Cryptocurrency markets have long been experiencing high volatility, and the trend is upward despite potential corrections. Even during the most fervent days of bull markets, it’s normal for altcoins to suffer losses exceeding 30%. But which altcoin faces the risk of dropping to the $400 levels?

BCH Price Commentary

Coinbase has submitted an application to the CFTC that includes DOGE, LTC, and BCH. If the CFTC does not object, these will be labeled as commodities starting April 1st and derivative products will be launched through Coinbase. Moreover, they will be free from the troubles of the SEC. Interest in these three altcoins has significantly increased for this reason.

BCH’s price climbed suddenly to $553 while it was below $500. The recovery was definitely exciting as it had dropped to $87 during the bear market. Despite Vitalik declaring it dead, some traditional investors believed in BCH’s price potential, earning over 500% gains today.

BCH’s price was at $530, up 10%, at the time of writing. Bitcoin, however, has not fully recovered from the Coinbase FUD. Despite stronger entries in the ETF channel compared to previous days, the performance remains weak.

BCH Price Prediction

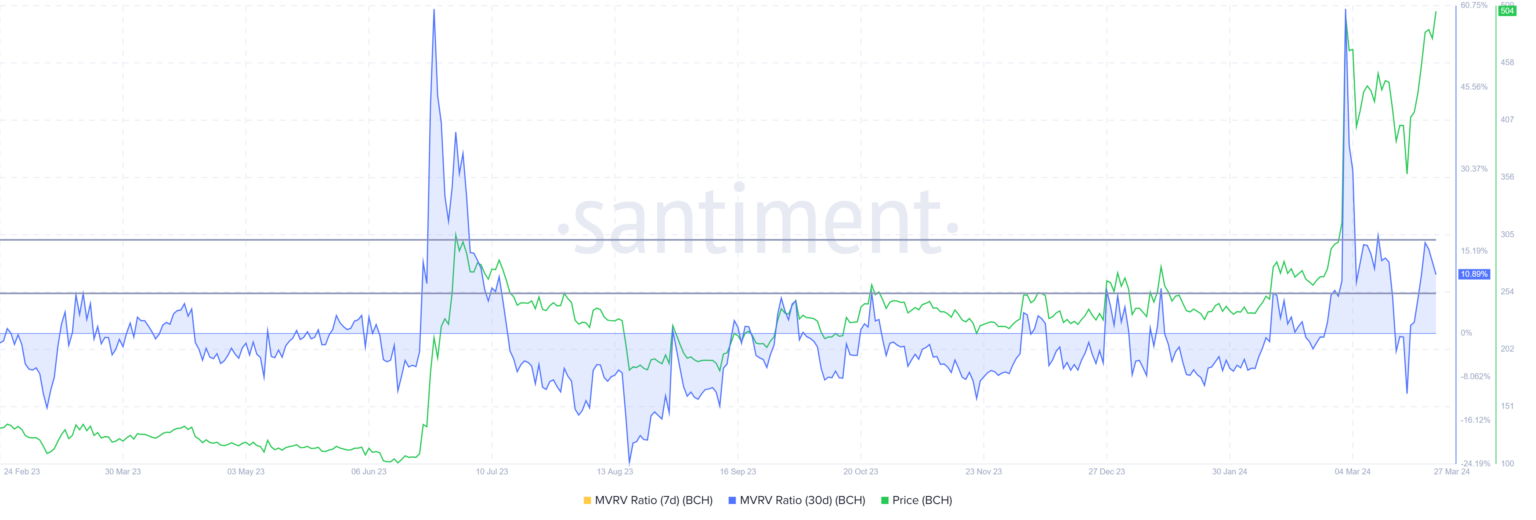

Bitcoin Cash‘s 30-day MVRV is around 10% and rising, which historically is a strong sell signal. Normally, BCH corrections start when the MVRV indicator is between 7% and 17%. This profitability zone is satisfying for investors. If selling starts, we could see a rapid drop to $501 and $448.

In a scenario where the second zone is also lost, the price retreating to $400 and $378 would erase a significant portion of the gains. However, there is an important detail to note. Even if the MVRV signals a sell, the news flow around April 1st is significant.

If the CFTC does not object and BCH derivative products are launched, this could lead to the three commodities-stamped altcoins being seen as a safe haven by other investors. While nearly 50 cryptocurrencies are caught in the crosshairs of Binance and Coinbase lawsuits, the SEC insists on not backing down. Therefore, it wouldn’t be unreasonable for investors to turn to alternatives closer to the CFTC and away from the SEC.

Türkçe

Türkçe Español

Español