While everyone is focused on the Bitcoin halving event scheduled for April, today’s topic is not BTC. Halving is a common occurrence for PoW altcoins, for instance, last year LTC also underwent a block reward halving. In a few days, Bitcoin Cash (BCH) will experience its halving. The Bitcoin block reward halving is expected to take place between April 20-22.

Bitcoin Cash Commentary

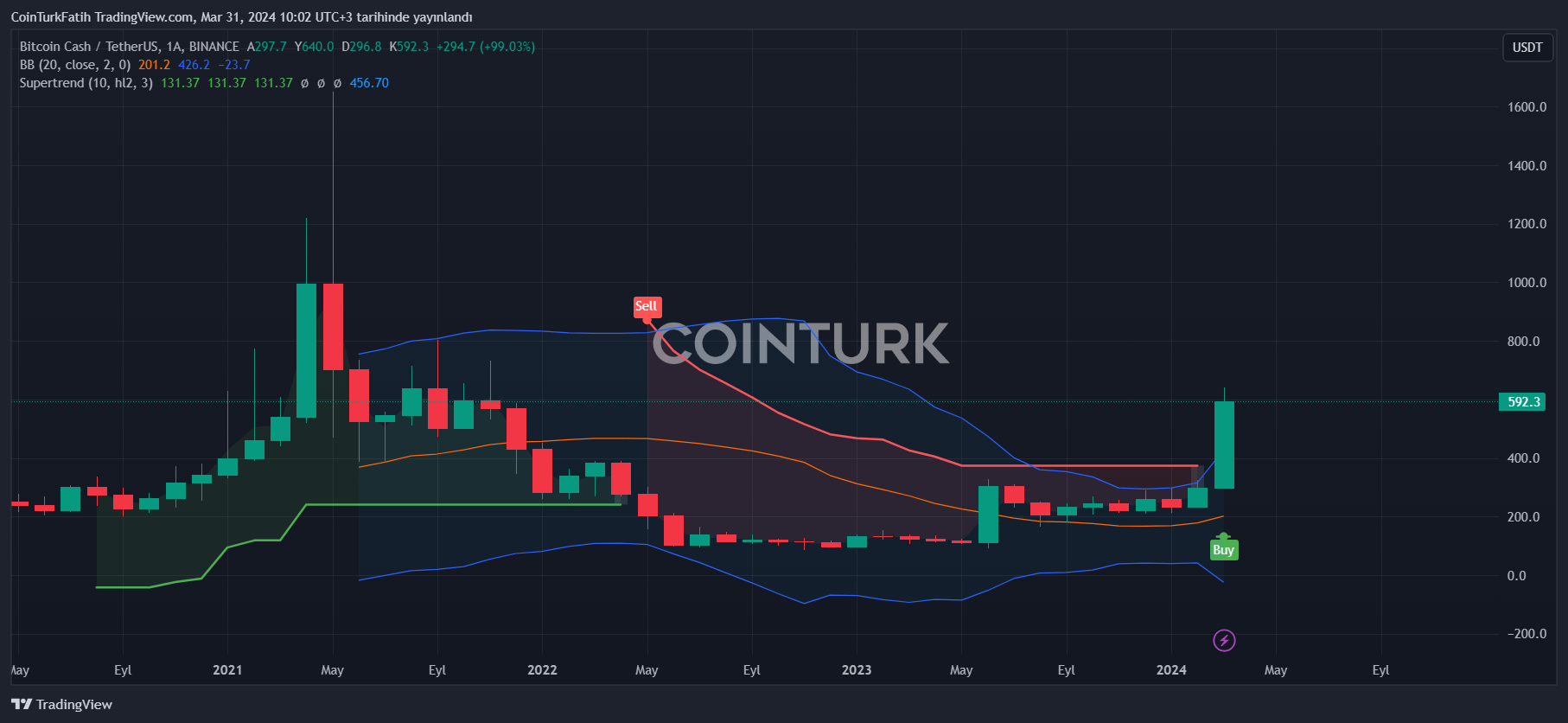

11 days ago, the price of Bitcoin Cash (BCH) fell to $348, but now it is above $600. We saw the price rise rapidly for two reasons, both coinciding with the same period. The main reason for the increase is the expected Bitcoin Cash block reward halving on Thursday. The second major price catalyst is the CFTC’s certification of BCH as a commodity.

Coinbase is very likely to launch BCH derivative services in April without any objection from the CFTC, thus preventing future headaches for investors from potential SEC accusations of unregistered securities offerings.

As legal pressure in the US mounts, especially for PoW altcoins, the likelihood of being classified as commodities increases, which may lead to heightened interest. If EDX Markets had not delisted it, we might have seen its price rapidly reach four figures due to increased institutional demand.

BCH Price Prediction

The second halving for Bitcoin Cash since its creation in 2017 will take place on Thursday. The price is rising with this expectation, and demand in futures trading is also strengthening. If the rally continues, BCH could retest the $641 level it previously rejected. Closures above this could bring $730 and $1000 targets into play.

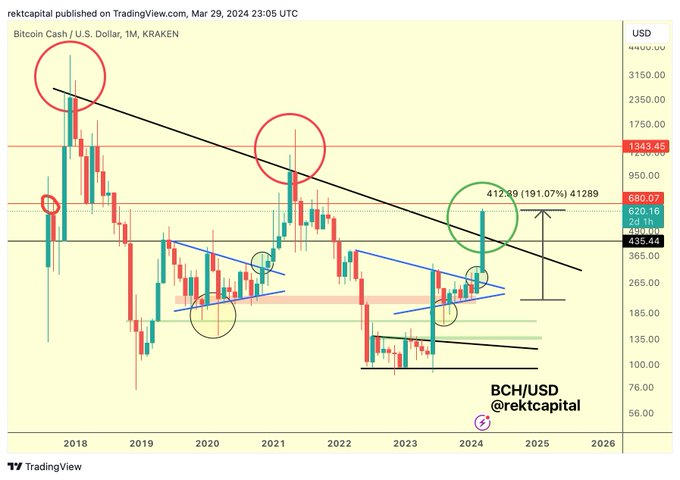

The ultimate goal of the optimistic scenario is the peak of $1,649 seen in May 2021. The chart shared by RektCapital suggests that closures above $435 in the optimistic scenario could extend the rally to $680 and $1,343.

However, if the price falls back below the long-term descending resistance trend line, closures under $435 could see the price drop to $265. We haven’t seen a ‘sell the news’ event yet, but BCH is expected to continue showing high volatility in the coming week.

Türkçe

Türkçe Español

Español