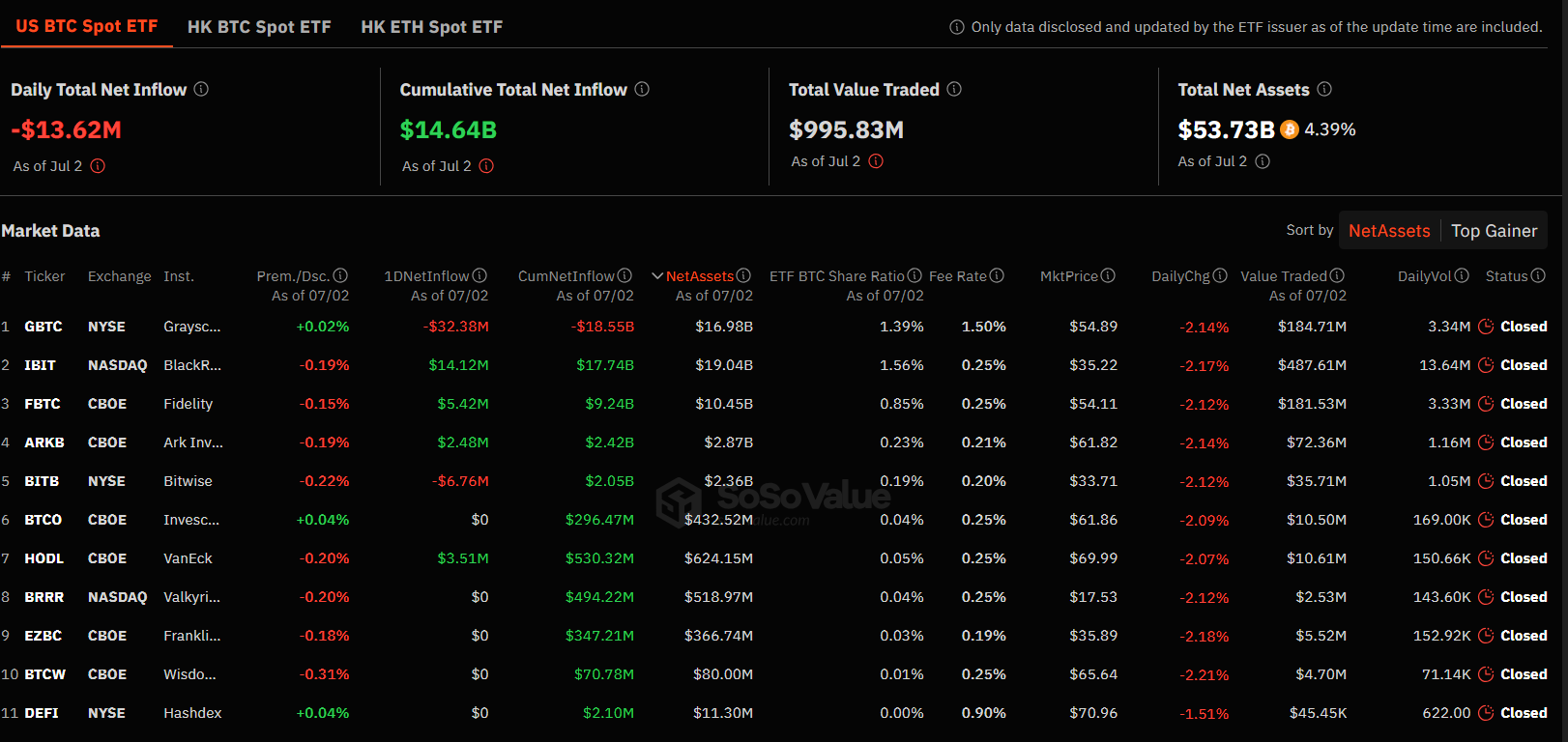

In the US, spot Bitcoin ETFs experienced a significant change yesterday, recording a total net outflow of $13.62 million. This figure marks a shift to negative flows after five consecutive days of inflows. Data from SosoValue highlighted the performance differences among various Bitcoin ETFs.

Grayscale Dominates Market with Major Outflows

Grayscale‘s GBTC bore the brunt of the outflows with a net loss of $32.38 million. This was the largest outflow recorded among ETFs. Bitwise’s BITB also faced significant losses with a net outflow of $6.76 million. These figures indicate a substantial withdrawal by investors from these funds.

On the other hand, some Bitcoin ETFs managed to attract positive inflows. BlackRock’s IBIT led with a net inflow of $14.12 million, indicating strong investor interest. Fidelity‘s FBTC followed with an inflow of $5.42 million, showing preference among some investors. VanEck’s Bitcoin fund also saw positive movement with a net inflow of $3.51 million, indicating confidence in its performance.

Ark Invest and 21Shares’ ARKB fund recorded a net inflow of $2.48 million, completing the group of funds that managed to attract investment despite the overall negative trend. These inflows suggest that while some investors are withdrawing, others see opportunities in these ETFs.

Market Volume Remains Low

Despite these fluctuations in net inflows and outflows, it is important to note that the overall trading volume for the 11 Bitcoin funds remained relatively low. On Tuesday, the total trading volume was below $1 billion, indicating a cautious market environment. This situation reflects investors’ cautious stance in the current market conditions.

While US spot Bitcoin ETFs experienced a total net outflow of $13.62 million in a single day, individual funds saw varying levels of investor activity. Grayscale’s GBTC and Bitwise’s BITB saw significant withdrawals, while other funds like BlackRock’s IBIT, Fidelity’s FBTC, and VanEck’s Bitcoin fund managed to attract new investments.