In the cryptocurrency market, Bitcoin experienced a volatile movement yesterday, pulling back to the $57,000 level. Subsequently, BTC made a new move towards $61,000 but failed to break the resistance and fell back below the $59,000 level. The volatile movement also led to outflows in spot Bitcoin ETFs. Let’s look at the numbers.

Outflows in Spot Bitcoin ETFs

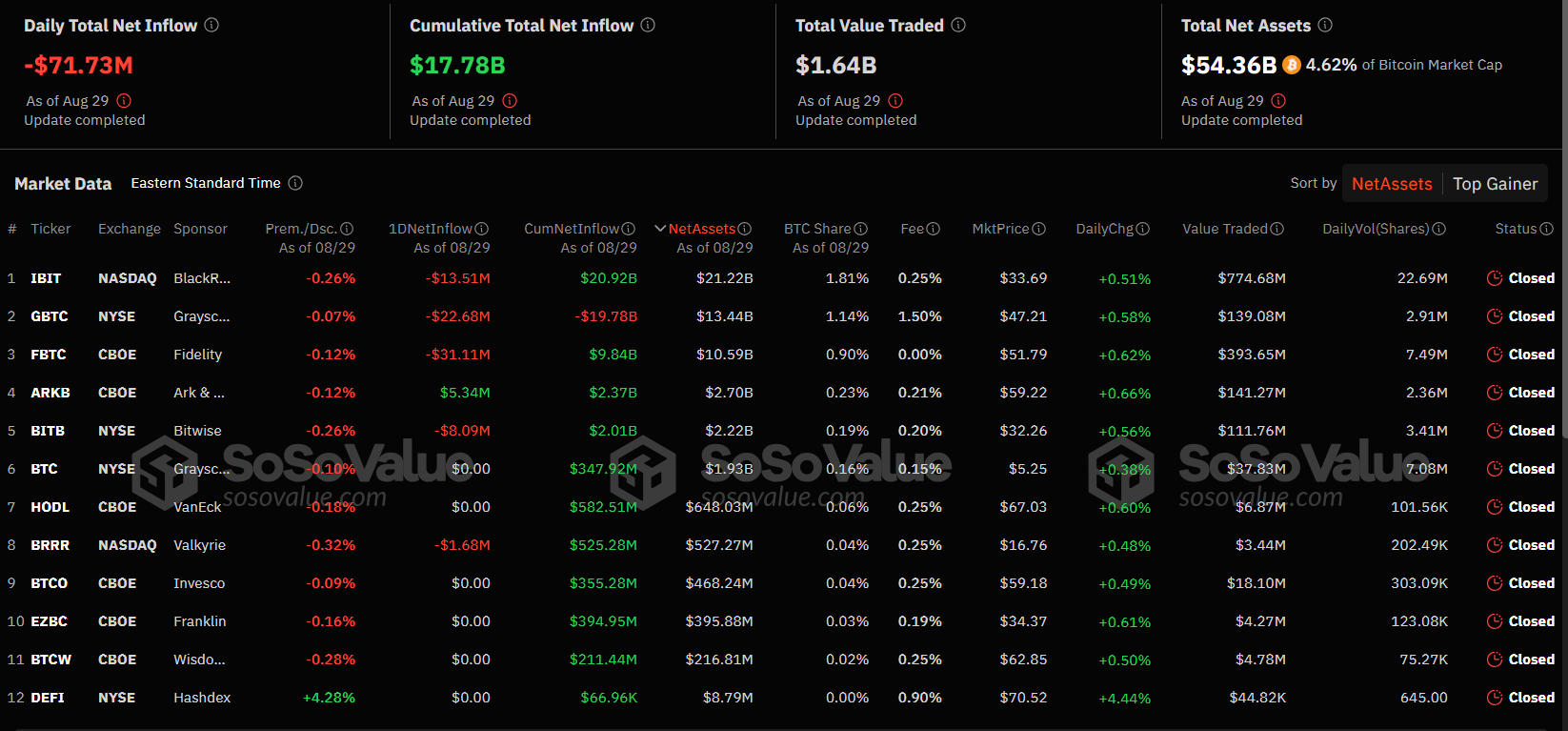

Spot Bitcoin exchange-traded funds (ETFs) in the US recorded a net outflow of $71.73 million on Thursday. This continued a three-day outflow streak. BlackRock’s largest spot Bitcoin ETF, IBIT, reported a negative flow for the first time since May 1, with an outflow of $13.51 million.

Grayscale’s GBTC continued this trend with an outflow of $22.68 million. Fidelity’s FBTC saw a net outflow of $31.11 million. Bitwise’s BITB fund had an outflow of $8.09 million, while Valkyrie’s BRRR ETF experienced an outflow of $1.68 million.

On the other hand, Ark and 21Shares’ ARKB fund was the only spot Bitcoin ETF to record a net inflow of $5.34 million. In total, the daily trading volume of 12 spot Bitcoin ETFs fell to $1.64 billion on Thursday, down from the previous day’s figure of $2.18 billion.

Current Status of Spot Ethereum ETFs

Spot Ethereum ETFs faced modest outflows. US spot Ethereum ETFs reported a net outflow of $1.77 million on Thursday, following positive flows the previous day. Grayscale Ethereum Trust (ETHE) stood out among these funds with an outflow of $5.35 million. In contrast, Grayscale Ethereum Mini Trust (ETH) recorded a net inflow of $3.57 million.

The other seven spot Ethereum funds ended the day without any inflows or outflows. The total trading volume fell to $95.91 million, down from the previous day’s figure of $151.57 million. Bitcoin, the flagship cryptocurrency, traded at approximately $58,984 with a 0.3% drop in the last 24 hours, while the leading altcoin Ethereum fell by 0.29% to $2,516.