The founder and chairman of the globally renowned software company MicroStrategy, emphasized that the demand for Bitcoin (BTC) is exceeding its supply. The well-known figure recently praised Bitcoin and spoke about the effects of the ETF approval process.

Suppressed Demand for Bitcoin

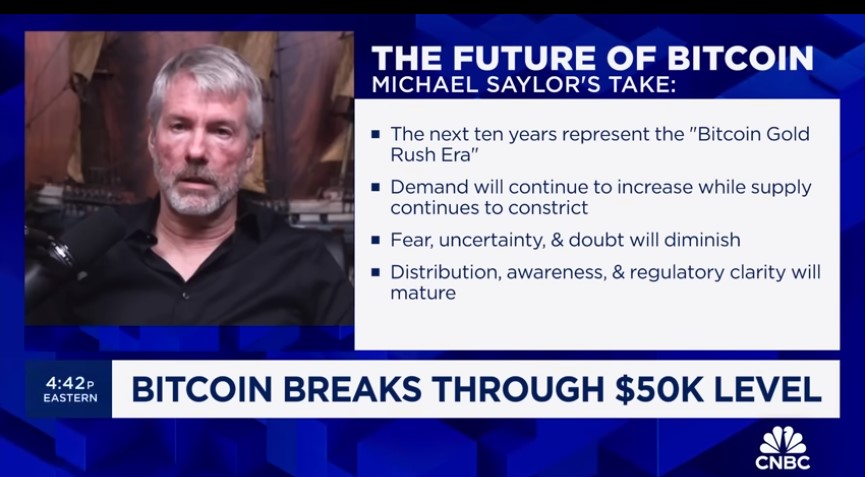

Famous BTC bull Michael Saylor, in a new interview with CNBC television, highlighted that the approval of spot market Bitcoin exchange-traded funds (ETFs) in the US has triggered a significant demand for the leading cryptocurrency. He stated the following in his remarks:

There has been suppressed demand for 10 years. People were waiting for these ETFs. And finally, mainstream investors can access Bitcoin. I think this is what’s driving the capital increase in the asset class. Initially, there was a rebalancing due to capital movement between the futures market, miners, MicroStrategy, and ETFs. But after this rebalancing, I believe the token has found its fundamentals, and now people are starting to realize that the demand for Bitcoin through these ETFs is about 10 times the supply coming from the natural sellers, the miners.

Effects of ETF Adoption

Spot market Bitcoin ETFs offer investors the opportunity to get acquainted with the leading cryptocurrency without having to purchase the token itself. They were approved by the US Securities and Exchange Commission (SEC) in January. According to Michael Saylor, the largest cryptocurrency by market value has become “the world’s most popular investment asset.” The prominent figure stated:

Bitcoin is new, digital, global, and unique. It is not associated with traditional risk assets because it does not come with exposure to any country, currency, company, quarterly results, product cycle, or competitor. It is not against weather conditions, war, employee base, or supply chain. This makes it a natural addition to a responsible investor’s portfolio.

Bitcoin was trading at $49,554, up approximately 17% over the past seven days at the time this article was written.