While derivative data indicates the end of volatility increase, BTC price continues to hold at $26,000. The fact that the king cryptocurrency maintains its support at $25,500 is also a positive detail. So what do current data and expert opinions suggest? We discuss the expectations regarding the cryptocurrency markets.

Is the Bitcoin Decline Over?

In the past few months, Bitcoin investors had become accustomed to less volatility, but historical data indicated that this would not last long. Volatility increase is usually completed within 2-3 days and these fluctuations generally occur within a 10% range.

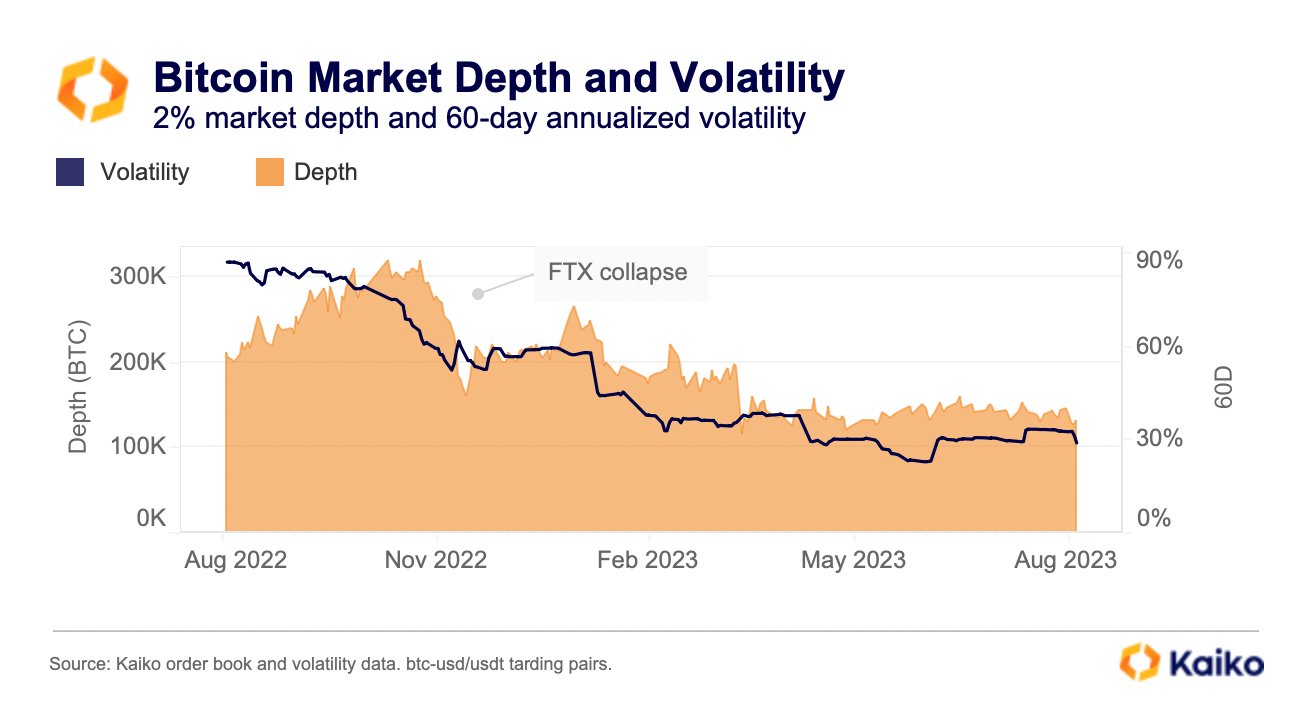

Some experts point to the decrease in liquidity as the reason for the recent increase in volatility. According to the recent market evaluation by Kaiko, a 2% decrease in Bitcoin order book depth reflects the decrease in volatility. It is possible that market makers have adjusted their algorithms to adapt to current market conditions.

Looking at derivative data is also a good option to see if the decline continues. This analysis aims to determine whether whales and market makers are entering a bearish trend or demanding higher premiums for protective hedge positions. Initially, investors need to identify similar situations in the recent past, and two events stand out.

Bitcoin Historical Data

The first decline lasted from March 8 to March 10 and followed the liquidation of Silvergate Bank, causing Bitcoin to drop to $19,600 with an 11.4% decrease. The next significant movement occurred between April 19 and April 21, causing a 10.4% drop in Bitcoin’s price. After more than three weeks, the price revisited the $27,250 level following SEC Chairman Gary Gensler’s address to the House Financial Services Committee, where he indicated that sanctions would continue.

Bitcoin quarterly futures contracts tend to trade at a slight premium compared to spot markets. This reflects the tendency of sellers to delay settlement in exchange for additional profit. In healthy markets, BTC futures contracts usually trade with annual premiums ranging from 5% to 10%. This situation, called “Contango,” is not unique to the cryptocurrency space. The futures premium for Bitcoin was 3.5% until the crash on March 8, indicating a moderate ease. However, during the same period, a 3.5% discount occurred during the decline.

The correction on April 19 had a minimal impact on Bitcoin’s futures main benchmark, and the premium remained around 3.5% while the BTC price revisited $27,250. In comparison to the recent 11.4% BTC crash between August 15 and August 18, there are noticeable differences. The starting point of Bitcoin’s futures premium was higher and exceeded the 5% neutral threshold.

Note how quickly the derivative market absorbed the shock on August 18. The BTC futures premium quickly returned to a 6% neutral-bull position. This indicates that the $26,000 drop did not discourage whales and market makers.

As a result, the $26,000 level in the recent decline could be a local bottom for futures contracts compared to previous decline comparisons.

So what will happen next? If the market starts to rise again, it can lead to rapid double-digit gains for altcoins. However, the BTC price will need to regain the $27,500 and $28,300 levels.