Bitcoin is struggling to hold above $29,500, but some altcoins have started to show positive divergence. Critical data coming this week could trigger another increase in volatility. The impulsive actions of a group of whales have caused the popular cryptocurrency to target $300 once again. So, what do the current data and on-chain measurements tell investors?

Bitcoin Cash (BCH)

Between July 6th and July 25th, Bitcoin Cash miners dumped a significant portion of their reserves. As a result, the price of Bitcoin Cash dropped from $295 to $233, a 27% decrease. Bullish whales started buying again last week. The BCH rally, which gained momentum since June 20th, began with its listing as one of the four cryptocurrencies by EDX Markets. The launch of cryptocurrency investment services for institutional clients by trillion-dollar companies like Citadel Securities, Fidelity Investments, and Charles Schwab had a significant impact on BCH’s rise to its June 2023 peak of $320.

Bitcoin Cash (BCH) Price Analysis

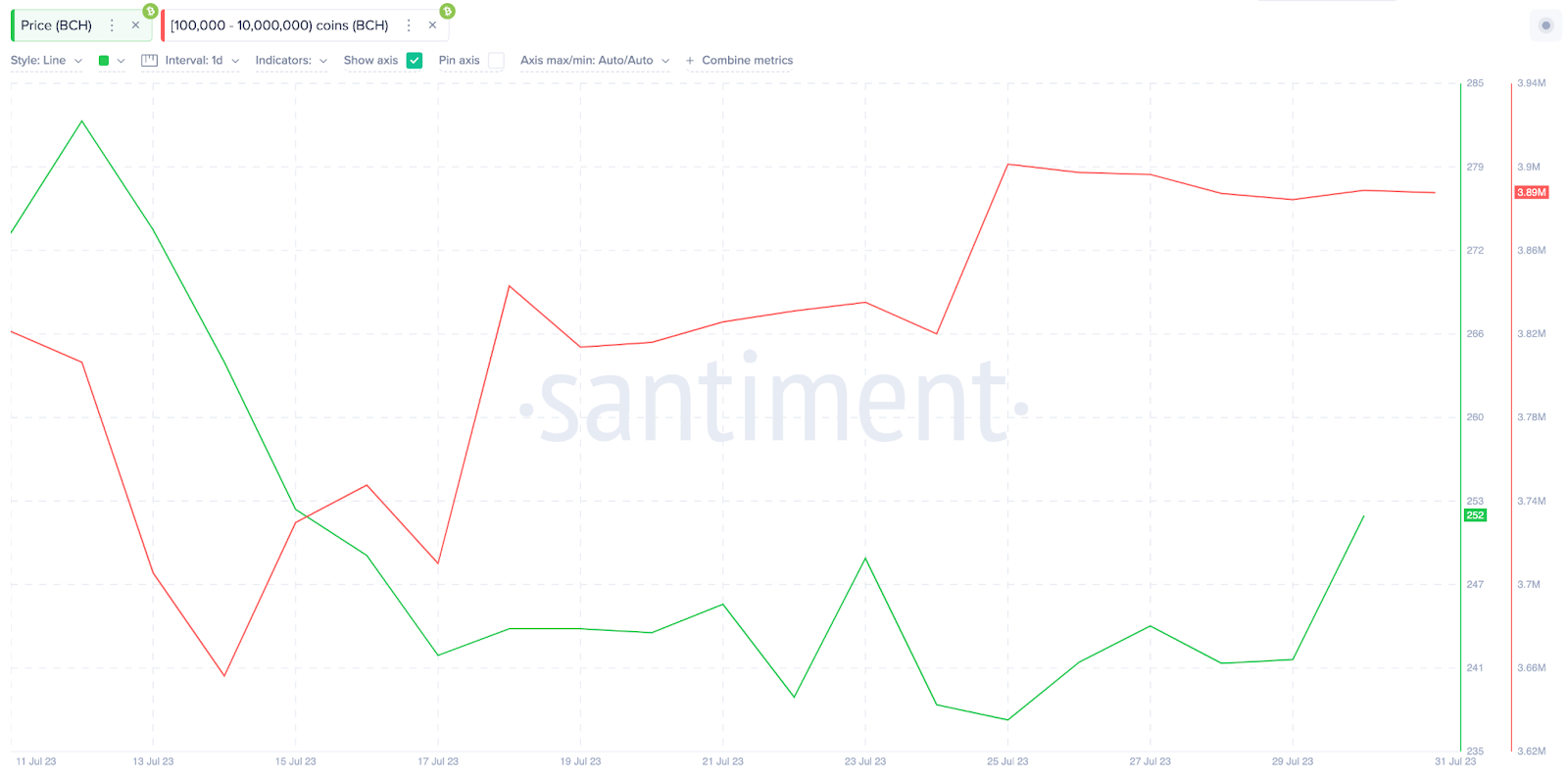

Despite the price correction in the first half of July, large investors continued to buy BCH. The Santiment chart below shows that whales holding between 100,000 and 10 million BCH made significant purchases in the last two weeks. These whales increased their BCH holdings by a staggering amount of 230,000 BCH during the period of July 14th to July 31st, taking advantage of the price drop.

The newly acquired 230,000 BCH indicates a demand of approximately $58.4 million. Meanwhile, the BCH Social Volume metric continued its consistent upward trend throughout last week. On July 21st, the Bitcoin Cash Social Volume score reached 62 and increased by 56% to 97 by July 30th.

As we move towards August 2023, it seems likely that bulls will push the price above $300 once again. To confirm this optimistic price outlook, bulls need to overcome the $280 resistance level permanently. If the price continues its strong recovery and maintains the current momentum of a 10% increase, the $300 target may not be a distant dream.

Türkçe

Türkçe Español

Español