Bitcoin experienced significant price movement after surpassing the $73,500 level and reaching its latest all-time high. The subsequent price drop in Bitcoin also led to a pessimistic atmosphere in the spot Bitcoin ETF market recently. Despite a continuous decrease in net inflows, CryptoQuant‘s CEO Ki Young Ju pointed out that there could be a potential revival in the spot Bitcoin ETF market.

CEO’s Comments on Bitcoin ETFs

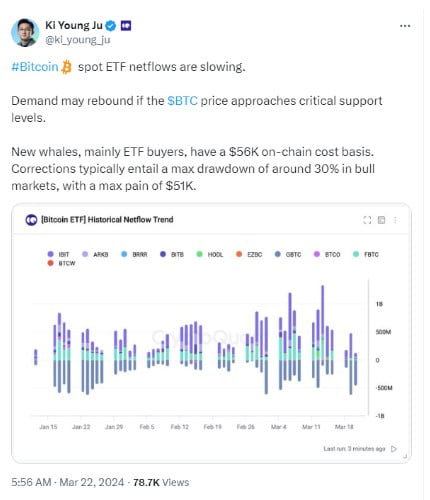

In a statement made on March 22nd, Ki Young Ju highlighted that despite the downturns in BTC price, there could be an increase in net inflows for spot Bitcoin ETFs. The analyst noted that, based on historical net inflow trends, demand for Bitcoin ETFs generally increased after BTC reached certain support levels.

According to data provided by BitMEX Research, BTC ETFs have shown a negative outlook over the last four trading sessions.

This was attributed to significant outflows from Grayscale’s GBTC, while record-low inflows for other ETFs, including BlackRock’s IBIT and Fidelity’s FBTC, were also considered contributing factors.

Young Ju mentioned that recent BTC whales, especially those based on ETFs, have an average cost of around $56,000. This suggests that these foundational market players, particularly ETF investors, typically purchase Bitcoin at an average price level of $56,000.

With all this data in mind, the CEO indicated that if BTC falls to the mentioned price threshold, there could be significant entries into the spot Bitcoin ETF market.

How Much is 1 Bitcoin in Dollars?

Over the past 7 days, Bitcoin’s price continued to trade between $62,000 and $68,000. On the other hand, Young Ju stated that corrections typically happen with a maximum of 30%, suggesting that such a decline would be sufficient for the market.

Following the expected drop from Bitcoin’s recent peak of $73,750, the price of BTC is predicted to fall as low as $51,000.

While these predictions and assumptions continue to be presented by analysts and notable figures, Bitcoin is currently trading at $64,627 at the time of writing. This price level indicates a 1.26% increase for BTC.

Türkçe

Türkçe Español

Español