Bitcoin (BTC) price has been stagnant in recent weeks, but investors in the largest cryptocurrency continue to wait with confidence in its upward potential. This confidence largely stems from the hope that the U.S Securities and Exchange Commission (SEC) will approve a spot Bitcoin ETF by the end of the year or no later than 2024.

Large Bitcoin Wallets Remain Silent

The cryptocurrency market has been struggling with Bitcoin’s prolonged sideways movements in the past few months. However, on-chain data from Glassnode shows that the number of wallet addresses holding 10 or more BTC is currently at an all-time high.

This indicates that trust in Bitcoin among high-net-worth investors is increasing or at least continuing, which could be a sign of a potential change in the short-term price outlook. Glassnode, a on-chain data platform, confirmed this by stating, “The number of wallet addresses holding 10 or more BTC reached an all-time high of 157,629 on September 25th.”

Despite the increase in wallet addresses, the fact that Bitcoin’s price is still under selling pressure raises the possibility of manipulative behavior. However, some market experts point out a different scenario. They believe that as long as Bitcoin fails to surpass the $27,000 level with sustainability, any upward movement could be a bear trap.

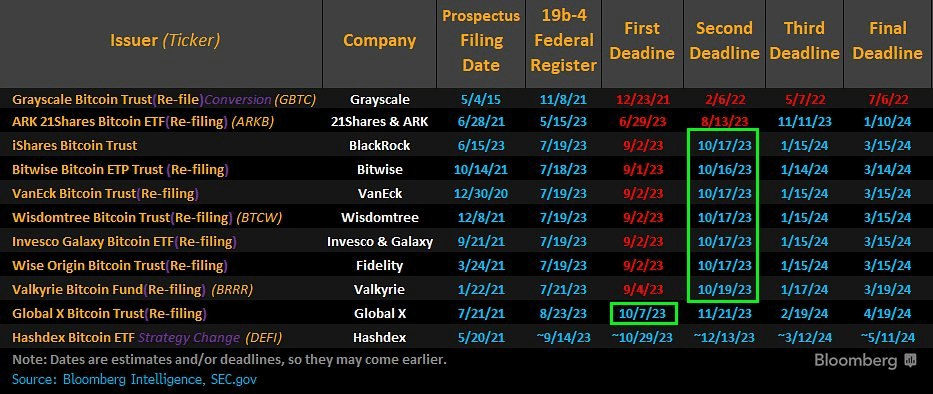

Approaching Decision Dates for Spot Bitcoin ETFs

Meanwhile, the nearest upcoming decision date for spot Bitcoin ETF applications by the SEC is set for October 16th, specifically for Bitwise’s application. Immediately after this date, on October 17th, investors will be following the decisions of the SEC regarding spot Bitcoin ETF applications made by asset management giants BlackRock, VanEck, Wisdomtree, Invesco & Galaxy, and Fidelity. On October 19th, SEC will announce its decision on Valkyrie’s spot Bitcoin ETF.

However, as per the regulations, the U.S. federal regulator can postpone the decision dates in October, just as it did in the first week of September. Market experts warn that a new postponement decision could disrupt the silence among major Bitcoin investors and potentially trigger a decline, similar to what happened this month.