The continued influx of funds into Bitcoin ETFs has pushed the price to satisfying levels, with a target of $50,000, although such an ambitious goal might be overly optimistic. These days, JPMorgan is taking a close look at cryptocurrencies and has shared its latest evaluation. So, what’s the current situation?

JPMorgan and Cryptocurrencies

Despite the bank’s CEO being a crypto skeptic, JPMorgan, one of the world’s largest financial institutions, is in the crypto business alongside BlackRock. JPMorgan’s research indicates that ETFs from BlackRock and Fidelity Investments have outperformed GBTC in terms of liquidity.

BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) ETFs have been impressing for weeks with their superior performance. Their reserves are growing rapidly, and those wanting to avoid the risks of holding cryptocurrencies are buying these ETFs.

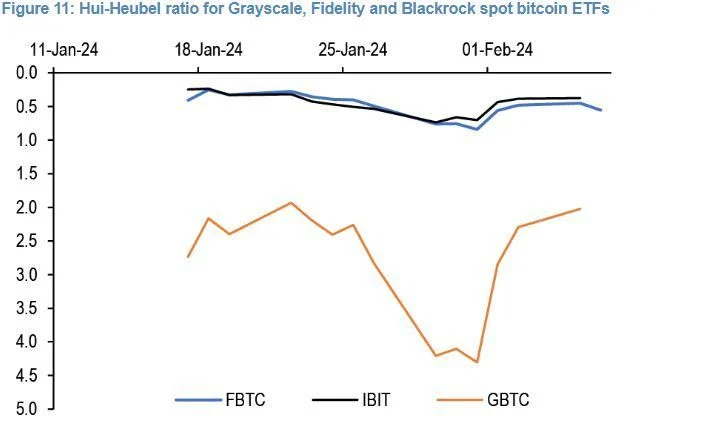

JPMorgan strategists used the Hui-Heubel ratio, which measures the market price’s response to volume, to write that the 2 new ETFs are better than GBTC.

“We find evidence that BlackRock and Fidelity Bitcoin ETFs already have an advantage over Grayscale Bitcoin Trust in certain liquidity metrics related to market breadth.”

ETF Trading Volume

According to Thursday’s data, for the first time since its launch, IBIT’s trading volume surpassed GBTC’s. Grayscale, with over $20 billion in reserves, had always occupied the top spot in volume due to excessive selling. According to Bloomberg Terminal, BlackRock’s ETF saw $301 million compared to GBTC’s $290.7 million in trading volume.

Bloomberg analyst Eric Balchunas wrote;

“Normally, it takes 5-10 years for a newborn baby to even come close to dethroning the liquidity kings of a category. IBIT did it in less than a month – today it’s trading more than both GBTC and BITO.”

To date, the total inflows into the newly launched Spot Bitcoin ETFs have reached $8 billion. However, since GBTC’s outflows are around $6 billion, the cumulative net inflow is in the region of $2 billion. The shift from GBTC to BlackRock and Fidelity ETFs is also significant. The BTC reserves of the two giants reached $3.4 billion and $2.9 billion, respectively, in less than a month.