Bitcoin’s price is moving sideways. BTC has dropped below the $61,000 level. This sideways movement has resulted in small inflows for spot Bitcoin ETFs. Although the inflows are small, spot Bitcoin ETFs ended the day positively. Let’s look at the details.

Single Outflow in Spot Bitcoin ETFs

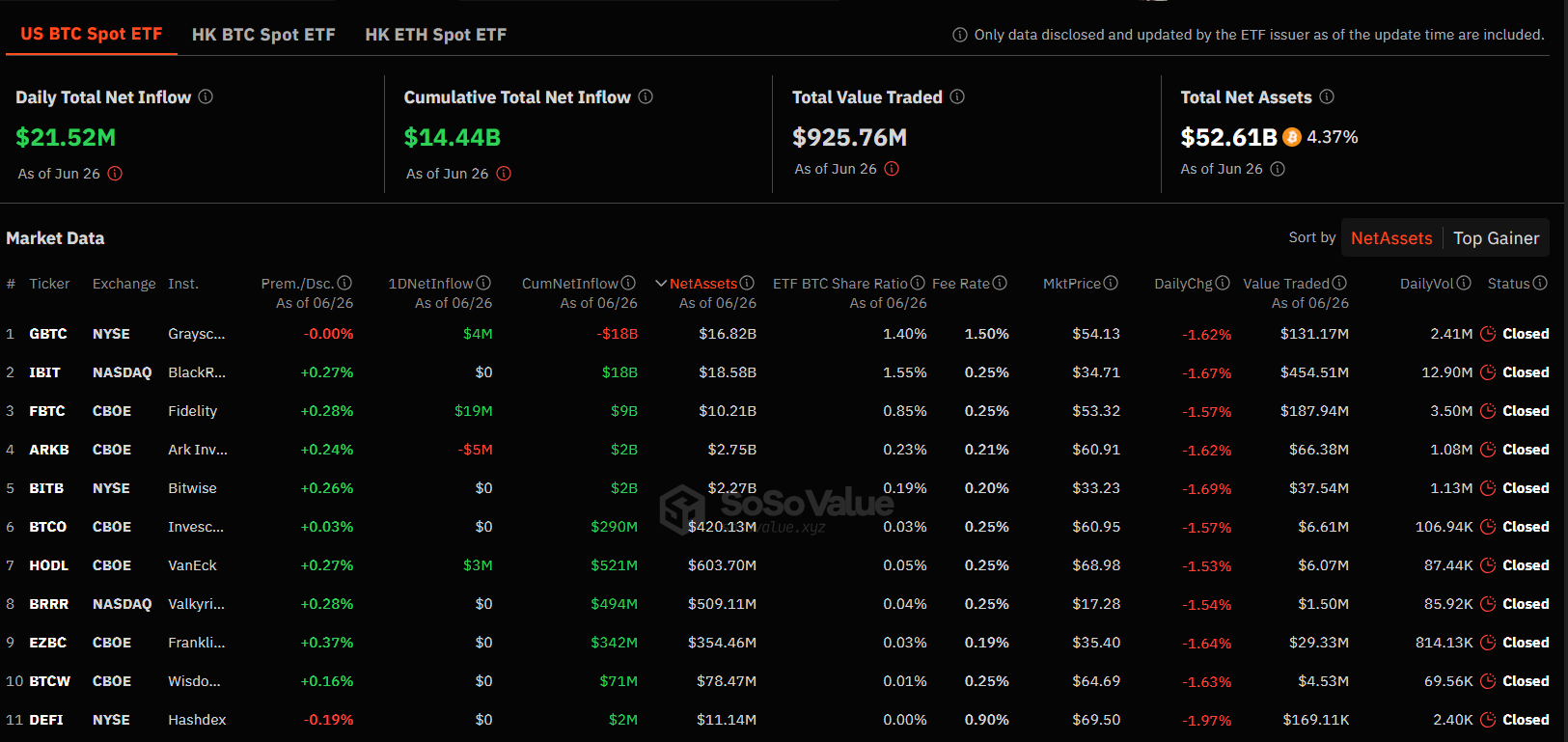

According to figures compiled by SoSoValeu, there was only one ETF outflow yesterday. The single outflow occurred in Ark Invest‘s Bitcoin ETF, ARKB. The outflow amounted to $5 million.

The fact that outflows were limited to a single ETF allowed the day to close positively. The absence of significant upward or downward movements in Bitcoin was the main factor.

Spot Bitcoin ETFs See $21.52 Million Inflows

Spot Bitcoin ETFs saw an inflow of $21.52 million yesterday, with the largest inflow occurring in Fidelity‘s spot Bitcoin ETF, FBTC. This ETF led the day with an inflow of $19 million.

The second largest inflow was in Grayscale’s spot Bitcoin ETF, GBTC, which saw an inflow of $4 million. VanEck’s spot Bitcoin ETF, HODL, saw an inflow of $3 million, bringing the total net assets to $521 million.

Lastly, there were spot Bitcoin ETFs that ended the day with neither inflows nor outflows. BlackRock had zero activity for the second consecutive day. With the remaining ETFs also ending the day with zero activity, the overall ETF market achieved a positive outlook.

Bitcoin and Cryptocurrencies

Looking at the general state of the cryptocurrency market, Bitcoin is trading at $60,785 at the time of writing. BTC’s sideways movement has allowed other altcoins to catch their breath. Accordingly, Ethereum is trading at $3,374.

The cryptocurrency Binance Coin (BNB) has pulled back from above $700 to trade at $570. Lastly, Solana was trading at $136 at the time of writing.