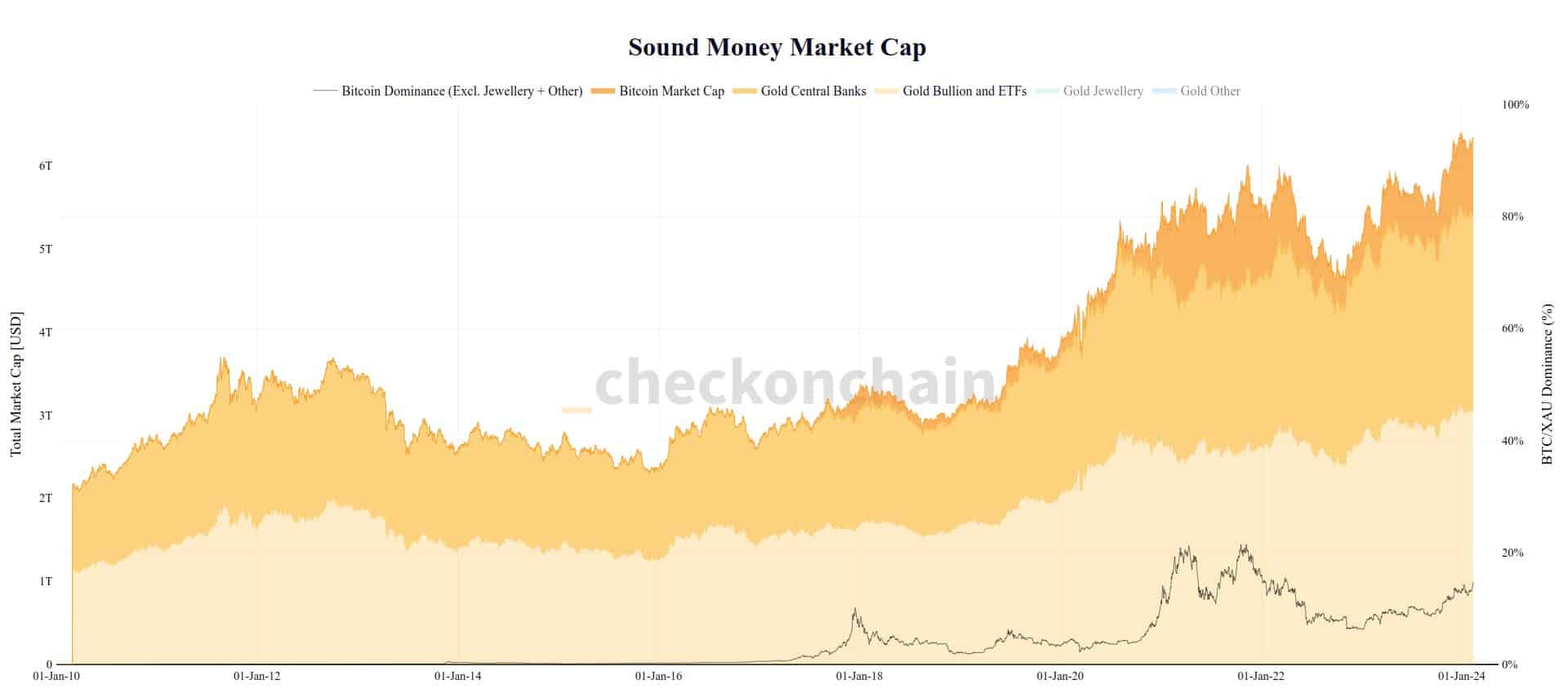

Spot Bitcoin ETF inflows increased once again in February, reaching approximately $500 million the day before. The pace of these inflows has caught the attention of investors. According to data obtained from on-chain data provider Checkmate, Bitcoin is steadily closing the gap with Gold, which is traditionally considered the leading strong currency.

Bitcoin and Gold Comparison

Crypto analytics firm Checkmate’s analysis shows that Bitcoin’s presence in the solid currency investment market is rapidly expanding. Representing 15% of the total investable market value in its current position, Bitcoin’s growth trajectory could indicate a promising future in the solid currency asset space. In a notable observation, analyst Bitcoin Munger emphasized that there were significant inflows into not one, but two Bitcoin Exchange Traded Funds (ETFs) last week.

Additionally, the analyst pointed out that Gold was not among the top 20 assets with strong inflows. This observation underscores the evolving landscape of traditional safe-haven assets in the face of Bitcoin’s rise. After the release of the US CPI data for January, the price of Bitcoin (BTC) experienced a slight decline but continues to hold at the $49,500 level. Moreover, strong Bitcoin ETF inflows highlight that institutions continue to show interest in this asset class as Bitcoin matures.

Expert Views on BTC

Another popular crypto analyst, Michael van de Poppe, appreciated the strong inflows into Bitcoin ETFs. However, he noted that there is no guarantee that the inflows will continue to increase from here. Michael Van de Poppe added that as long as the Bitcoin price maintains the $46,000 level, it will continue to rise. According to Poppe, the BTC price could climb to $55,000 during the pre-halving rally. Another market analyst, Rekt Capital, believes that the pre-halving negative situation has ended and that BTC has already entered the pre-halving rally phase.

Türkçe

Türkçe Español

Español