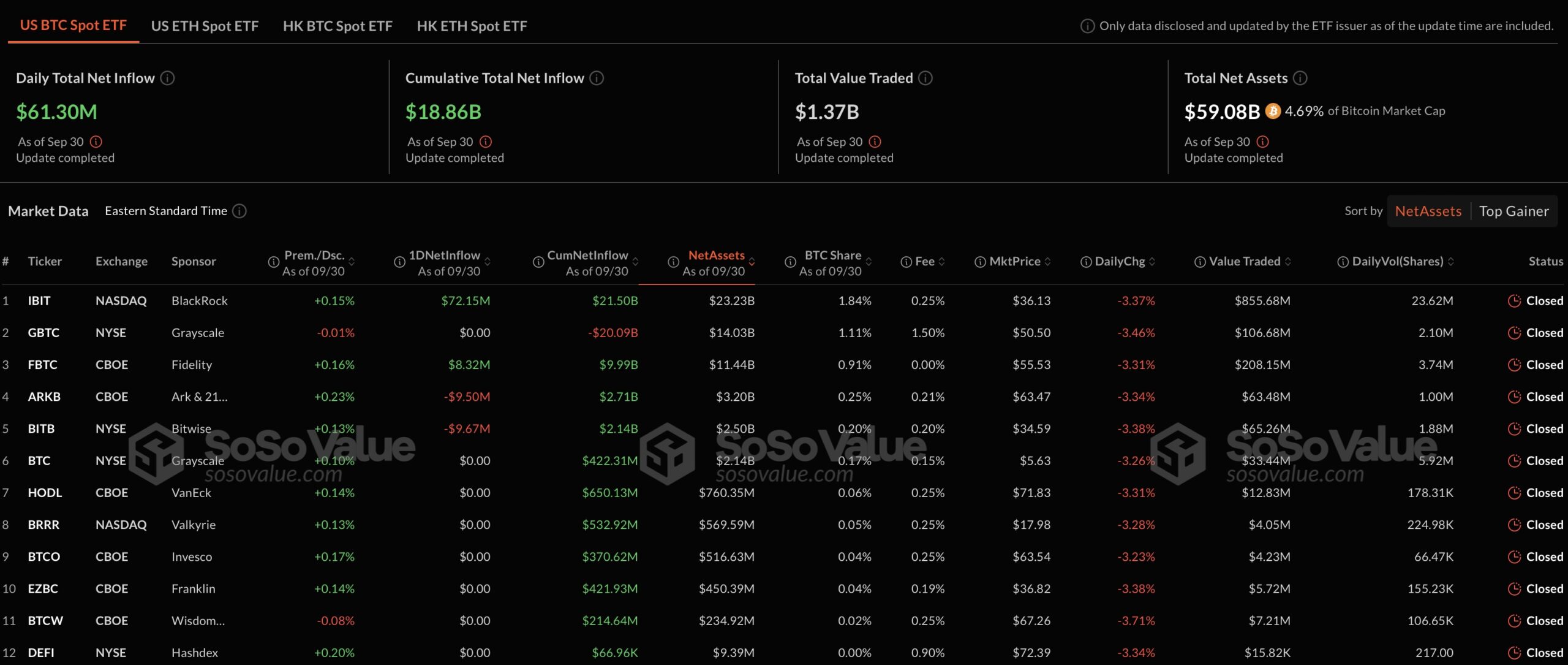

The spot Bitcoin  $119,760 ETFs in the United States closed the first trading day of the week with robust performance, attracting a total of $61 million in investments. The highest inflows were seen in funds from BlackRock and Fidelity, while Ark Invest and Bitwise ETFs experienced significant outflows. Conversely, spot Ethereum

$119,760 ETFs in the United States closed the first trading day of the week with robust performance, attracting a total of $61 million in investments. The highest inflows were seen in funds from BlackRock and Fidelity, while Ark Invest and Bitwise ETFs experienced significant outflows. Conversely, spot Ethereum  $3,002 ETFs ended the day in the negative, displaying a contrasting trend.

$3,002 ETFs ended the day in the negative, displaying a contrasting trend.

BlackRock and Fidelity’s Funds Fuel Bitcoin Interest

The most notable investment among spot Bitcoin ETFs came from BlackRock, amounting to $72 million. As the world’s largest asset management firm, BlackRock successfully increased investor interest in the leading cryptocurrency. Following closely, Fidelity’s ETF garnered $8 million in inflows.

The investments attracted by these two major companies indicate that investor confidence and demand for spot Bitcoin ETFs in the U.S. remain strong.

Negative Trend in Spot Ethereum ETFs

Despite the overall positive trend in spot Bitcoin ETFs, this did not reflect on the spot Ethereum ETFs, which closed the day down by $822,000. This situation suggests that investor interest in the altcoin king, Ethereum, remains weaker compared to Bitcoin.

Overall, it was observed that the spot Bitcoin ETFs had a positive performance on the first trading day of the week, while the spot Ethereum ETFs closed with a weak performance. Investors continue to position themselves according to the market’s variable nature, and the activity in spot ETFs provides significant signals regarding the cryptocurrency market.

Türkçe

Türkçe Español

Español