The first trading day of the week for spot Bitcoin ETFs is today, following yesterday’s holiday, which could lead to increased market volatility. After an average daily net inflow of $450 million last week, the cumulative value of professional crypto investment tools has surpassed the levels of November 2021, reaching an all-time high. So, what’s next?

Bitcoin and Altcoins

Bitcoin’s price has had its best two-week closing, confirming the end of the bear season and setting its sights on an all-time high (ATH). The decline following the February 19 daily close was short-lived, and strong demand at lower levels is boosting motivation. Since the US markets were closed on Monday, spot Bitcoin ETFs also did not trade.

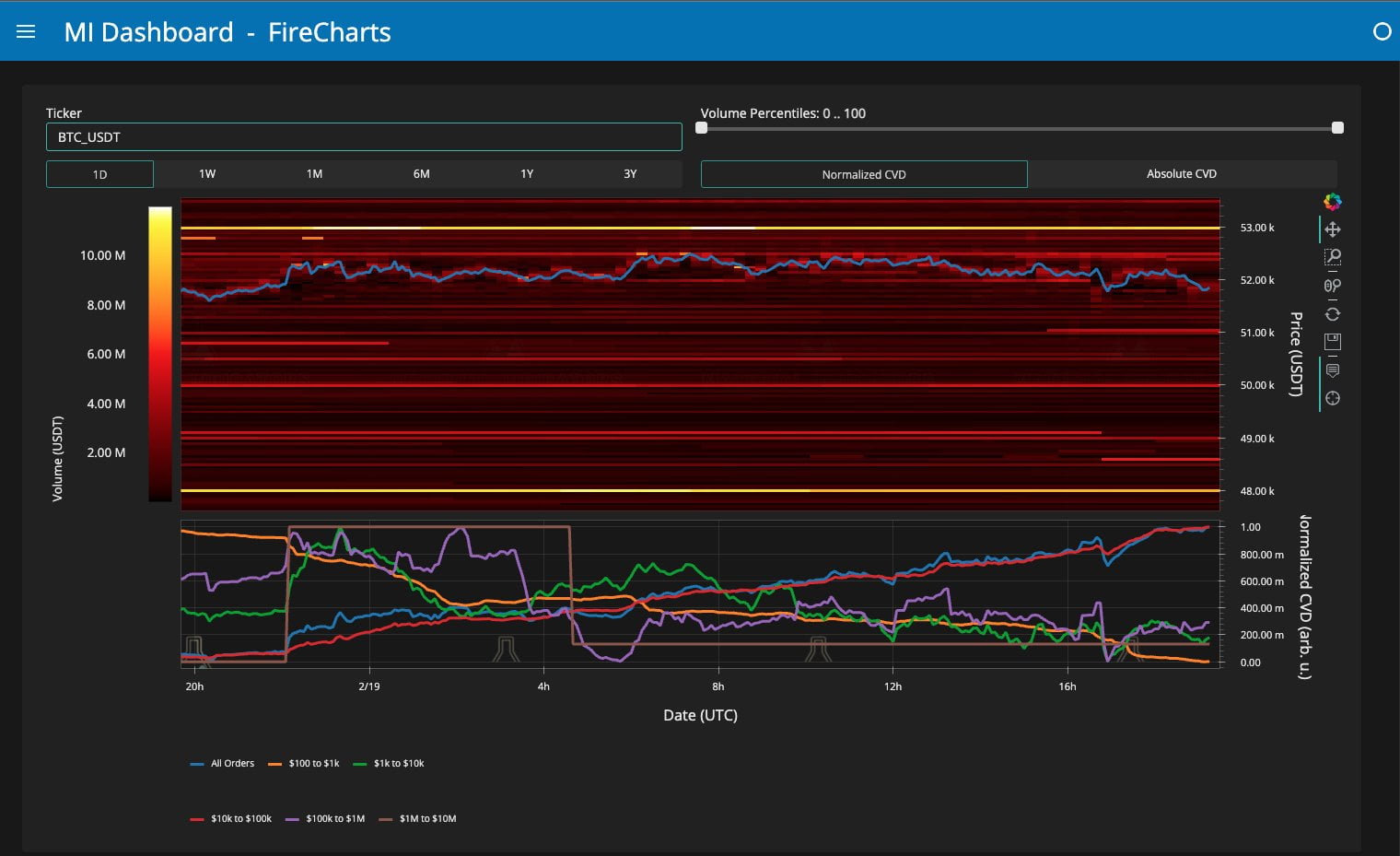

Material Indicators recently warned investors that after rapid increases, Bitcoin’s price could enter a resting phase.

“If Bitcoin doesn’t bounce from here, consider the door open to $51,000 and if that doesn’t hold, look to the next support levels at $50,000 and then $48,600. If these levels don’t hold, things could get very exciting in the short term. The long-term outlook remains unchanged.”

Experts who analyze order book liquidity make price predictions based on investors’ unrealized positions in exchanges. On the other hand, a potential decline in BTC could have a multiplier effect on altcoins. Conversely, if the current levels hold or rise, we should see altcoins experience rapid increases.

Ethereum (ETH)

More volatile than BTC is Ethereum. We have long discussed the bottom of the ETHBTC pair, and the parity, now at 2022 levels, should see a rebound. The accelerated rise at the beginning of the week has rekindled hopes that the price will exceed $3,000 after 665 days. The last time ETH’s price lingered at these levels was on April 26, 2022.

Michael Poppe, founder and CEO of MNTrading, wrote about the largest altcoin by market value;

“This is still a great period to transition from Bitcoin to Ethereum. The upward momentum continues with Ethereum, not Bitcoin.”

Skew also wrote that a continued strong stance in BTC’s price is very promising for altcoins. This week’s close above $52,000 could be the signal for the anticipated rallies in altcoins.