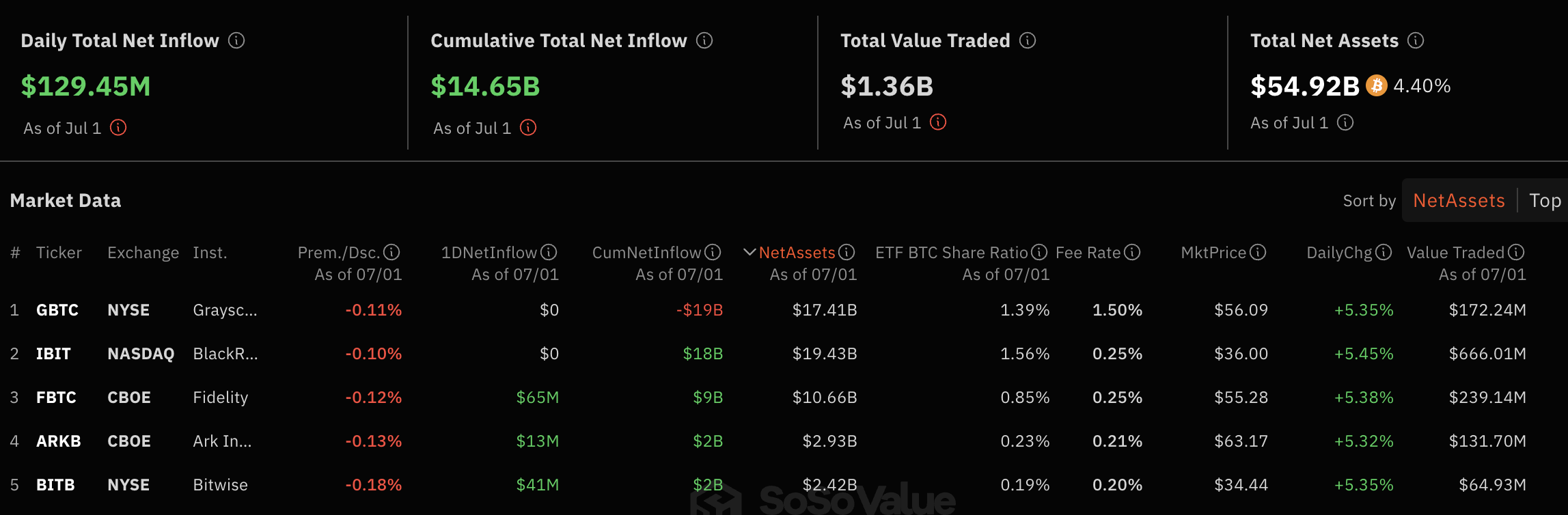

Based in the United States, 11 spot Bitcoin exchange-traded funds (ETFs) managed to see a total daily net inflow of $129.45 million on July 1, marking the fifth consecutive day of positive flows for the funds. The net inflows recorded on July 1 also indicated the largest fund acquisition seen by the ETF funds since June 7.

Continued Inflows into ETF Funds

According to SosoValue data, Fidelity’s FBTC fund led the inflows with $65 million yesterday, followed by Bitwise’s BITB fund with $41 million. Ark Invest and 21Shares’ ARKB fund reported a net inflow of $13 million. Funds from Invesco and Galaxy Digital, VanEck, and Franklin Templeton saw relatively small inflows of around $5 million or less.

The two largest spot Bitcoin ETF funds by net asset value, BlackRock’s IBIT fund and Grayscale’s GBTC fund, did not record any inflows on July 1. The 11 Bitcoin funds saw approximately $1.36 billion in trading volume on July 1. Since their inception in January, the ETF funds have achieved a total net inflow of $14.65 billion.

What’s Happening with Bitcoin?

Meanwhile, according to Tradingview data, at the time of writing, the price of Bitcoin was trading at $63,050, up 0.25% in the last 24 hours. Bitcoin rose from a brief low below $60,000 last week but continues to trade below the price levels seen above $71,000 in early June.

QCP Capital analysts stated in a report published on July 1 that both Bitcoin and Ethereum tend to perform better in July due to historically observed positive seasonality. Coinbase analysts also highlighted the positive seasonal trend in July.

With all these developments, eyes are particularly on the macroeconomic data to come from the United States. Positive indications from this data regarding interest rate cut decisions could trigger a rise in risky investment products such as Bitcoin and altcoin projects.