Bitcoin ETFs have had a positive week, surpassing all-time high levels of net inflows after breaking numerous records. Following the significant rise in Bitcoin, Blackrock’s Bitcoin ETF (IBIT) reaped the most benefits from the strong trading activity. The expectation for IBIT’s assets to reach $10 billion has now become closer than anticipated.

Bloomberg Analyst Comments on ETFs

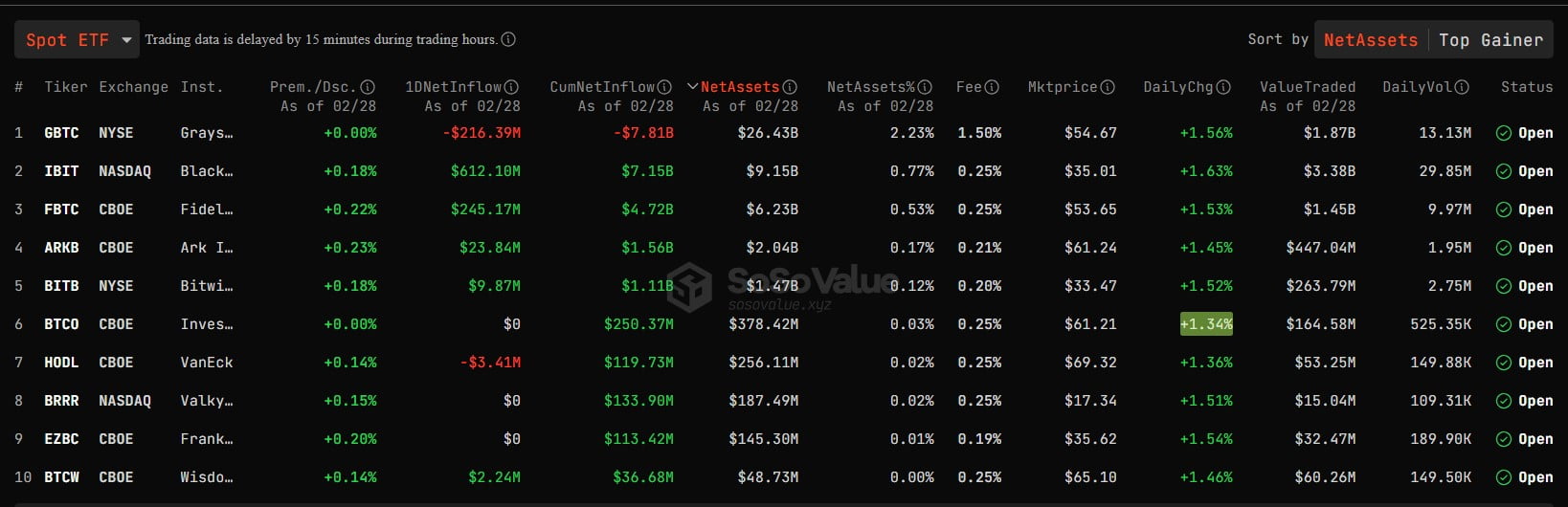

According to Bloomberg analyst Eric Balchunas, Blackrock’s Bitcoin ETF is likely to reach the $10 billion asset level tomorrow. This milestone is happening sooner than expected, as previous forecasts were set for the end of the calendar year’s quarter. Currently, Bitcoin ETFs have broken the record for the largest inflow since their inception last month, with $673 million.

BlackRock iShares Bitcoin ETF (IBIT) has broken the record for the highest inflow to date, with $612 million. IBIT surpassed the daily trading volume of the majority of large US stocks, with $3.2 billion, breaking its previous record of $1.3 billion. Following the recent surge, Blackrock’s net inflow has exceeded $7.15 billion, with the company’s assets nearly increasing by $9 billion.

ETF Success for BlackRock

After yesterday’s trading, Blackrock climbed to the fourth position in the ETF markets overall, having previously been in seventh place for its Bitcoin ETF. The increased trading activity of Bitcoin ETFs indicates a more positive investor sentiment. This adoption also helped bridge the initial gap that distinguished cryptocurrencies from traditionally regulated markets.

On the other hand, the Crypto Fear and Greed Index has risen to its highest close in four years. The current levels are at 80, indicating that the market is experiencing “Extreme Greed.” Advocates of cryptocurrency and ETF experts agree that BTC ETFs are performing better than fundamental market indicators.