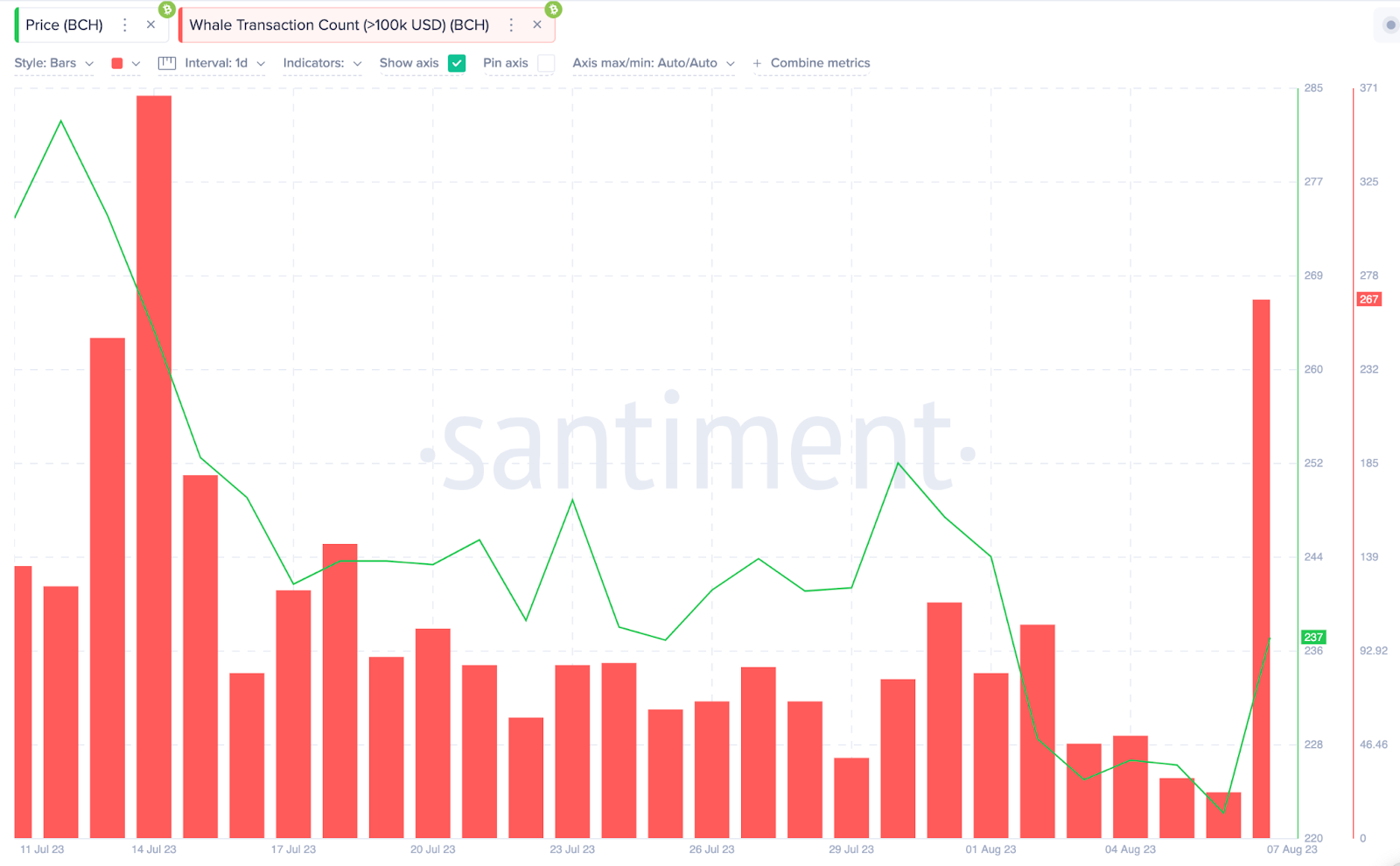

The listing of Bitcoin Cash on the institutional trading platform EDX Markets helped the price reach its 2023 peak of $329 in late June. Whales, who halted their trading activities for about a month, now seem to be active again. According to data from Santiment, BCH recorded its highest Whale Transaction Count since mid-July on Monday.

The graph below shows that BCH reached 267 Whale Transactions on August 7. Interestingly, the last time Bitcoin Cash had such whale trading activity was about a month ago on July 14.

An increase in whale interest often implies a price increase. For now, with the bulls in control, the price of BCH Coin may test $280 in the coming days. In the short term, the most challenging resistance level is around $250. If the bulls cannot overcome this resistance, we may see a drop to support at the $225-$220 range.