Bloomberg analyst Eric Balchunas reports that nine Bitcoin exchange-traded fund (ETF) issuers are accumulating billions of dollars worth of BTC shortly after their launch.

ETF Process in Bitcoin

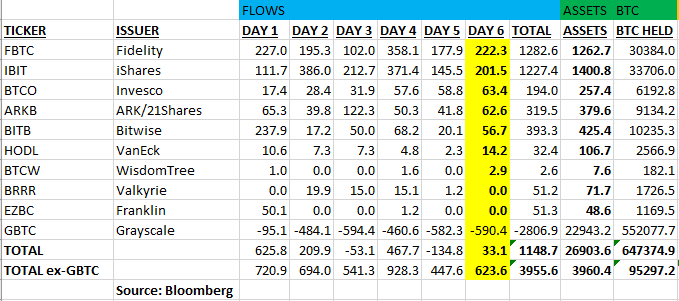

Analyst Eric Balchunas informed his followers on social media that he has been closely monitoring the capital movements inside and outside the recently launched nine Bitcoin ETFs. According to Balchunas, the issuers include Fidelity (FBTC), iShares (IBIT), Invesco (BTCO), ARK/21Shares (ARKB), Bitwise (BITB), VanEck (HODL), WisdomTree (BTCW), Valkyrie (BRRR), and Franklin Templeton (EZBTC), which collectively own approximately $4 billion worth of a total of 95,297.2 BTC as of January 19.

At the top of the list is iShares with over $1.4 billion in 33,706 BTC, followed by Fidelity with $1.262 billion worth of 30,384 BTC. Bitwise is in third place with 10,235 BTC valued at $425.4 million, and ARK/21Shares has accumulated 9,134.2 BTC, reaching nearly $379.6 million.

Comments from Bloomberg Analyst

Invesco ranks fifth with 6,192.8 BTC worth $257.4 million, followed by VanEck with 2,566.9 BTC valued at $106.7 million and Valkyrie with 1,726.5 BTC worth $71.7 million. Franklin Templeton secured the eighth spot by acquiring 1,169.5 BTC valued at $48.6 million, and WisdomTree completed the list by holding 182.1 BTC worth $7.6 million. Eric Balchunas also noted that the purchasing activities of the nine Bitcoin ETF issuers have surpassed the sales of crypto giant Grayscale (GBTC), stating:

Despite GBTC seeing an outflow of -$590 million on Friday, the Nine surpassed it with +$623 million (third-best day). Both IBIT and FBTC had over $200 million each, while BTCO and HODL had their best sales to date. With the Nine’s assets under management (AUM) reaching $4 billion compared to GBTC’s -$2.8 billion, total net flows are at +$1.2 billion, and their share of AUM has risen to 14%.

Eric Balchunas also suggested that the biggest GBTC sellers were FTX and investors who accumulated shares last year when the fund was trading in a deep discount zone.

Türkçe

Türkçe Español

Español