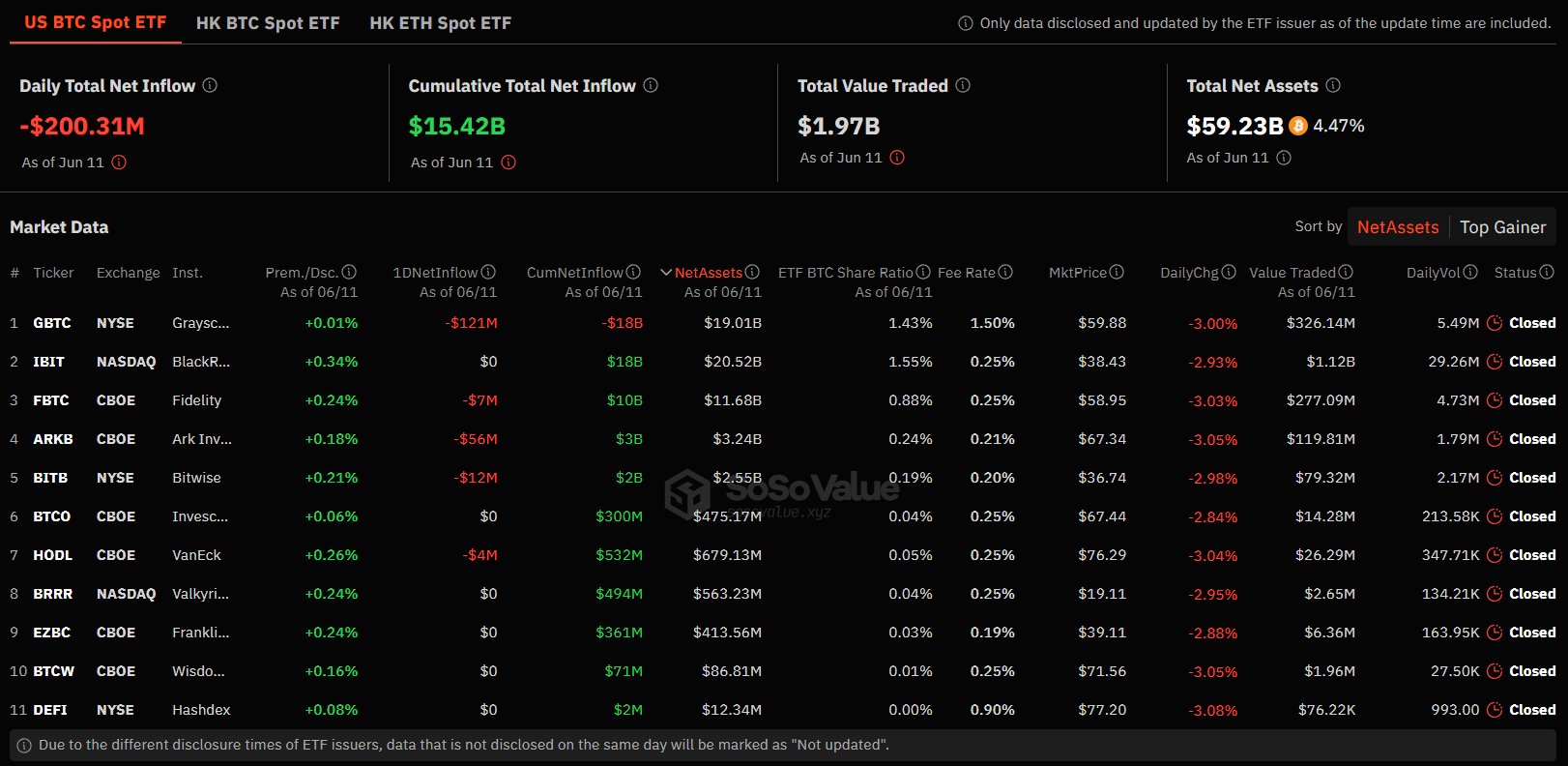

Bitcoin ETF data indicates a significant shift in market sentiment. On June 11, 2024, the total daily net outflows from Bitcoin ETFs were recorded at $200.31 million. This can be seen as a reflection of the recent pullback in the cryptocurrency Bitcoin. Let’s look at the spot Bitcoin ETF figures.

Bitcoin ETF Figures

Looking at the distribution of major ETFs, Grayscale Bitcoin Trust (GBTC) experienced the most significant net outflow, amounting to $121 million. However, despite the outflows, the ETF is trading at a slight premium.

On the other hand, BlackRock’s Bitcoin ETF (IBIT), which recently surpassed Grayscale in total net assets, saw no net inflows or outflows. However, it traded at a 0.34% premium. This reflects continued investor interest and confidence in the ETF. The absence of outflows during a period of overall outflows indicates high investor expectations.

Other ETF Figures

The Fidelity WiseOrigin Bitcoin ETF (FBTC) experienced a net outflow of $7 million but still traded at a 0.24% premium, indicating continued investor interest. Similarly, ARK Invest’s Bitcoin ETF (ARKB) saw a significant net outflow of $56 million.

Among other ETFs, the VanEck Bitcoin ETF (HODL) reported a $4 million outflow, while Bitwise’s Bitcoin ETF noted a $12 million outflow. Despite the outflows, some Bitcoin ETFs had balanced inflows and outflows, resulting in zero net change. Examples include Invesco, Valkyrie, Franklin, WisdomTree, and Hashdex’s Bitcoin ETFs.

Overall, these data indicate mixed market sentiment towards Bitcoin ETFs. Despite short-term pullbacks, the ETFs still trading at a premium and continued investor confidence highlight their perceived importance. Additionally, the outflows have impacted Bitcoin’s price, which dropped to $66,050 yesterday. At the time of writing, Bitcoin, the flagship cryptocurrency, is trading at $67,304.

Türkçe

Türkçe Español

Español