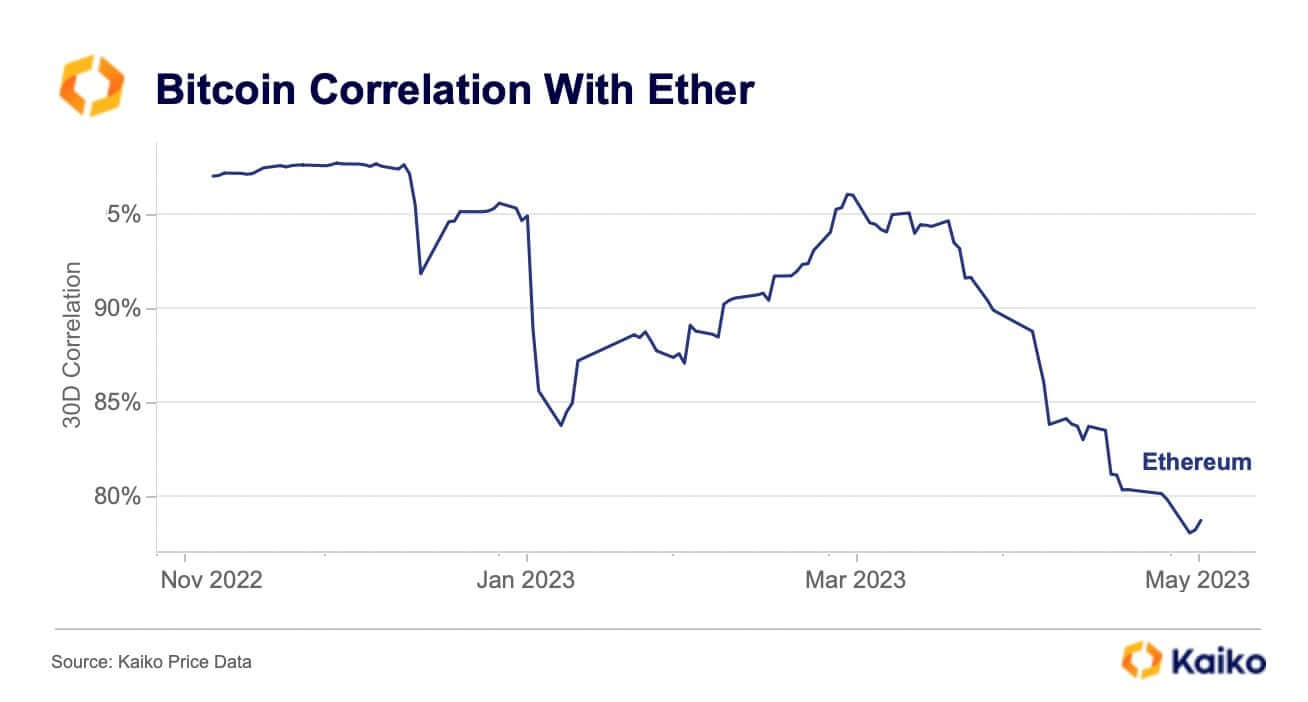

Crypto research firm Kaiko reported that the 30-day correlation of the largest cryptocurrency Bitcoin (BTC) with the largest altcoin Ethereum (ETH) fell below 80 percent this week for the first time in 18 months.

First Time Since November 2021

Crypto research firm Kaiko reported that the 30-day correlation between Bitcoin and Ethereum fell to about 78 percent this week, falling below 80 percent for the first time since November 2021.

Correlation is a measure of how much the prices of two assets move together. When correlation is low, their prices are expected to move in different directions more often. In other words, a drop in correlation means that the price of BTC and ETH are not moving together as much as they used to.

Bitcoin/Ethereum Analysis from Cryptocurrency Exchange Coinbase

Coinbase, the giant US-based cryptocurrency exchange, analyzed the correlation between BTC and ETH gains. The cryptocurrency exchange concluded that the correlation fell in mid-to-late March as BTC began to outperform other cryptocurrencies in the face of the banking crisis that erupted in the US and increased regulatory scrutiny on cryptocurrencies other than Bitcoin.

“The decline in this correlation became more pronounced in the days following Ethereum‘s Shanghai (Shapella) update and is reminiscent of a similar trend observed during The Merge update in September 2022 (when the Ethereum consensus mechanism changed from proof-of-work to proof-of-stake),” Coinbase said in a report.

In theory, a decrease in the correlation between two assets should strengthen the case for diversification by including both assets in an investment portfolio.

Data from crypto data platform CoinMarketCap shows that the price of Bitcoin and Ethereum have risen about 62 percent and 50 percent, respectively, since the first day of 2023.