Bitcoin, the world’s largest cryptocurrency by market cap, continues to be priced below $26,000 as it enters a robust accumulation phase. On-chain data signifies a surprising trend where Bitcoin whales continue to buy with each dip.

Whale Accumulation Indicates Potential for Strong Recovery

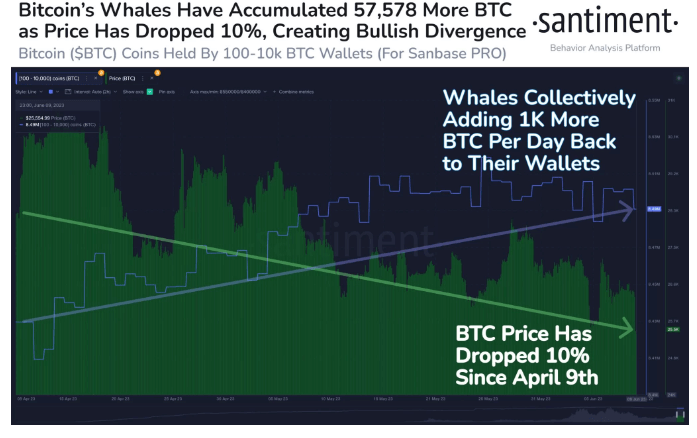

The on-chain data platform Santiment reported that Bitcoin whales accumulated close to 60,000 BTC amidst a 10% decline over the past few weeks. As altcoins continue to wobble, there’s a silent bullish divergence between falling prices and Bitcoin-accumulating whales. With whale assets increasing by about 1,000 BTC per day as prices fall, there is reason to believe a strong recovery could occur.

Meanwhile, long-term Bitcoin investors continue to hold their BTC, indifferent to the US Securities and Exchange Commission’s (SEC) lawsuit against Binance and Coinbase.

In addition to this, Bitcoin’s dominance ratio in the market is nearing 50% following the sharp decline in altcoin prices last week after the SEC’s stringent regulatory actions. This is the first time since April 2021 that Bitcoin’s market dominance has approached 50%. A dominance generally above 50% is a severe bear market signal, indicating investors are moving their money into large-cap coins, the safe havens. For instance, during the 2018 bear market, Bitcoin’s market dominance exceeded 50%.

Market observers predict Bitcoin will move within a narrow range above $25,000 support, potentially reaching up to $26,500 in the coming days.

Bitcoin Miners Are Moving Their BTC to Exchanges

On the other hand, on-chain data shows that Bitcoin miners are moving their assets to exchanges. Last week, miners caused a notable amount of BTC to enter exchanges, resulting in a Bitcoin exchange inflow of $70.8 million. This stands out as the third-largest exchange inflow ever recorded, $30.2 million less than the highest inflow of $101 million observed during the 2021 bull market.

However, significant net outflows were seen from cryptocurrency exchanges like Binance and Coinbase last week. According to data provided by Nansen, there was a significant outflow of $2.376 billion in multi-chain assets (excluding Bitcoin) from Binance last week. Net outflows of $124 million from Binance.US, $1.787 billion from Coinbase, and $739 million from Coinbase Custody were recorded.